Galileo rallies ahead of Fraser Range exploration results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Galileo Mining (ASX:GAL) was a standout performer on the ASX on Friday. The stock leapt by as much as 65% as the company continues its exploration program at its Fraser Range Project’s Lantern prospect.

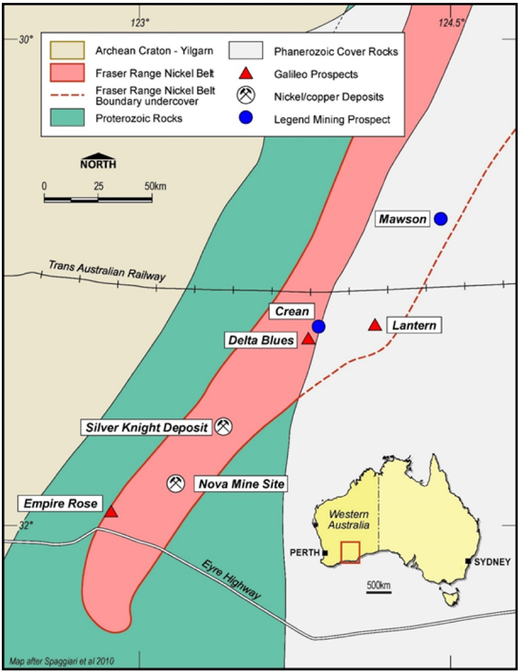

Located south-east of Kalgoorlie in Western Australia’s Fraser Range Nickel belt, the company’s The Fraser Range Project sits within a mining location with major untapped potential.

The region was brought to life just eight years ago, in 2012, with Sirius Resources’ discovery of the Nova nickel deposit which triggered a stunning share price rise that saw Sirius go on to reach a $1 billion market capitalisation.

More recently, in December 2019, Legend Mining (ASX:LEG) unearthed a massive nickel sulphide-copper discovery at its Rockford Project’s Mawson Prospect, also in the Fraser Range. These diamond drill results resulted in a 150% share price surge.

So what has driven Friday’s buying of GAL?

While Galileo announced no news of its own on Friday, its Fraser Range nickel belt neighbour, Legend Mining entered a trading halt pending exploration results from AC drilling at its Rockford Project’s Mawson prospect.

Fraser Range nickel belt investors have good reason for optimism around Legend’s pending exploration results, and those of Galileo too.

There are plenty of parallels between the two explorers, both with potential to be the next Nova mine as they look to uncover high value Nova style targets in the Fraser Range nickel belt.

Firstly, Galileo’s Lantern prospect is approximately 40 kilometres along strike from Legend’s Mawson Prospect.

Further, one of the most successful players in the Australian mining industry, Mark Creasy — who was integral to the discovery of the Nova nickel-copper-cobalt deposit — had a prominent hand in Legend’s Mawson nickel-copper-cobalt discovery. Creasy is also the founder and major shareholder of Galileo Mining.

In the following video, Galileo Managing Director Brad Underwood discusses why the Fraser Range is a major focus of activity for Galileo; the current RC drilling at the key Lantern Prospect; and the company’s upcoming drilling programs at the Fraser Range.

Exploration continues at Lantern Prospect

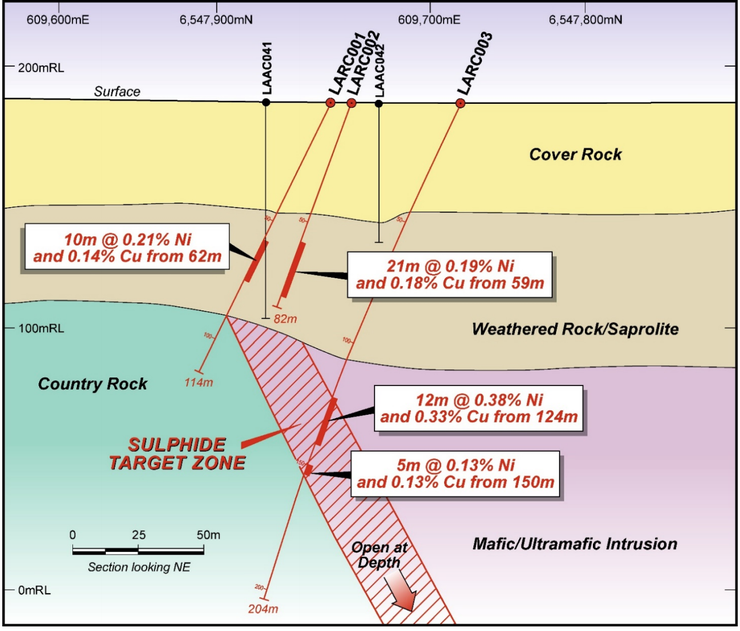

On 17 March, Galileo reported significant nickel and copper assay results from Reverse Circulation (RC) drilling at the Lantern prospect — sending the share price up by as much as 24% that week despite the challenging conditions in global markets, which saw the All Ords lose almost 40% since its February peak.

The results indicated the potential for a large mineralised system with over two kilometres of untested strike length.

The RC drill hole at the Lantern prospect intersected disseminated nickel-copper sulphide mineralisation — information that the company will integrate to provide the targets for planned diamond drill hole testing.

Underwood said: “This is an excellent result from the first ever RC drilling program at the Lantern Prospect. We have now discovered a fertile mineralised system containing nickel and copper sulphides.

“Our next step is to define the extent and quantity of the target metals and, given that we have over two kilometres of untested strike length at this one target alone, the potential for a large discovery is outstanding.”

Upcoming work programs include downhole electromagnetic survey at LARC003 with the prospect of highlighting something even bigger and better, or perhaps pointing to the prospect of a much larger mineralised zone.

Stepout AC and RC drilling will also be conducted which could provide indications that it is part of a much larger strike.

AC drilling will be conducted at the newly identified magnetic and gravity targets to search for more geochemical anomalies associated with prospective rock units.

Following this, Galileo intend to undertake diamond drilling of key targets with the potential of uncovering a discovery hole.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.