Following the dateline from exploration to resource definition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Dateline Resources Ltd (ASX:DTR) released its quarterly result on Wednesday, highlighting the progress that it has made at the Gold Links Project in Colorado.

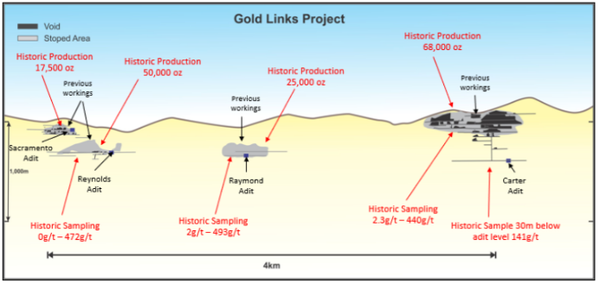

This project is comprised of several contiguous historic gold mines that have been consolidated by the company.

Gold Links has historically produced up to 150,000 ounces of high-grade gold which featured bonanza grades of up to 493 g/t gold and in particular, records indicate crude ore shipments up to 287 g/t gold from the Gold Links ‘2150’ vein.

Mineralisation can be traced on surface and underground for almost six kilometres from the northern to the southern sections of the project.

While a resource is yet to be defined, well-documented records indicate that there are large areas that remain untested at surface and little to no exploration has been done below the valley floor.

Dateline also owns the Lucky Strike and Mineral Hill permitted gold properties and has recommissioned a gold processing plant located at the Lucky Strike Mine.

Gold Links and the Lucky Strike are located approximately 50 kilometres apart.

8000 metres of drilling at Gold Links

In the June quarter the company commenced an 8,000 metre drilling program at the northern section of the Gold Links Project.

The drilling program is intended to prove the down-dip extension of both the Sacramento and 2150 veins.

The drill program has so far been expanded from 41 to 45 holes as a result of testing further along the strike of the Sacramento vein.

In what appears to be an astute move given the presence of high-grade mineralisation at depth, management decided to acquire a multi-purpose drill rig capable of both reverse circulation (RC) and diamond core drilling, with the latter providing access to deeper sections of the orebody.

Some of the shallower holes have been completed in full by RC drilling.

Much anticipated assay results from 60 samples

Stages one and two of the three stage Sacramento drilling program have been completed for a total of 16 holes.

The company is awaiting the return of assay results for 60+ samples which are expected back by August 9, and at that stage they will be digitized and presented to the market.

Drilling has commenced on the 2150 vein where the holes planned are longer than the holes drilled at Sacramento.

Consequently, substantial news flow is imminent, potentially providing share price momentum in the second half of 2019.

As well as exploration results, in May executive director Stephen Baghdadi said, “With the project now consolidated under a single ownership, all the tenements on freehold land and a fully-funded exploration program set to go, we are on track to meet our goal of establishing a maiden JORC Resource in the December quarter of this year.”

That would indeed be a market moving development.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.