Euro Manganese ticking the boxes at Chvaletice Manganese Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Euro Manganese Inc. (TSX-V/ASX:EMN) has provided an update on important prerequisites leading up to the development of its proposed Chvaletice Manganese Project.

EMN is a battery materials company, focusing on the development of the Chvaletice Manganese Project in which it holds a 100% interest.

The proposed project incorporates the reprocessing of a significant manganese deposit hosted in tailings from a decommissioned mine that is strategically located in the Czech Republic. The site is in relatively close proximity to the major Western European industrial hubs that are active in the automotive and battery manufacturing sectors.

Euro Manganese plans to be a leading, competitive and environmentally superior primary producer of ultra-high-purity manganese products in the heart of Europe, serving the lithium-ion battery industry, as well as other high-technology applications.

The company’s capacity to financially deliver on the project has been strengthened following the successful close of the second tranche of the oversubscribed private placement of AUD$30 million completed earlier this month.

Encouraging government support for project

The permitting process for the project continues to build on five years of meaningful and constructive engagement with governments, regulatory agencies and local communities.

Euro Manganese has benefitted from ongoing collaboration and support for the project at various levels of the Czech Government, which approved the company’s application for investment tax credits on eligible project expenditures.

In March 2020, the government issued a ruling under European Union’s Natura 2000, determining that the Chvaletice Manganese Project is not expected to adversely impact endangered and protected species habitat.

Current permitting work is focused on producing a Final Environmental and Social Impact Assessment for the project.

Completing the assessment is the next step in the permitting process, following the successful initial public screening procedure of the project’s Preliminary EIA by the Czech Ministry of the Environment in late-2020.

Regulatory bodies that participated in the initial screening procedure have viewed the project positively because it is designed to eliminate a longstanding source of water pollution and restore the site back to a more natural state.

Water management is an essential part of the project design, and a comprehensive groundwater monitoring program has been in place since 2017 to establish benchmark data on the extent of the contamination from the former mining operation.

To date, 25 monitoring wells have been drilled, and the water is tested monthly.

Management is targeting the use of only recycled, contaminated and waste water in its production process.

Construction of all-important demonstration plant imminent

Detailed design of the Chvaletice Manganese Project’s Demonstration Plant (DP) by the Changsha Research Institute for Mining and Metallurgy is progressing well, with 97% of equipment ordered and fabrication about to begin.

The demonstration plant consists of six interconnected modules that will replicate the entire HPM production process to be used in the commercial operation of the project.

Planning work is underway for a revamp of two industrial buildings that were part of the original Chvaletice mining operation four decades ago.

The buildings will be upgraded to house the Demonstration Plant modules.

The permitting process for the building renovation and construction work is underway and targeted for completion in June/July 2021.

DFS on schedule for start of 2022

The company continues to make solid progress on the definitive feasibility study (DFS), which is targeted for completion in the March quarter of 2022.

To date, the study is tracking on schedule and on budget, with approximately 50% of physical progress complete as at the end of April 2021.

The DFS is expected to provide the design, cost and scheduling details needed to arrive at a final investment decision and secure full financing for the project.

Testing is underway to help optimise the design of processes, including materials handling, solid/liquid separation, leaching, purification and crystallisation.

Recent work on the site included a geotechnical drilling program of 20 bore holes in both the mine site and process plant areas to quantify ground conditions required for the design of building foundations.

Additionally, a groundwater pumping test is planned to determine the availability of contaminated ground water as a potential source of process make up water for the plant.

Robust industry demand for high purity manganese products

The final investment decision for the Chvaletice Manganese Project will also depend on securing offtake agreements with customers who want to purchase its high purity manganese products.

As the only sizeable manganese resource in the European Union, the project is in a strong strategic position.

Customer interest is increasing, and discussions continue with several potential off-takers of Chvaletice’s HPM products.

Discussing the relationship between product demand and environmental standards, chief executive Marco Romero said, “For many prospective customers, the Chvaletice Manganese Project ticks all the boxes.

“As a recycling project, we have the potential to be one of the world’s greenest sources of high purity manganese, which will help auto makers and battery manufacturers meet the EU’s increasingly stringent environmental standards.

‘’We expect to help the EU meet its decarbonisation goals while cleaning up a longstanding source of water pollution and creating long-term local employment.

‘’There’s no other HPM production opportunity like this in the world.”

All of these factors should positively impact the final investment decision due in 2022.

If all goes according to plan, the FID would be followed by the arrangement of project financing and start of construction, with plant start-up, commissioning and commercial production projected for late 2024 or early 2025.

The caveat in terms of these projections is that the project continues to be subject to COVID-19 pandemic-related risks, including travel restrictions, that could impact the company’s ability to meet its upcoming targets.

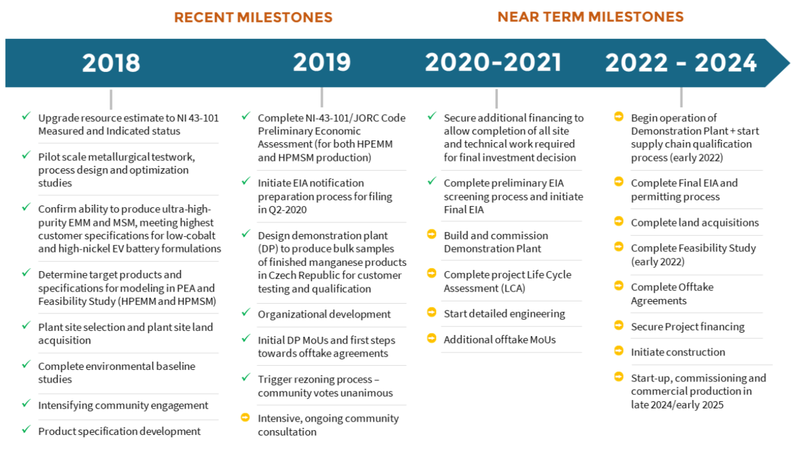

However, all going to plan, the following timeline indicates the program that lies ahead.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.