Drilling at Rupice drives Adriatic higher

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

This related to the company’s polymetallic (featuring high zinc grades) Rupice Project in Bosnia, with that broader region of former Soviet states drawing substantial attention from multinational miners in recent years due to the high grade long life deposits that have been identified.

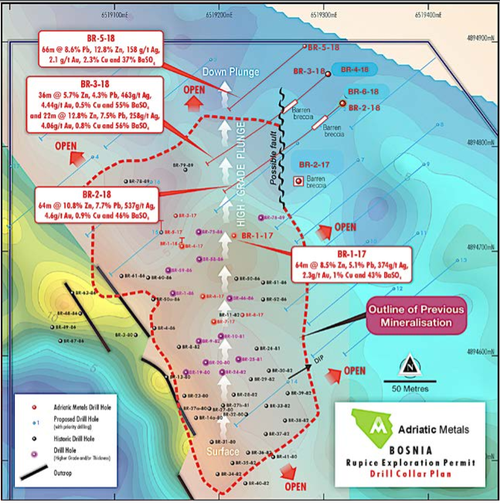

While management was able to appraise investors of assay results from the recent hole BR-4-18 and advised that the drilling of BR-6-18 had been completed, some outstanding news regarding hole BR-5-18 was in the offing.

Of course, ADT remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Zinc grades of 12.8 per cent

This morning’s update based on recent drilling confirmed a further high-grade and thick intercept, extending mineralisation north of Rupice.

The intercept included 66 metres at 2.1 g/t gold, 158 g/t silver, 2.3% copper, 8.6% lead, and importantly an extension of the very robust zinc grades which were 12.8%.

These results extend the high-grade mineralisation approximately 110 metres down-dip from an historical hole.

This hole’s proximity and similar geological features to another high-grade hole situated only 40 metres to the north highlights the continuity and thickness within the interpreted northern mineralisation corridor, suggesting the potential for further exploration upside.

The landscape changes just as quickly in the investment world as it does at the mine site.

The release of further news just before the market opened on Tuesday morning piqued investor interest as can be seen in the following chart that maps trading from the open. Importantly, this rerating has been driven by the second highest trading volumes ever recorded by Adriatic. It shows this rise has been driven by the second highest trading volumes ever recorded by Adriatic. , In fact, this morning’s development resulted in the company’s shares surging more than 15 per cent in morning trading.

The past performance of these products is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As we said this morning, only limited drilling to date has already resulted in extensions to known mineralisation, as well as confirmation that the resource remains open at substantial widths in several directions.

Consequently, updated results don’t in isolation provide an accurate guide as to the big picture, but they are providing management with valuable information in terms of understanding the highly prospective territory at the Rupice Project.

Consistent geology, thickness and high grades

However, it is hard to argue that results such as those released this morning that feature such impressive thicknesses and high zinc grades don’t bode well for the company.

Adriatic’s chief executive, Geraint Harris commented, “BR-5-18 represents not only another significant extension to the north and once again down-dip at the Rupice North Zone, but it also demonstrates a remarkably consistent geology, thickness and a high-grade metal assemblage akin to the other holes we have drilled in this area.

“Our ongoing exploration programme continues to enhance our understanding of the stratigraphic and structural controls on the mineralisation corridor at Rupice North.

“Our drill programme is increasing in intensity based on the recent spectacular results and we will now expand our drill testing of the prospective mineralisation in several of the directions where the mineralisation remains open.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.