CXB makes battery grade Lithium carbonate with advanced processing tech

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

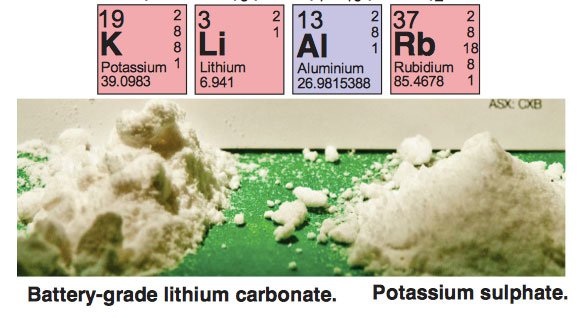

Cobre Montana (ASX:CXB) has achieved the highest purity level yet from its advanced lithium extraction technology, reaching 99.66% on an lithium mica ore sample taken from the 514.8Mt Cinovec project in the Czech Republic.

This breakthrough has led the company to signing a Heads of Agreement with project owner European Metals (ASX: EMH) to extract lithium from Cinovec with initial production to come from tin tailings. This agreement details a proposed 50/50 JV to process these tailings and produce lithium carbonate.

CXB’s advanced processing technology is optimised to extract lithium from lithium mica rocks, a long neglected source of this valuable material. Lithium is forecast to be great demand over the coming years as it’s a key ingredient in rechargeable batteries powering electric cars, and renewable energy devices such as solar panels.

CXB has been applying its processing technology to lithium micas at its main lithium project in Western Australia – Lepidolite Hill near Coolgardie – and at Cinovec in a bid to accelerate its ambition to create a globally significant lithium (‘Li’) resource base, drawn exclusively from lithium micas.

Lithium carbonate sells for around $6,000 a tonne and CXB estimates it can extract the material from Cinovec’s tin tailings for as little as $2,000 a tonne.

These cost estimates were factored into a Scoping Study on Cinovec recently released by European Metals.

Processing technology unlocks value

CXB has an exclusive licensing arrangement with Perth-based Strategic Metallurgy – which has developed advanced lithium extraction technology that uses little energy and low temperature leaching to extract battery grade lithium from mica rocks and other sources such as tin tailings.

The technology can also extract potassium sulphate, a valuable ingredient for fertilisers.

Mica rocks are considered a ‘forgotten source’ of lithium and have long been neglected in favour of more easily attainable resources, such as the brine systems found in South American nations like Peru and Brazil, or hard rock deposits found in Nevada in the United States.

In the case of the hard-rock deposits mining costs are often very high, then comes the process of using high temperature furnaces and intense leaching to extract the lithium.

The method CXB have an exclusive license for uses low temperature leaching to recover lithium from mica which can be found in mine dumps, tailings dams and discharge from existing mining operations including tin extraction. The CXB process is able to create high purity products quickly, with less energy and significant by-product credits.

In terms of resource size, Cinovec is classed within the top five hard rock lithium deposits in the world at 514.8Mt inferred – but the pervasive lithium mica within the host rocks sets it apart.

CXB now has the opportunity to partner with European Metals and produce battery grade lithium carbonate from lithium bearing tin tailings generated during the recovery of tin and tungsten from the Cinovec deposit.

A low cost opportunity for a high-grade product

As European Metals drives Cinovec towards full production, CXB’s ultimate aim is to use its processing technology on the mica rocks that are found in abundance there, creating a low cost yet high grade lithium source close to Europe’s industrial heart.

Lithium is a key material for the production of lithium-ion batteries, which are in increasing demand from the electronics and electric vehicle industries.

Owing to CXB’s lower cost extraction methods, should the company’s technology be applied, an inferred lithium resource of 5.5Mt Lithium Carbonate Equivalent (LCE) and 514.8Mt Li2O (0.1% Li cutoff) can be calculated.

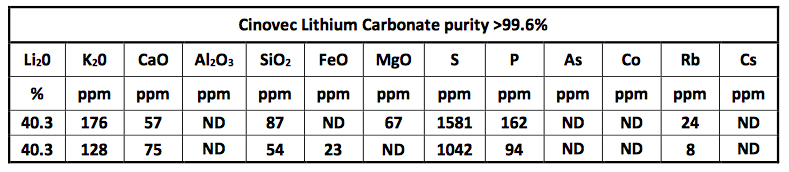

The first batch of lithium CXB produced had a purity of 99.56%, and the second batch it produced improved that figure with a purity of 99.66%.

This second demonstration of the extraction technology at Cinovec is aimed at showing the technology’s consistency and scalability.

CXB’s Managing Director Adrian Griffin says the positive results at Cinovec are echoed by similar results at the company’s Lepidolite Hill project in Western Australia.

“We have succeeded in producing battery grade lithium carbonate from mica sourced from both Lepidolite Hill and Cinovec,” he says.

“We have repeated the result at Cinovec and had a look at the production implications of processing such materials. The fundamentals are outstanding, and the HoA crystallises our commercial position at Cinovec; a position we see as being very strategic in our quest to capitalise on lithium micas by the application of disruptive processing technology.”

Heads of Agreement confirmed

CXB and Cinovec’s project owner EMH have signed a non-binding Heads of Agreement (HoA) with a view to forming a 50/50 JV to produce lithium carbonate and associated by-products from tin tailings at Cinovec.

The HoA records the terms both parties intend to be part of the JV to be agreed at a later date, and the agreement will support the initial period of mining and production at Cinovec by EMH.

Under the terms, CXB will manage the JV on the processing side and procure the technical assistance of Strategic Metallurgy. EMH will handle the mining and provide the tailings, following the extraction of tin and tungsten.

The initial feedstock will be tin tailings, both from tin mining by EMH, and stockpiles from historic mining stretching back over 600 years.

Cinovec fuels CXB’s global ambitions

The Cinovec deposit is one of the world’s largest hard rock lithium resources and with the assistance of CXB’s licenced technology, EMH has worked up a 5.5Mt inferred resource and set an additional exploration target of up to 5.3Mt.

If this exploration potential is realised, EMH would have the largest lithium resource in the world and CXB could be in a strong position as the processor of its by-products.

CXB is also developing five lithium projects in Western Australia, including the Lepidolite Hill project near Coolgardie where it’s produced high-grade samples of lithium using its processing technology.

With these projects in play, CXB stands to become a leading lithium producer, opening up a new frontier for the material by drawing from lithium micas.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.