European Metals submits EIA and releases drill results

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

European Metals Holdings Limited (ASX:EMH; AIM: EMH; NASDAQ: ERPNF) through the Cinovec Project company Geomet s.r.o has submitted the documentation relating to the initial environmental impact assessment (EIA) notification to the Czech Ministry of the Environment.

This will be an important derisking milestone for the group.

EMH is developing the largest hard rock lithium resource in the European Union.

It is worth noting that following European and Czech environmental legislation the submission also includes an independent expert assessment of Natura 2000 (the European Union’s network of nature protection areas) which concluded that there is no negative impact on proximate nature reserves or any other sites of natural importance.

In terms of timing, the Ministry of Environment has launched a two month screening procedure, including the notification of all concerned stakeholders.

By way of background, Geomet controls the mineral exploration licenses awarded by the Czech State over the Cinovec Lithium/Tin Project.

Geomet is owned 49% by European Metals and 51% by CEZ a.s. through its wholly owned subsidiary, SDAS.

Cinovec hosts a globally significant hard rock lithium deposit with a total Indicated Mineral Resource of 372.4Mt at 0.45% Li2O and 0.04% Sn and an Inferred Mineral Resource of 323.5Mt at 0.39% Li2O and 0.04% Sn containing a combined 7.22 million tonnes Lithium Carbonate Equivalent and 263kt of tin.

Drilling results in line or better

There was another important development today with the company releasing the latest results from its current nineteen-hole resource drilling programme at the Cinovec Project.

Drilling of seventeen of the nineteen holes has been completed and the eighteenth hole is currently underway.

Analytical results for another six of the drill holes from the Cinovec South deposit have been released and European Metals executive chairman Keith Coughlan discussed the significance of these developments today in saying, “We are pleased to report that submission of the EIA to the Czech Government fulfils a critical path item in relation to finalising the approval for the Cinovec mine.

"We anticipate that the process will enable European Metals and its JV partner CEZ to actively engage with the relevant stakeholders to ensure that all affected parties are consulted and all viewpoints are actively considered.

"With regard to the drill results, we advise that the interim results of the current drilling programme at Cinovec are either in line with, or better than our expectations.

"The primary purpose of the programme is to convert a larger portion of the resource to the measured category to provide greater certainty of the financial model and security to the financiers we are currently in discussions with.

"It is important to note that the first stage of the ore processing, the wet magnetic separation, has the effect of greatly increasing the grade of lithium oxide in the concentrate to approximately 2.85%.

"The zinnwaldite concentrate produced from Cinovec requires only roasting, compared to the calcination and roasting required in processing spodumene.

"This will have the effect of considerably reducing greenhouse gas emissions of the project when compared to spodumene projects.”

EMH highlights ‘’in lab’’ beneficiation results

Given the relative ease of beneficiation of the Cinovec deposit through wet magnetic separation, management decided that it was important to report the drill results and the “in lab” beneficiation results.

The MPH previously reported outstanding lithium recoveries at coarse grind with wet magnetic separation (WMS) achieved a >80% pure lithium mica concentrate grading 2.85% Li2O with a lithium recovery of 92%.

The current drill programme has been planned to define blocks of resource for the first 5 years of mining within the Cinovec-South area, with a goal to convert the resource from indicated to measured category.

The holes have been terminated in ore consistent with the aim of targeting the first 5 years of resource blocks for the mine.

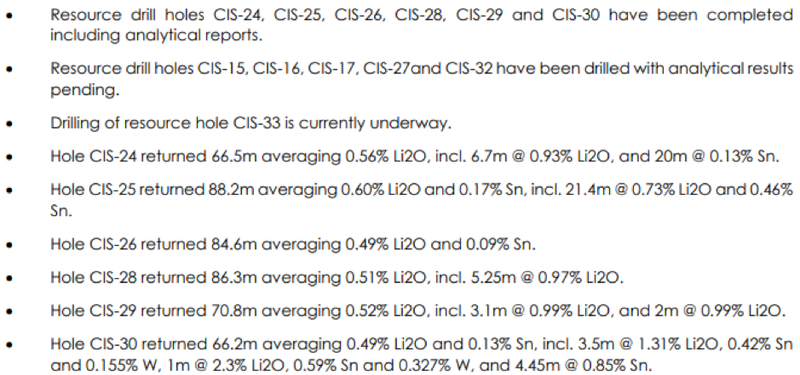

All holes (CIS-24, CIS-25, CIS-26, CIS-28, CIS-29 and CIS-30) are collared in over-lying rhyolite, and the following indicates the grades of lithium and tin.

The release of an upgraded resource will prompt analysts to revisit their valuations and it will also provide a clearer path in terms of management’s ability to progress operational milestones and secure funding.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.