Early New Year’s gift for Castillo Copper

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

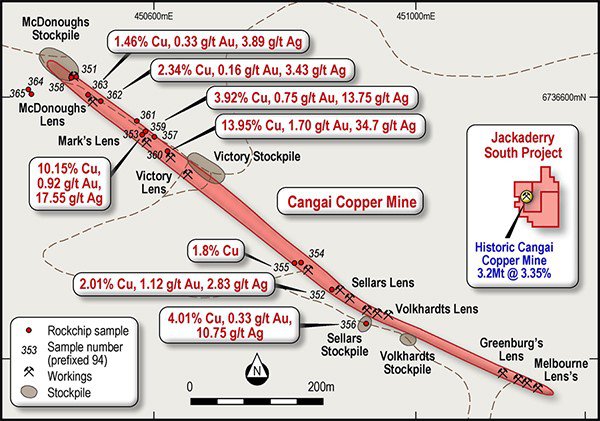

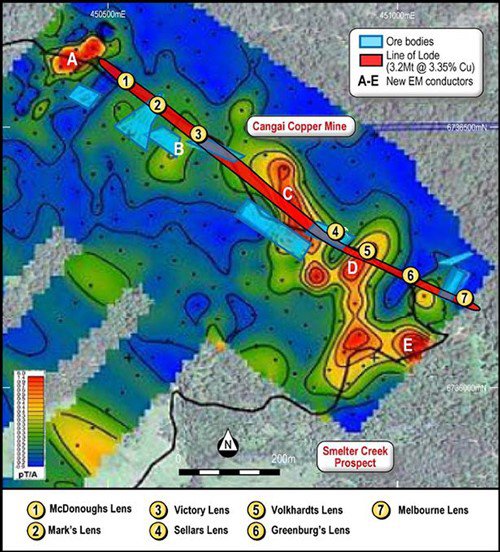

Castillo Copper (ASX:CCZ), an ASX-listed base metal junior focusing on copper, cobalt, zinc and nickel, has announced the unexpected discovery of five geological anomalies at its Cangai Copper Mine following electromagnetic surveying.

The EM results indicate there are potentially significant, highly mineralised sulphides within the areas identified, and could also mean CCZ is able to materially build on its existing JORC inferred resource. Its company assets comprise four tenure groups that collectively hold 11 highly prospective copper-cobalt-zinc-nickel project areas in New South Wales and Queensland.

Initial geological interpretation suggests the new anomalies comprise highly mineralised sulphides not factored into the current JORC Inferred Resource which CCZ has at its disposal (3.2 million tonnes @ 3.35 percent copper; 20.2 grams per tonne silver, and 0.80 grams per tonne gold) which derived from historic drilling results.

Figure 1Source:Casillo Copper Ltd.

To facilitate an increase in its overall Resource at Cangai, CCZ says that “more funds are being allocated to expand the current drilling program and incremental surveys,” and hopes to update the market with its latest batch of assay results in the near-term, according to a company shareholder update.

CCZ has called today’s results a “game-changer” that could significantly alter the scale of the current resource at the Cangai Copper Mine.

It is, however, early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

Independent confirmation of today’s results comes via a detailed report from Newexco, the company selected by CCZ to analyse its exploration results. The five significant electro-magnetic (EM) conductors at Cangai Copper Mine are now expected to be further investigated as a first priority.

Given the extraordinary discovery of five new large conductors and the fact that this is the first time a ground EM has been applied to Cangai Copper Mine, CCZ’s Board approved the expansion of its drilling program.

Figure 2Source:Casillo Copper Ltd.

Interestingly, CCZ’s published results bear strong similarities to Sandfire’s (ASX: SFR) Degrussa project in Western Australia (WA), whereby “high-grade supergene ore oxide material sits above larger volumes of highly-mineralised sulphides”.

Drilling will recommence immediately following the New Year break while drilling samples will be assayed by ALS Laboratories (NSW) with results expected in coming weeks.

In response to today’s published EM results, CCZ Executive Director Alan Armstrong said that,” The Board views this development as a pivotal point in Castillo Copper’s evolution, as the EM survey has delivered an outcome that materially exceeds our expectations. Indeed, this new discovery is timely as the current drilling campaign moves into full swing. The Board highly values the work carried out by Newexco, as their experience in major copper discoveries, including work carried out on a massive sulphide deposit in Western Australia, is invaluable to evaluating the potential deposit at Cangai Copper Mine.”

Following this morning’s news, CCZ shares have continued their steady climb from July of last year, now trading at $0.08, up around 280% over the past six calendar months.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.