European Metals surges 20% in response to positive processing results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

European Metals Holdings Limited (ASX:EMH; AIM: EMH; NASDAQ: ERPNF) has released promising results from locked-cycle testwork (LCT), a metallurgical processing assessment conducted on ore concentrate extracted from the company’s flagship Cinovec Lithium Project.

Such is the significance of these results that the company’s shares surged to a high of $1.39 in morning trading, representing an increase of about 20% compared with the previous day’s close of $1.15.

Unfortunately, as the broader sharemarket shed more than 100 points, some of these gains were lost, but its current price still reflects a significant positive rerating on a tough day for investors.

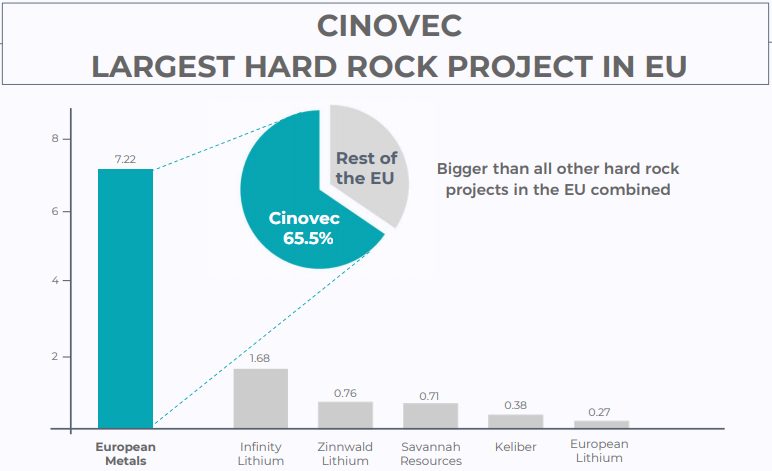

The Cinovec Project, located on the German border of the Czech Republic, is the largest hard-rock lithium resource in Europe, containing lithium-bearing mica known as zinnwaldite which the company intends to refine using a number of processes initially outlined in a pre-feasibility study (PFS).

92% lithium recovery slightly exceeds PFS flowsheet

The principal objective in terms of commissioning the LCT was to confirm the flowsheet for the processing of zinnwaldite concentrate from Cinovec run-of-mine ore.

The LCTs differ from previous proof of concept and optimisation testwork conducted during the Cinovec PFS.

LCT confirms the effect of recycle streams that carry some lithium and other alkali metals on the overall recovery of lithium from the pregnant leach solution resulting from the water leaching of the roasted zinnwaldite concentrate and the ability to produce battery-grade lithium carbonate.

The LCTs have processed zinnwaldite concentrate from drill core samples taken from the southern part of the Cinovec orebody, representing ore that will be processed in the first five years of the mine plan.

The recovery of up to 92% of the lithium in the concentrate sample compares favourably with the similar recovery in the PFS flowsheet of 91%.

However, this new recovery of up to 92% is before lithium plant DFS/FEED optimisation testwork that will be targeted in specific process areas, and this is expected to increase hydrometallurgical recovery in the lithium plant to more than 92%.

Separate metallurgical testwork on the Front-End Comminution and Beneficiation (FECAB) circuit is underway and is designed to improve upon the lithium recovery of 90% from ore to concentrate.

Cheaper and cleaner workaround for fluoride removal meets EV specs

Ahead of the LCTs, an alternative process to remove fluoride was tested in order to meet the Electric Vehicle grade specification of less than 50 ppm in the lithium carbonate.

The previously announced PFS flowsheet proposed the removal of fluoride by the use of activated alumina, a relatively costly step because the activated alumina was not considered suitable for regeneration.

This step has been replaced by a cheaper and cleaner two-step process involving chemical precipitation and ion-exchange.

This new method of fluoride removal has been proven to be highly effective, easier to implement and is less costly as the ion-exchange resin can easily be regenerated and re-used many times.

In addition to fluoride, the zinnwaldite mica at Cinovec contains alkali metals, including potassium, rubidium and caesium, which are leached into solution and will build up in the plant if not removed from the circuit.

The LCTs have proven conclusively that unwanted alkali metals can be removed preferentially by control of temperature, pH, solution saturation and crystallisation.

It has been confirmed that these alkali metals will not build up due to recycling processes within the plant.

The removal of these deleterious elements within four LCTs with minor loss of lithium is a major step towards confirmation of process plant design.

Discussing the group’s impressive progress in terms of identifying of all processing methods, executive chairman Keith Coughlan said, “In a significant vote of confidence for our Pre-Feasibility Study (PFS), the proposed process methodology has been confirmed by excellent locked-cycle test results which also include new processes involving recycle streams.

"The robustness of the process was further confirmed by the stabilisation of the process streams, enabling the work to stop after only four of the six test cycles were completed.

"The recovery of up to 92% of the lithium in the zinnwaldite concentrate at this early stage of DFS testwork is very promising for increased recoveries during the planned process optimisation work.

"Further, an improved fluoride removal step which is cheaper and cleaner represents only the beginning of further optimisation work which we expect will result in greater lithium recoveries and even stronger economics for the Cinovec Project.’’

From a processing perspective it is also important to note that the current LCTs have been commissioned to confirm the lithium carbonate processing flowsheet.

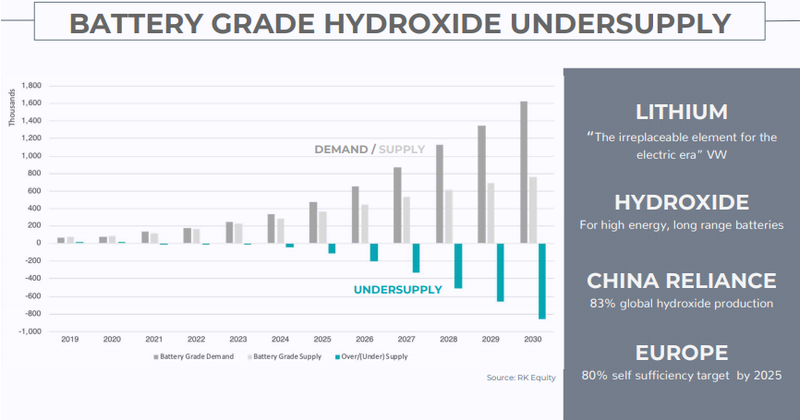

The Cinovec Project has optionality to either produce a battery-grade lithium carbonate product or to further process the lithium carbonate to produce battery grade lithium hydroxide.

As the Front-End Engineering Design FEED program continues, testwork should be commissioned to confirm the optimal production route for lithium hydroxide and to produce marketing samples for prospective offtake partners and environmental samples to assist in permitting approvals.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.