Galan’s second drill hole provides confidence

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

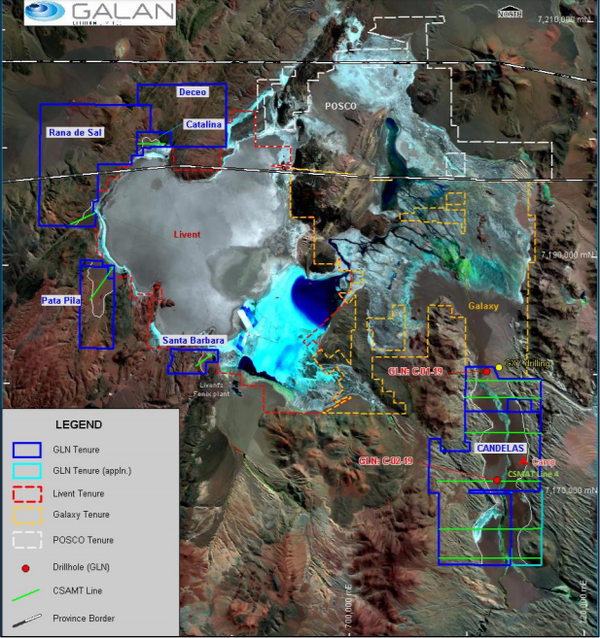

Galan Lithium Ltd (ASX:GLN) has completed drill hole C-02-19 to a depth of 662 metres at the Candelas Lithium Brine Project located immediately to the south-east of the Hombre Muerto salar in Argentina.

Early data is encouraging with a 202 metre section from 460 metres to the end of hole returning robust conductivity levels.

The results were well received by the market with the company’s shares increasing more than 20% from 25.5 cents to a high of 31 cents within 30 minutes of the news being released.

While the levels are of a lower order than those recorded in C-01-19, they are still expected to return lithium values albeit at lower levels.

However, management noted that sample waters were elevated in temperature, indicative of proximal hydrothermal activity which would dilute the aquifer at this location.

As indicated on the following map, the area being drilled is to the south-east of Galan’s tenure.

Similar geology to maiden drill hole

Drill hole C-02-19 largely replicates the geology of the maiden drill hole including good levels of potential porosity within a thick 230 metre sequence of conglomerates, comparing favourably with the 105 metres thickness delineated in C-01-19.

Similar to C-01-19, C-02-19 has a layer of ignimbrite to 167 metres below shallow alluvial cover.

Management said that the extended presence of these lithologies provided confidence that they should continue south of C-02-19 in the Candelas channel.

The tectonic basin in this area was found to be much deeper (632 metres vs 310 metres), encountering a very thick sequence of sands and clays at depth to 400 metres before entering interbedded breccia and conglomerates to 632 metres, similar in character to that observed in maiden drill hole C-01-19.

Provides better understanding of the region

Cutting through much of the highly technical geological characteristics, Galan’s managing director, Juan Pablo Vargas de la Vega responded favourably to the drilling results in saying, “Much has been achieved to date in a short time frame.

“We are dealing with a unique geological setting for lithium brines and our knowledge of the region increases with the more work we do.

“The lithium potential remains strong for Candelas as it does for our prospective western tenements at Hombre Muerto”.

A third drill hole targeting an area north of the current hole and south of the maiden hole will commence shortly.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.