Galileo identifies another prospect in the Fraser Range

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Electromagnetic (EM) surveying over Galileo Mining Ltd’s (ASX:GAL) Delta Blues Prospect in the Fraser Range region of Western Australia has yielded promising results.

Three large and strong conductors have been modelled from the EM data at shallow depths between 95 and 170 metres below surface. Infill EM surveying of the newly identified targets is planned to be undertaken in conjunction with ongoing regional surveying at the Delta Blues Prospect.

Infill surveying is expected to be completed this quarter with drill planning to commence upon receipt and interpretation of the supplementary data.

This is strategically important for the group as management has consistently underlined the fact that it views Galileo’s Fraser Range assets as the cornerstone for a long-term nickel operation.

The latest results indicate that as well as the highly promising Lantern Prospect which will be the focus of near-term drilling, the company could now be potentially looking at another site in Delta Blue just to the west of Lantern.

Managing director Brad Underwood highlighted that this builds on the drill-ready Lantern Prospect and another early-stage prospect in Green Moon.

Commenting on the positive start to the 2021 field season, Underwood said, “The new results from Delta Blues confirm our view that this is one of several top-quality prospects we have identified in the Fraser Range.

‘’We are developing a solid foundation of prospects with great potential for nickel mineralisation.

‘’It has been just two years since our first aircore drilling program on our greenfields tenements in the northern Fraser Range.

‘’We are now in a position where we have targets ready for drill testing at our Lantern Prospect and new targets developing at our Delta Blues and Green Moon prospects.

‘’Our drilling programs in 2021 are designed to test these targets with the aim of making new discoveries.”

This news couldn’t come at a better time with the nickel price continuing to hover in the vicinity of US$18,000 per tonne after breaking above that mark to hit a long-term high in January.

Right location, right team and cash to drill

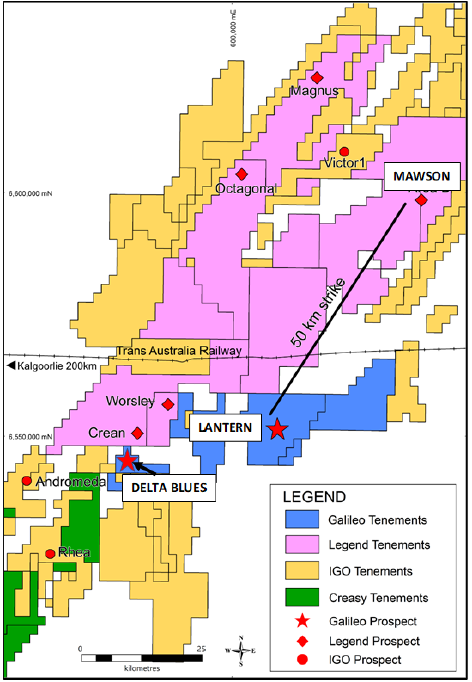

It is worth noting that while Galileo is focused on the exploration and development of nickel, copper and cobalt resources in Western Australia it also has joint ventures with the Creasy Group over tenements in the Fraser Range which are highly prospective for nickel-copper sulphide deposits similar to the operating Nova mine.

GAL also holds tenements near Norseman with over 26,000 tonnes of contained cobalt, and 122,000 tonnes of contained nickel, in JORC compliant resources, an important factor to bear in mind as cobalt appears to be coming back into favour.

Of course, Creasy’s in-depth knowledge of the Fraser Range region, and indeed his broader success in making some of Australia’s largest discoveries, is an asset in its own right.

As the founder of Galileo, Creasy earmarked these assets and as he remains a major shareholder with a stake of 26% is helping to shape the group’s exploration strategy, as he did so successfully at Nova and Mawson.

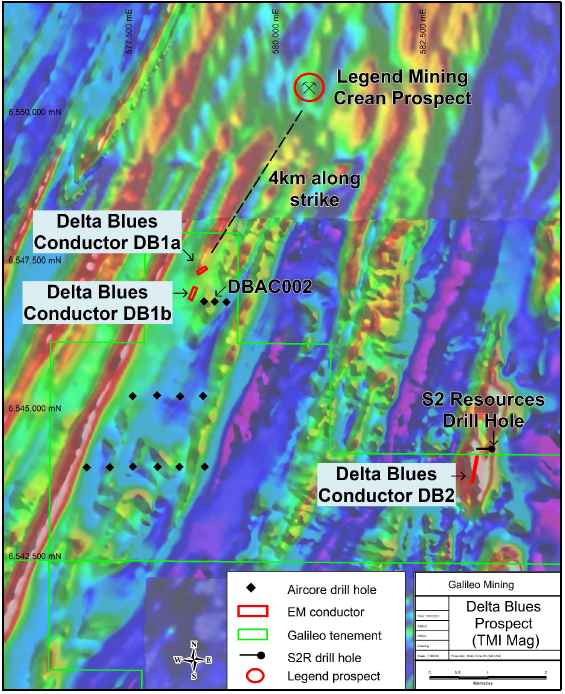

The close proximity of Delta Blues relative to Galileo’s Lantern Project, as well as other major deposits being developed by IGO (Nova) and Legend Mining (Mawson) can be seen below, and this further reinforces Galileo’s profile as one of the best emerging nearology plays in the prolific Fraser Range nickel province.

Aircore drilling at the Delta Blues prospect in late 2019 intersected nickel prospective host rocks with weathered sulphides observed in petrology samples.

Petrographic description of rock chips from hole DBAC002 identified a metamorphosed cumulate mafic granulite with minor goethised sulphides.

This rock unit appears to have intruded a metamorphosed volcano-sedimentary package in a similar geologic environment to magmatic systems with known nickel sulphide mineralisation in the Fraser Range.

Modelling of EM data at anomalies DB1a and DB1b show strong conductors of 4,100 Siemens and 2,500 Siemens respectively. Conductor DB1a is 600 metres north-west of drill hole DBAC002 and conductor DB1b is 300 metres west-north-west of DBAC002.

Both of these targets are located approximately four kilometres along strike from Legend Mining’s Crean Prospect (see above) where drilling has identified ultramafic intrusive rock units prospective for nickel sulphide mineralisation.

Modelling of EM data at anomaly DB2 indicates a conductor of 2,700 Siemens. The centre of this conductive model is 300 metres south of a six-metre band of semi-massive and net-textured sulphide intercepted in diamond core drilling by S2 Resources.

The presence of sulphides in DBAC002 and in S2 Resource’s drilling suggests that the cause of the conductive anomalies may well be related to additional sulphide mineralisation.

However, conductive anomalies can also be formed by non-economic rock units including graphitic or sulphidic sediments.

Further regional EM surveying and infill EM surveying is underway and is expected to be completed in the March quarter, assisting management in developing targeted drilling programs.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.