FYI begins trading on the US-based OTCQX

Published 15-APR-2021 12:23 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FYI Resources Limited’s (ASX: FYI) application to join the US-based OTCQX market has been accepted, with the company trading under the stock code OTCQX: FYIRF from today, 15 April 2021.

FYI is positioning itself to be a significant producer of 4N (99.99%) and 5N (99.999%) high quality, high purity alumina (HPA), through low carbon and environmental footprint production and adhering to high ESG standards.

“We are delighted to now be part of the North American financial community and be trading on the OTCQX” FYI’s Managing Director, Mr Roland Hill said.

“With our Tier One support and US aspirations, we believe it is a perfect time to increase our exposure to one of the largest and most sophisticated markets in the world. In light of the growing US interest in E-mobility and battery related investments, as a participant in the electric vehicle revolution, FYI believes it is an important step in our future to become a participant in the OTCQX.”

The listing comes just as Foster Stockbroking has put an increased price target on FYI, rising from 68 cents to $1.52.

It is also follows the company’s highly promising Definitive Feasibility Study update.

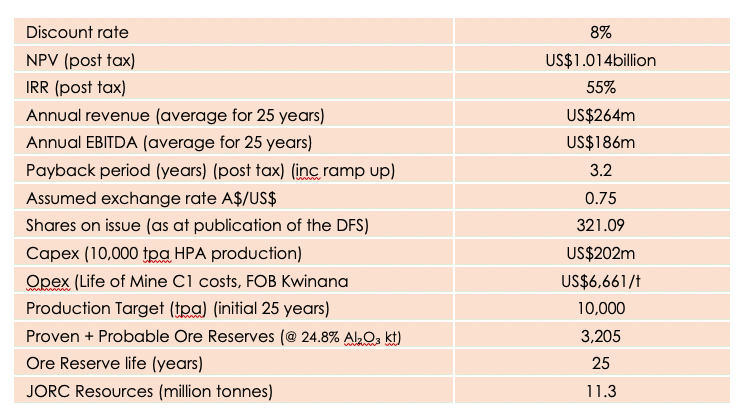

FYI’s project’s Net Present Value (NPV) has almost doubled - from $543M to now over US$1BN.

As you can see in the table below, this is a step change in the economics of FYI’s project, and continues to demonstrate that FYI’s market cap of $181.4M appears undervalued.

Read: FYI’s Net Present Value Almost Doubles - Now Over US$1 Billion

FYI expects that trading on the OTCQX will enhance the visibility and accessibility of FYI to the growing market of North American retail, high net worth and institutional investors.

The primary advantages to North American investors include:

- Allows trading of FYI in local time zone

- Trades and settlements are in US Dollars (no exchange rate risk or additional fees)

- The OTCQX is a common share (same class) as the FYI shares traded on the ASX (ASX: FYI)

- All shares are maintained through our current share registry services is Automic Group

“OTCQX promotes both high financial standards and ‘best practice’ corporate governance and statutory compliance,” Hill said. “Home Exchange reporting-being FYI’s ASX obligations, satisfies the OTCQX requirements and disseminates throughout the US without additional compliance requirements.

“This major step for the Company into the US markets is a direct response to the increase in US investor interest in FYI’s fully integrated and innovative flowsheet design which delivers high quality, high purity alumina (HPA) coupled with the excellent project financial metrics, a positive ESG impact and increasing investment exposure into electric vehicle (EV) and strategic battery minerals supply chain opportunities.”

With its listing out of the way, FYI has now turned its attention to seeking DTC eligibility from The Depository Trust and Clearing Corporation (DTC). This is independent of trading on the OTCQX.

DTC manages electronic clearing and settlement of publicly traded companies across the United States and in over 130 other countries, thereby giving investors around the world the opportunity to trade in the securities of member companies electronically from their online accounts. It provides for cost-effective clearing and guaranteed settlement, simplifying and accelerating the settlement process of daily trades. Eligibility will ensure a more liquid and transparent market for FYI’s common shares within the United States as is the case with daily on-market trading on the ASX.

FYI is expected to complete the process in May.

In the interim OTCQX trading will be conducted through OTC market Maker, BRiley https://brileyfin.com/

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.