Fort Cady Borate Project DFS progressing well

Published 25-SEP-2018 12:29 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

American Pacific Borate and Lithium Ltd (ASX:ABR) has provided an update on its progress as it seeks to complete the definitive feasibility study (DFS) for its Fort Cady Borate Project in the December quarter of 2018.

As a backdrop, the Fort Cady project is in Southern California, and the resource is a highly rare and large colemanite deposit with substantial lithium potential.

It is the largest known contained borate occurrence in the world not owned by the two major borate producers Rio Tinto (ASX:RIO) and Turkish state-owned Eti Maden.

The JORC Resource at Fort Cady has 13.9 Mt of contained boric acid.

ABR has met a number of major milestones in the last month, including finalisation of site layout and discussions with potential partners with respect to the sale of boric acid and gypsum once in production.

Management also said that positive discussions with regulatory bodies regarding project support and permitting were ongoing.

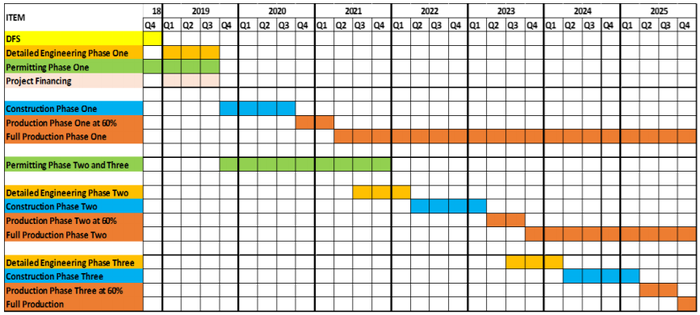

The company has established a timeline that projects first production in the fourth quarter of 2020, representing a comparatively swift transition from construction to production.

While this is subject to financing and permitting, the following timetable provides a comprehensive outline of the company’s goals and development schedule.

Commenting on these developments, ABR Managing Director Michael Schlumpberger said, “The DFS for our Fort Cady Borate Mine remains on target for completion in Q4 CY2018.

“We have now finalised our site layout that is consistent with our approved Plan of Operations (mining permit).

“We are pleased to be targeting, subject to financing and final permitting, the commencement of production in Q4, CY2020.

“We continue to believe that we have all the right ingredients to become a globally significant producer of borates, including a large colemanite resource that has been successfully mined before, likely low pre-production capex, a brilliant logistics solution and close access to all necessary utilities.”

It is worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

Product development and partners

Of course, as is the case with any commodity, having a buyer for your product is essential and management had some interesting comments to make on this note.

As mentioned, the company continues to have positive discussions with potential partners for the sale of boric acid and gypsum.

In particular though, management is encouraged by its gypsum discussions and believes there is a large Californian market that can potentially absorb its by-product gypsum at full production.

In addition to discussions with respect to boric acid and gypsum, ABR is considering the option of selling by-product hydrochloric acid (HCl) from its potassium sulphate (SOP) production.

Discussions are progressing with large users of HCl in California that have the potential of underwriting an increase in SOP production.

Whilst discussions are at a preliminary stage, the company is considering options of decoupling the SOP production from the broader project with a view to financing that element of the project via alternate means.

This could potentially have a positive benefit on project financing, an important factor in derisking the development process, and quite often a share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.