Graphite prioritised: Archer to sell magnesia project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Amidst a strategic review of its assets, Archer Exploration Limited (ASX:AXE) has agreed to sell its Leigh Creek Magnesia Project in South Australia with plans to use the proceeds to fund the development of its advanced and speciality materials business.

The company signed a legally binding share sale agreement for the sale of all of the shares in Leigh Creek Magnesite Pty Ltd (LCM) and CH Magnesite Pty Ltd (CHM) — both are wholly owned subsidiaries of AXE which hold the magnesia project.

Located approximately 20 kilometres northwest of Leigh Creek Township, the Leigh Creek Project consisting of two granted exploration licences – EL 5730 (held by LCM) and EL 6019 (held by CHM), is the world’s largest cryptocrystalline magnesite deposit and hosts 48% of world cryptocrystalline (small grained) magnesite resources.

AXE’s strategic review of its assets comes as the company looks to focus its future investment and management attention towards areas that will deliver the best risk weighted returns for its investors.

This sale of the Magnesia Project allows AXE to intensify its focus on its emerging advanced and speciality materials business with the associated development of the Campoona graphite mine.

AXE Executive Chairman, Greg English, said, “We believe this is a good deal for our shareholders. Whilst we still see the potential for the eventual development of the Magnesia Project, the funds from the sale announced today can be used more immediately to drive greater shareholder value through the development of our advanced and speciality materials business.”

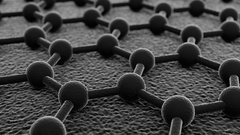

“We want to focus on our areas of strength, and we have excellent capability with Mohammad who is driving our graphite, graphene and advanced materials strategy, as highlighted by our recently announced collaboration agreements for the development of carbon based bio-sensors and quantum computing technologies.

“We also remain excited about our Blue Hills copper project and the prospectively of our extensive cobalt tenements. Given the depth of opportunities within the Archer portfolio, it is imperative for us to concentrate on the projects that we believe will create most shareholder value, and where we are less dependent upon third party decisions to drive projects forward.”

However AXE remains a speculative stock and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

The buyer of the Magnesia Project, a private Australian company, will pay a $2.0 million base payment plus a bonus to AXE. The buyer has until the end of August to complete due diligence to its satisfaction and decide whether it will complete the purchase. It deal is also to be approved by AXE shareholders.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.