GTI ready to drill new targets

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in gold and base metals explorer, GTI Resources Ltd (ASX:GTR) have already surged 20% in 2019, but it could be argued that they are still shy of fair value.

Unjustified selling in November due to a downturn in broader equity markets rather than stock specific developments sees the company still trading at a sharp discount to the average trading range in the second half of 2018.

However, this may not be the case for much longer as the company embarks on a focused drilling campaign in the March quarter.

Management will be drawing on data gathered in the December quarter to target highly prospective mineralisation at the company’s Meekatharra VMS (volcanogenic massive sulphide) Project, 55 kilometres south of Meekatharra in the Eastern Goldfields of Western Australia.

During the December quarter GTI undertook reprocessing and interpretation of recently acquired airborne electromagnetic data at the Meekatharra Project.

1.5 million tonne resource at Austin

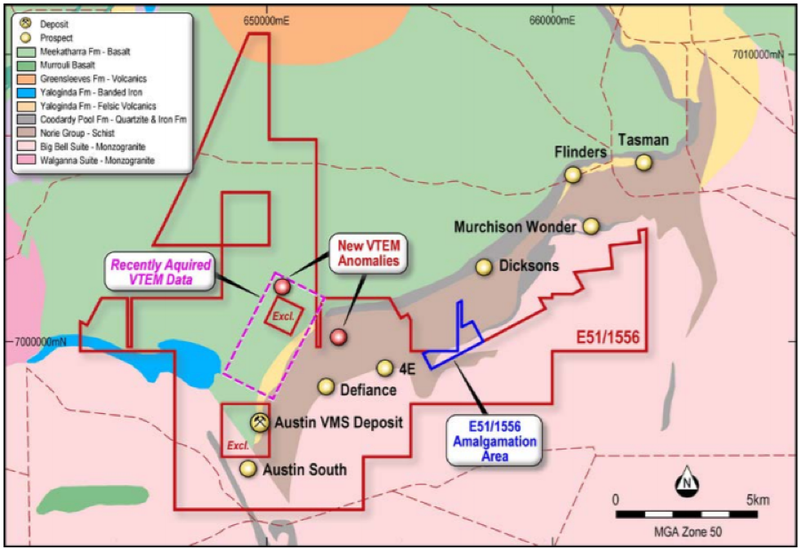

Additional information covered a gap in the previous data, over prospective lithologies, along strike and to the north of the Austin VMS deposit.

The Austin VMS deposit contains a reported mineral resource, comprising Measured, Indicated and Inferred categories of 1.48 million tonnes at 1.02% copper, 1.39% zinc, 3.51 g/t silver and 0.25 g/t gold, prepared in accordance with the JORC (2004) Code.

Reprocessing and interpretation of the recently acquired data identified a shallow, weakly conductive feature overlying a deeper magnetic unit in the north-western part of the area, although no other deeper (less than 300 metres in depth) discrete bedrock conductors were apparent in the remaining data.

Earlier reprocessing of data covering the remainder of the project area identified a new anomaly approximately five kilometres north-east of the Austin VMS deposit.

As illustrated on the following map, two new anomalies lie to the north-east and north-west of the Defiance prospect.

Building on previous exploration success

Exploration by previous owners identified two VMS prospects within the Meekatharra Project, the Defiance and 4E prospects.

They have returned anomalous copper and zinc results, including 4 metres at 0.18% copper, 8 metres at 0.34% zinc and 10 metres at 0.23% copper, from first pass drilling completed during 2010.

In the course of discussions with executive chairman, Murray McDonald he said, “These two prospects and the new anomalies identified from the reprocessed data will be the focus for the company’s on-ground exploration programs.”

Providing further potential upside is the recent increase in size of the E51/1556 licence area which was attained by amalgamating tenements previously covered by surrendered mining leases.

The newly incorporated tenure of 1.2 square kilometres covers magnetic basement along strike and to the east of the Defiance and 4E prospects.

GTI also holds licences within the Eastern Goldfields region of Western Australia prospective for gold and base metals, including the MEEKA project located south of Meekatharra and the NIAGARA project located south-west of Kookynie.

McDonald also referred to ongoing discussions regarding other opportunities, with the outcomes to be conveyed after completing the preliminary stages of investigation.

Consequently, there could be dual catalysts on the horizon as drilling results from the targeted exploration programs come to hand, and there is the prospect of GTI being involved in another project.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.