Galileo starts drilling as nickel hits long-term Australian dollar high

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

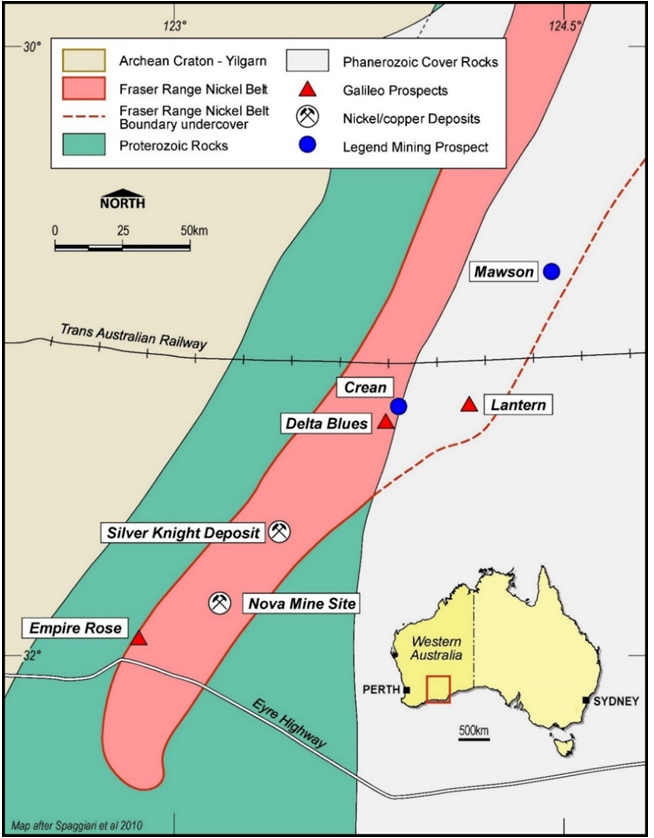

Galileo Mining Ltd (ASX:GAL) has launched its 2021 exploration field programs at the company’s Fraser Range Nickel Project in Western Australia, having commenced electromagnetic surveying as it targets conductors associated with previously identified nickel sulphide mineralisation.

In tandem with these initiatives, management is preparing for the first reverse circulation (RC) drilling programme of 2021 that should begin in February.

The key targets for initial drilling campaign are an electromagnetic conductor on the margin of a large intrusion (Lantern East), and sulphide mineralisation associated with an ultramafic intrusion (Lantern South).

EM surveying is underway at the Delta Blues prospect where drilling in late 2019 intersected nickel prospective host rocks with weathered sulphides observed in petrology samples.

As shown below, large areas of prospective ground in that area have yet to be covered and surveying is designed to continue until at least the end of April with the expectation that new conductive targets will be generated for drill testing.

The price is right

Commenting on the start of the 2021 exploration program, Galileo managing director Brad Underwood said, “We are very pleased to be back working in the field at our Fraser Range Project where we have already identified small but significant amounts of nickel sulphide in a greenfields environment with the potential for major discoveries.

‘’The EM surveys which started this week are designed to locate conductors that could be associated with nickel sulphide mineralisation.

‘’Additionally, drilling in February aims to test a well-developed conductive anomaly at the Lantern East Prospect, as well as focusing on the existing sulphide mineralisation at the Lantern South Prospect.

“We are a nickel sulphide explorer with a strategy of making greenfields discoveries in known mineralised provinces at our Fraser Range and Norseman Projects.

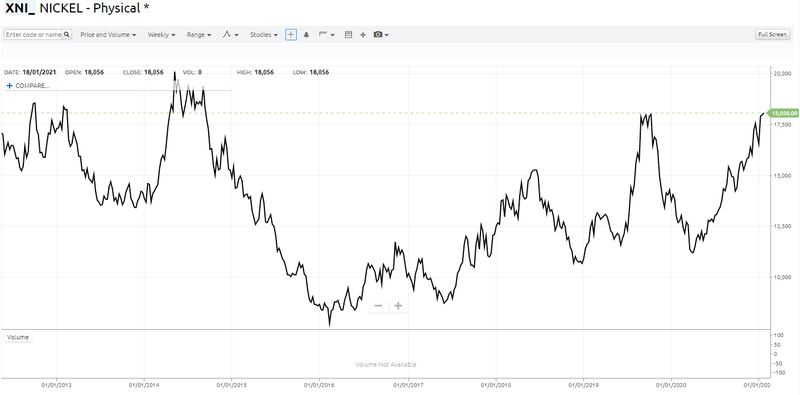

‘’With the price of nickel exceeding US$18,000 per tonne this is a great time to be exploring for nickel sulphide.

‘’A discovery in 2021 could be transformational for the company.”

Interestingly, when nickel last traded at around US$20,000 per tonne in 2014, the Australian dollar fluctuated in a range between about US$0.85 and US$0.95.

Applying the midpoint of that range implies an Australian dollar nickel price of approximately $22,200 per tonne.

Based on current foreign exchange rates, the Australian dollar is sitting at US$0.77, implying an Australian dollar nickel price of nearly $23,400 per tonne, representing a premium to the heady highs recorded in 2014.

Consequently, Australian nickel companies such as Galileo are operating in a premium pricing environment.

Creasy understands the geology and the processes required for discovery

Given the group’s exploration success in 2020, this could be a defining year for Galileo as it embarks on deeper drilling at highly prospective sites that have the potential to produce another Nova (ASX: IGO) or Mawson (ASX: LEG) discovery.

Just as Mark Creasy was involved in the Nova and Mawson discoveries, he has a significant part to play in Galileo’s future.

Not only was Creasy the founder of Galileo, he remains a substantial shareholder with a stake of 26%.

More importantly, he knows the Fraser Range region like the back of his hand, and this is very evident in Galileo’s hasten slowly approach.

Just as IGO and Legend took some time with early-stage exploration initiatives, including extensive electromagnetic surveying and shallower drilling, Galileo is taking a similar path.

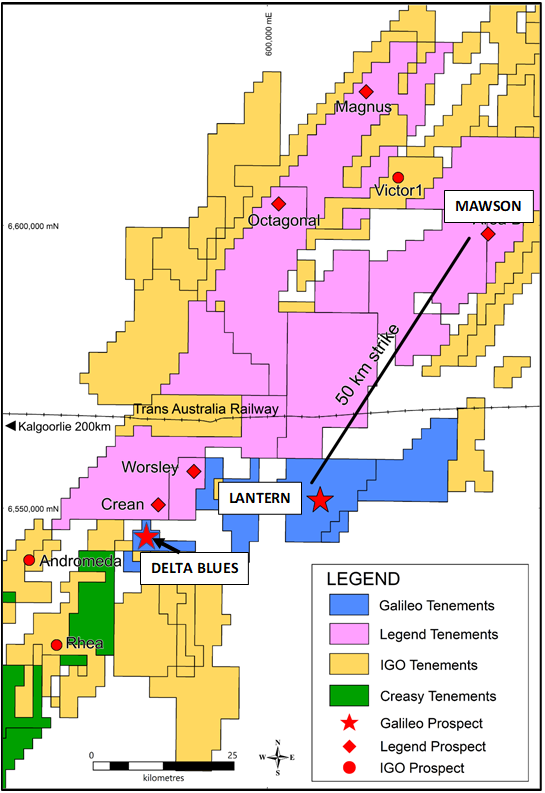

As indicated below, Galileo’s Lantern prospects lie along strike, 50 kilometres to the south-west of the Mawson discovery with Nova situated along trend to the south-west of Galileo’s prospects.

Underwood outlines electromagnetic and drilling strategy for 2021

With the foundations now in place and promising targets identified, Galileo is positioned to capitalise on this groundwork in an aggressive fashion, particularly given the group’s strong cash position of more than $7 million.

Not only will this fund significant exploration at Fraser Range, but it will also assist in mounting a comprehensive exploration program at the group’s Norseman Project where soil sampling was primarily undertaken to identify areas prospective for nickel sulphide mineralisation.

EM surveying is a very useful tool in the exploration for nickel sulphide mineralisation due to the conductive response of sulphide minerals that contain nickel.

Massive and semi-massive nickel deposits regularly exhibit conductive signatures when a current is passed through the earth.

When the surface input current is switched off, the secondary current produced in the conductive body can be measured.

The decay of the secondary current is then recorded at surface and the observed measurements are modelled by a geophysicist to provide the targets for drill testing.

Approximately 1,200 metres of drilling is planned at the Lantern East and Lantern South prospects.

Initial drilling at Lantern East was unable to determine the source of the conductive anomaly and subsequent EM surveying provided additional data to allow for remodelling of the targets.

The revised models have conductivities ranging from 2,500 Siemens to 3,925 Siemens and with the top of both bodies less than 180 metres below surface.

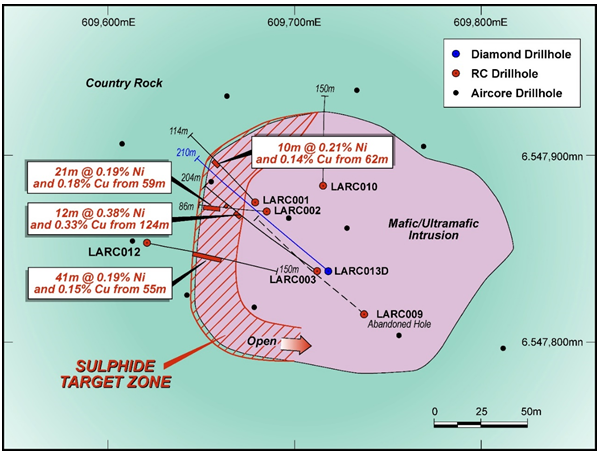

Drilling is planned at the Lantern South prospect to follow up on sulphide mineralisation previously intercepted.

Drill holes are planned to the south of LARC012 to expand the known area of mineralisation along the margin of the ultramafic intrusion.

Previous intercepts at this prospect include 41 metres at 0.19% nickel and 0.14% copper from 55 metres in LARC012.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.