Force Commodities acquires stake in DRC lithium region

Published 07-AUG-2017 15:10 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

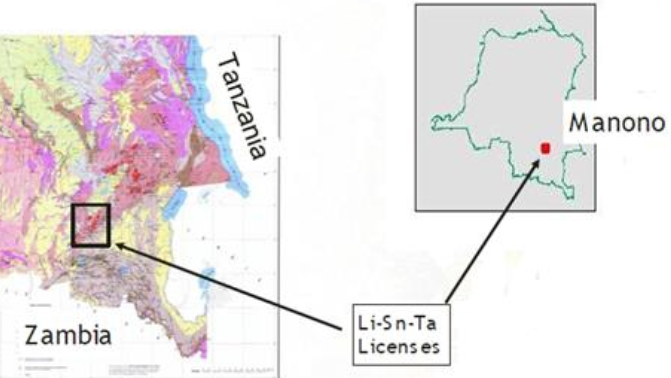

Force Commodities (ASX: 4CE) has negotiated a Heads of Agreement to acquire interests prospective for lithium, tin and tantalum within Manono-Kitotolo Pegmatite in the Democratic Republic of Congo (DRC).

4CE will acquire a 70% interest in the Kiambi project which is considered highly prospective for lithium, tin and tantalum as recently evidenced by the success of AVZ Minerals; its shares doubled in the last fortnight on the back of outstanding exploration results at its Monono project. Results included 202.8 metres grading 1.57% lithium dioxide.

4CE has also entered into a Heads of Agreement which will see it take a 70% stake in a joint venture to be formed with the DRC government-owned entity, Cominiere SA, and a holding exploration licence PR 12453 in the DRC. This is also prospective for lithium, tin and tantalum mineralisation, and further exploration licences are expected to be included, subject to the company beginning its work and investing at least $500,000 in exploration.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

Kiambi situated just 30km from AVZ’s project

The key takeaway with regard to these transactions is the proximity of the Kiambi project to AVZ’s Manono Lithium Project, with the tenements being located just 30 kilometres south-west. The tenements being acquired are not only located in close proximity, but are within the same Manono-Kitoltolo Pegmatite.

It is also worth noting the long-term 30 year mining license that has been granted to 4CE – a significant aspect of the company’s plans, given the potential scale and long life of lithium projects within the DRC. The 30 year granted mining lease is valid from April 2015, and can be renewed for 15 years at a time in accordance with the DRC mining code.

The Kiambi project comprises granted mining license PE 8251 covering an area of 34 square kilometres and exploration licence PR 12453, which is in the renewal process, covering an area of 400 square kilometres. The project is well served from a transport perspective and a hydroelectric plant provides power to the area.

While the region has historically been mined for tin, this ceased in 1953. Though subsequent studies had identified the existence of pegmatites in the project area, mining activities were not conducted.

Manono-Kitotolo could be world’s largest pegmatite

With a strike length of 15 kilometres and average width of 800 metres, the Manono-Kitotolo lithium pegmatite deposits are believed to be the largest in the world. In terms of geological make up, mineralisation is mainly spodumene and lepidolite.

In commenting on AVZ Minerals’ (ASX: AVZ) recent exploration success, the company’s Executive Chairman Klaus Eckhof described the project area as a “world-class resource”.

As at close of business on August 4, 2017, AVZ had a market capitalisation of $130 million. By comparison, 4CE’s market capitalisation is only $7 million; but this news has the potential to provide positive share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.