First customer signed up for WMN’s Indonesian graphite hub

Published 24-JUN-2015 12:20 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australian graphite developer Western Mining Network (ASX:WMN) has signed up a major South Korean industrial supply company as its first long term off-take customer for its Indonesian graphite play.

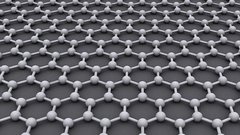

Graphite is in great demand worldwide as a key component in lithium-ion batteries and is also being applied in scores of high tech uses, including high strength materials.

WMN wants to mine high-grade graphite at its Tamboli Project, process it to 94% purity, and export it to the global markets from its strategic location on the island of Sulawesi in Indonesia.

The company is also setting up an industrial park just outside the mine to create a hub of graphite innovation – giving it a revenue stream that takes in every aspect of the graphite market.

To bring this about, WMN has been conducting extensive drilling to develop a JORC compliant resource at Tamboli.

It’s also locked in a definitive agreement with a South Korean consortium to construct a processing and purification plant, capable of producing commercial grade graphite powder, which sells on the world market for up to $1,200 USD/tonne.

First customer for Tamboli

In a major step for Tamboli, WMN has signed a letter of intent (LOI) with South Korean industrial supply company Dongsung Highchem Co Ltd, which has committed it to taking 50,000 tonnes of graphite per year from the project.

The LOI was signed after Dongsung analysed samples of WMN’s Tamboli graphite ore, and will be used for steel applications in Korea. The company also analysed WMN’s mining plans and its beneficiation plant.

The announcement of this deal, before WMN even enters production, demonstrates the strategic importance of new sources of graphite to the industry.

The final agreement between WMN and Dongsung detailing monthly delivery volumes and pricing points is expected to be finalised in the coming months.

WMN’s Executive Chairman, Christopher Clover, says with this agreement in place, WMN is now well positioned to accelerate its push to get the Tamboli mine into production.

“This LOI is another important step in developing Tamboli and provides further validation there is a strong market for the product which could be supplied from the project,” he says.

“Due to Tamboli’s location and excellent infrastructure there has been substantial interest from several parties. With our project partners now in place, the company is looking forward to finalising the remaining steps which include financing in order to being Tamboli on line.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.