Early Drill Results Support Emerging Large-Scale Gold System at TTM’s Dynasty Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

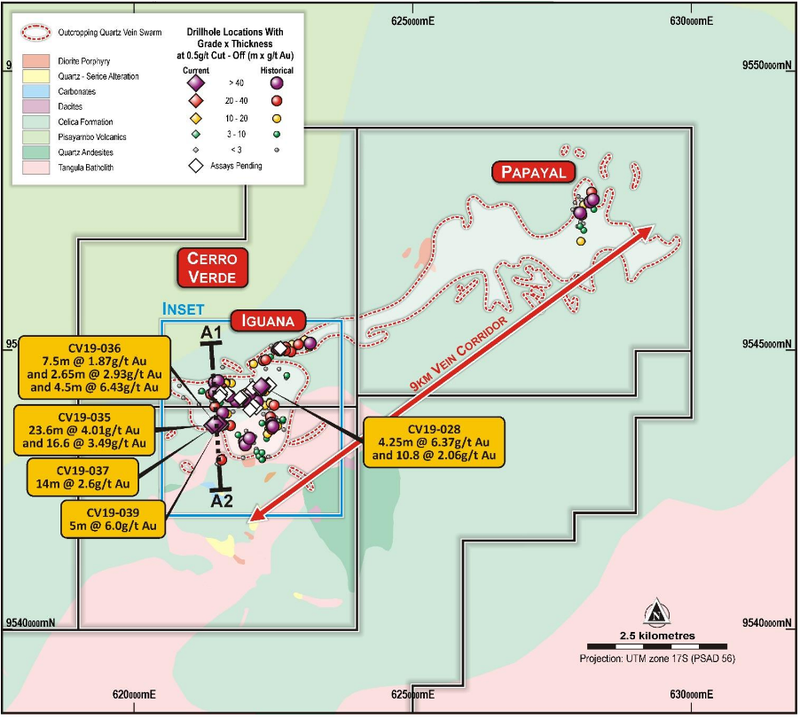

A first batch of assay results have arrived from a recently completed diamond drilling program at Titan Minerals Limited’s (ASX:TTM) Dynasty Gold Project, providing further support of an emerging large-scale gold system and extending known mineralisation that remains open in multiple directions.

The company is also currently re-logging and sampling historical drill cores on the project, with assays results to be released next month, and is also in the final stages of planning a fresh 6,000m drill campaign. The increased activity comes off the back of a buoyant market for gold stocks and a recent capital raise.

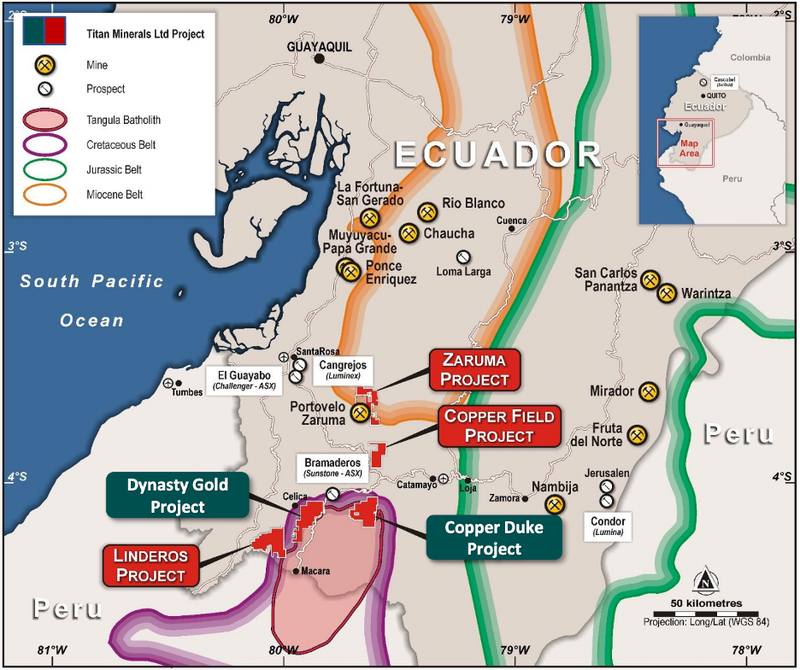

Dynasty is an advanced stage exploration project located in the Loja Province of southern Ecuador. It hosts a foreign resource (Canadian NI 43-101) estimate of 2.1Moz averaging 4.5g/t gold. The project is located in a region that has attracted major mining companies looking for world class assets.

It comprises five concessions totalling 139km2 and includes three concessions that received an Environmental Authorisation in early 2016 which are fully permitted for exploration and small-scale mining.

Diamond drill results

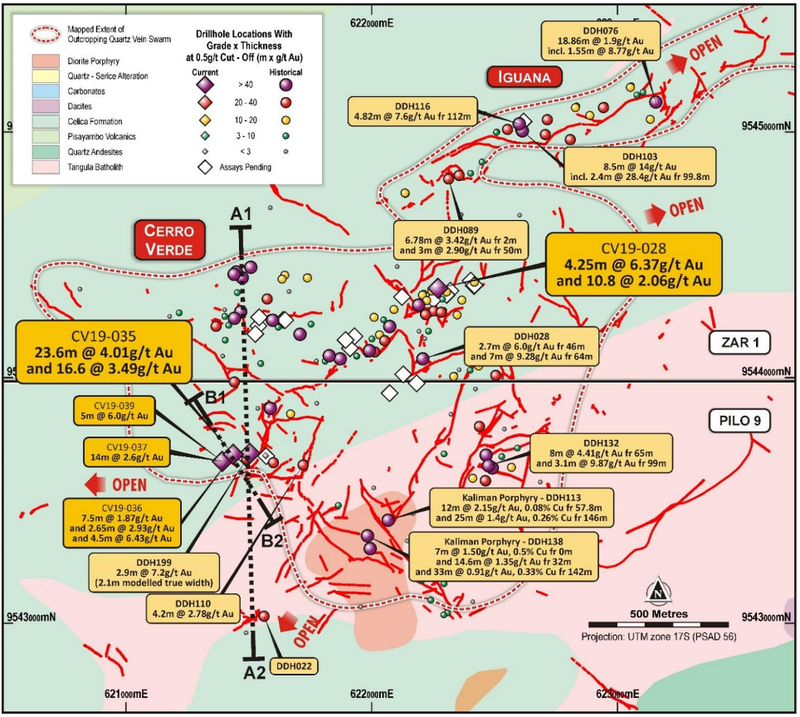

The assay results reported show that deeper intercepts return higher grades over broader mineralised intercepts for the quartz veins, the subject of current results and modelled in the foreign resource estimate, which is based on selective core sampling of predominantly vein material only.

The reported results are for the first 10 of 41 drill holes, totaling 4,419 metres of diamond drilling, confirm the presence of additional mineralisation outside the previous mineral resource estimate.

Assay results for the first 10 diamond holes include:

- 14.5m @ 6.43g/t gold from 119m, including 6.65m @ 12.5g/t gold from 122.55m

- 23.6m @ 4.01g/t gold from 107.9m, including 6.0m @ 11.0g/t gold from 111.15m

- 16.6m @ 3.49g/t gold from 171.4m

- 2.80m @ 2.51g/t gold from 38m

- 15.2m @ 3.04g/t gold from 133.8m

- 5.00m @ 6.00g/t gold from 68.1m

- 4.25m @ 6.37g/t gold from 56.85m

- 10.8m @ 2.06g/t gold from 89.5m

The mineralisation identified is anticipated to deliver additional metal endowment from extensions to mineralised zones along strike and down-dip, and from broader mineralised zones haloing some of the veins previously modelled.

The reported results show the presence of high grade mineralisation on strike extensions and up to 300m vertically below high grade veins recently mined in open pits and are located 120m down-dip of original vein intercepts. Further drilling is required to assess the continuity of mineralisation confirmed at depth.

Assay results confirm the presence of additional mineralisation outside the previous mineral resource estimate. The mineralisation identified is anticipated to deliver additional metal endowment from extensions to mineralised zones along strike and down-dip, and from broader mineralised zones haloing some of the veins previously modelled.

The broader zones reported include drilled intercepts measuring three to five times wider at a 0.5g/t gold cut-off that result from including mineralised material in halos outside modelled veins, but previously not sampled in original drilling.

Commenting on the new assay results Titan Managing Director, Laurie Marsland said:

“The initial batch of assay results are very encouraging. Wider and higher grade intercepts at depth, and where altered material surrounding the veins is included, we are seeing up to three to five times wider intercepts than previously reported.

“These results add weight to the view of developing open pits over these extensive high-grade mineralised vein swarms, that typify the Dynasty Gold Project, we are very much looking forward to starting the new 6,000m drill campaign to further develop this exciting project.”

Planned Work

A 6000m drill campaign to is to start imminently with planning now in its final stages.

The logging of core from the recent drill program is nearing completion and further assay results are currently pending analyses.

The re-logging and sampling of the historical drill core at Dynasty (drilled 2004 to 2007) has commenced, with the first assay results expected during August 2020.

Bids from drilling contractors for re-commencement of diamond drilling at the project during the third quarter of 2020 are currently being evaluated and planning is in its final stages. The emphasis will be on collecting oriented core and core on new drill orientations for inclusion in geologic modelling updates.

The company confirm that the Resource Update, in compliance with JORC Code, remains on track for the end of 2020, with the planned drilling and ongoing core sampling programs at Dynasty Gold Project targeting this conversion.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.