CXX starts FEED – and savings have already been found

Published 12-AUG-2016 15:16 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Cradle Resources (ASX:CXX) has just started front end engineering and design (FFED) work on its Panda Hill niobium project, and it’s already identified savings.

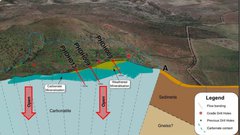

The ASX-listed miner told its shareholders today that FEED work had started on the project, which is forecast to supply 6% of the world’s niobium.

It said a slew of partners, consultants, and service providers had been appointed to the process, and it was already paying dividends.

It said that after review, the tailings dam for the project would cost less than predicted under the project’s definitive feasibility study, with the amount of earthworks needed reduced, therefore reducing up-front costs for the project.

It did not say, however, how much these savings would amount to.

Meanwhile, offtake agreement talks continue in earnest, with CXX telling shareholders that it had entered into negotiations with offtake parties “covering four geographical regions”.

It also updated on its financing efforts, saying that an indicative term sheet for a circa $100 million senior loan was in the process of being prepared.

In addition, the financier is working to secure a loan guarantees under Germany’s “United Loan Guarantee Scheme”, which “cover against economic and political credit default risks”.

Preliminary financing is being pencilled in for the fourth quarter.

CXX and niobium

Niobium has previously been labelled as a ‘space age’ material thanks to its use in products such as modern car bodies, space shuttles, and jet engines.

It is a key ingredient in high-strength, low alloy steel – with its demand set to grow at around 3% per year according to recent reports.

Panda Hill is one of the few niobium projects aiming to come onto the market in the coming years – taking aim at a market which has traditionally been tight.

“This will be the first new niobium producer in 40 years and the only new producer of this rare metal in the foreseeable future,” CXX chairman Craig Burton previously said.

“The demand for niobium continues to grow strongly due to the burgeoning worldwide demand for new-age materials and associated elements like lithium, graphite, and niobium. Panda Hill is only seeking to capture a modest portion of this ongoing demand growth.”

This is still an early play and its impact remains to be seen, so take a cautious approach to any investment decision made with regard to CXX.

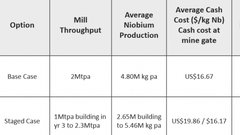

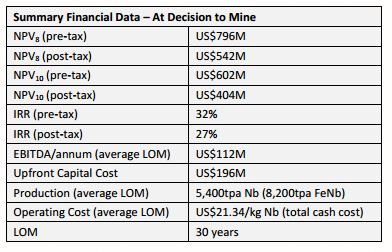

The results of the DFS indicated the project would have an annual EBITDA figure of $122 million, based on a project with an upfront capital cost of $196 million and production of 5400 tonnes of niobium per year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.