Greenpower’s assay results identify district scale LCT pegmatite system

Published 02-JUN-2017 14:33 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Greenpower Energy (ASX: GPP) announced on Friday that it had received the final batch of assay results in relation to the exploration initiatives the company has been taking at its Robello Rare Earth Elements (REE) project.

In addition to the Rare Earth Elements discovery, Phase 1 of the Morabisi lithium-tantalum-REE project has been successful in identifying lithium-Cesium-tantalum (LCT) pegmatites with geochemistry suggesting they occur on a district scale.

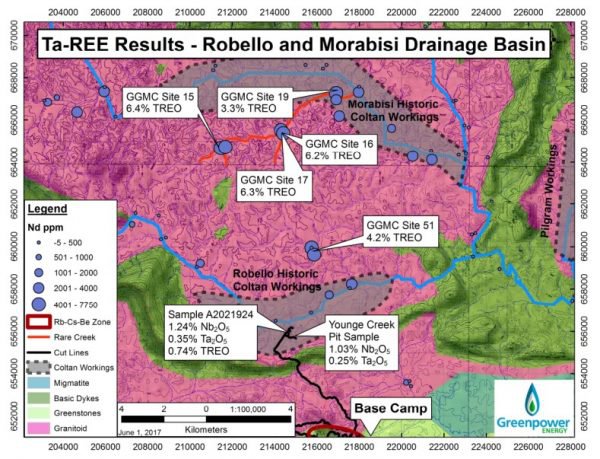

Stream geochemistry has identified three strong target areas with LCT indicator elements. These three areas are Turesi Ridge, Banakaru (20 kilometre ridge) and East Camp (20 kilometre ridge.

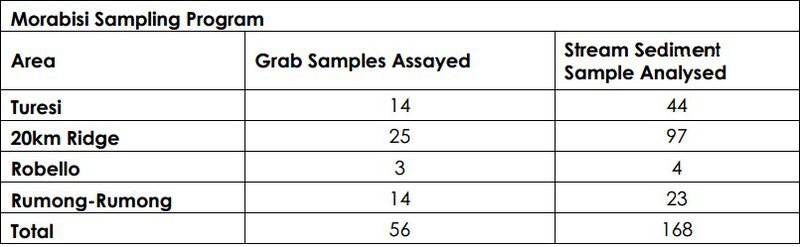

Samples collected in the course of the Morabisi program are as follows.

With regard to the broader project, management said the historic mines at Robello were very evident with several remnants of heavy equipment left behind by the Morabisi Mining Company.

There was evidence of the impact of floods, and while this made it difficult to find a suitable location to dig test pits, two locations delivered promising sample material, producing a heavy concentrate samples for Coltan.

It should be noted here that this company is in the early stages of its development on all fronts and investors should therefore take a cautious approach to any investment decision made and seek professional financial advice with regard to this stock.

Results from pit sampling returned high grades of up to 1.03% Nb205 and 0.25% Ta205. Management is of the view that some of the results are likely ore grade in an alluvial mining scenario, but it is important to bear in mind that this sample was collected as a standard stream sediment sample and not a gravel concentrate.

As Rare-Earth Elements are heavy minerals, higher grades would be expected closer to bedrock.

The following details the area tested as well as the results of some of the samples.

Commenting on the significance of these results, GPP Executive Chairman, Gerard King, said, “The results received to date are very encouraging and indicate a district scale LCT pegmatite system is evident at Morabisi, in addition to what looks potentially like an economic alluvial REE, Tantalum and Niobium deposit within the same PGGS permit area”.

Discussing upcoming objectives, King said, “The joint venture is currently finalising its views on Phase 2 with the general view being to immediately employ a portable track mounted diamond drill rig to test LCT pegmatites in fresh rock and better understand the potential of the ore body.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.