CXX in talks with leading European bank on niobium financing

Published 10-JUN-2016 14:58 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Cradle Resources (ASX:CXX) will be funded through to decision to mine after snagging $2.16 million – with the company in advanced discussions with “a leading European bank” about ongoing finance.

It told its investors today that it had placed 8 million shares at 27c each to raise the cash – which will mean CXX is in a position to make it to an expected major financing decision regarding its Panda Hill niobium mine in Tanzania.

Part of the cash will go on the final instalment of cash owed to the original project vendor.

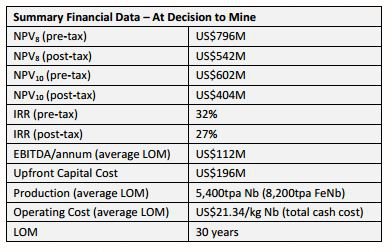

CXX also told investors that the Panda Hill joint venture company was in “ongoing and advanced” discussions with a leading European Bank about a mixture of debt and equity funding for the project – which it said in April had a pre-tax internal rate of return of 32%.

The tax rate could change in the time from now until exports occur from the project – but releasing the projects definitive feasibility study CXX chairman Craig Burton said that “the number speak for themselves”.

It told investors at the time that the project would have an annual EBITDA figure of $122 million – based on a project with an up-front capital cost of $196 million and production of 5400 tonnes of niobium per year.

Details of the project, according to the DFS

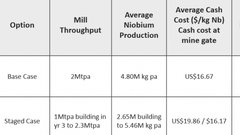

The project is being planned on a stepped schedule – whereby the first four years of throughput will be 1.3 million tonnes per annum before this is stepped up to 2.6Mtpa.

The step-up in production will be funded by the first four years of production.

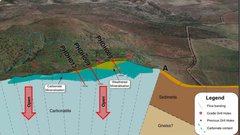

It has previously confirmed the ability to process raw niobium ore from the project into a saleable product.

On CXX and niobium

Niobium has previously been labelled as a ‘space age’ material thanks to its use in products such as modern car bodies, space shuttles, and jet engines.

It is a key ingredient in high-strength, low alloy steel – with its demand set to grow at around 3% per year according to recent reports.

Panda Hill is one of the few niobium projects aiming to come onto the market in the coming years – taking aim at a market which has traditionally been tight.

“This will be the first new niobium producer in 40 years and the only new producer of this rare metal in the foreseeable future,” Burton previously said.

“The demand for niobium continues to grow strongly due to the burgeoning worldwide demand for new-age materials and associated elements like lithium, graphite, and niobium. Panda Hill is only seeking to capture a modest portion of this ongoing demand growth.”

*Editor’s note* – It should be noted that Tanzania is a high risk region owing to political instability which can affect mining projects getting off the ground.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.