Cracking drillhole sends Galan’s shares soaring

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

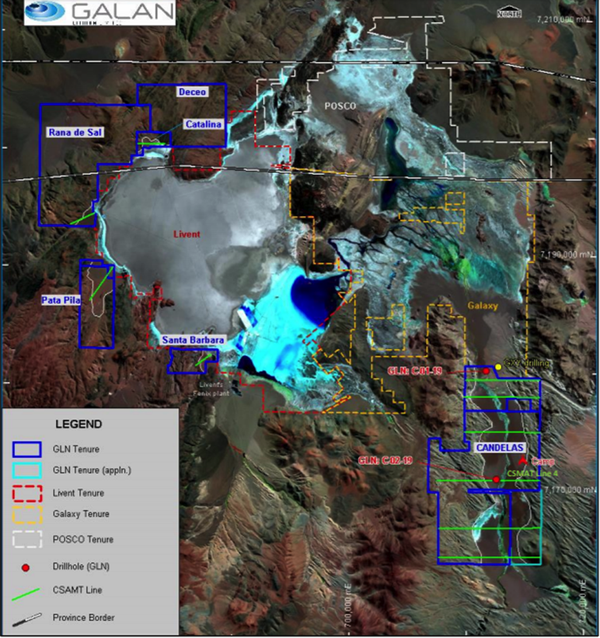

Galan Lithium Ltd (ASX:GLN) has released highly promising results from third drillhole (C-03-19) at the Candelas Lithium Brine Project on the Hombre Muerto salar in Argentina.

Field measurements indicate that the upper levels of a brine bearing aquifer have been encountered in the third drillhole from depths of approximately 280 metres to the current depth of approximately 310 metres.

Importantly, this drillhole is approximately 2.5 kilometres south-east of the maiden drillhole which provided outstanding results including an intercept of 192 metres at 802 mg/l lithium with low impurities.

Not surprisingly, this news has excited investors with the company’s shares up approximately 30% in morning trading.

Similar geology to high grade maiden hole

In geological terms, the sequence largely replicates that observed in the maiden drillhole incorporating a thick layer of ignimbrite lying below surficial alluvial cover.

The hole then encountered a sequence of sands and clays hosting salty waters which then, at about 280 metres, turned to brines hosted within a permeable breccia-conglomerate.

Conductivity measurements from brine samples exceeded the 200 millisiemens/cm limits of the field recording instrument whilst specific gravity was recorded at 1.13 grams per cubic centimetre.

Brine temperatures were below 20° centigrade, confirming that the aquifer intercepted in the second drillhole, where aquifer temperatures reached in excess of 55° centigrade approximately seven kilometres to the south, has likely been diluted with localised hydrothermal waters.

Galan has also now received assays from the second drill hole (C-02-19) which was completed to a total depth of 662 metres.

These assays confirm the field observations which indicated a lower grade lithium bearing aquifer interpreted to be due to dilution from hydrothermal waters.

Share price momentum from further updates

Commenting on the third drillhole, Galan’s managing director, Juan Pablo Vargas de la Vega said, “The discovery of further brines within the Candelas channel reinforces our view that the project has the very real potential to host a significant lithium resource in one of the world’s premium salars at Hombre Muerto.

“I look forward to updating shareholders as we continue drilling the third hole”.

Early stage data is promising, and perhaps an indication that further updates could provide further share price momentum.

It could be argued that there is significant scope for further share price upside given that the company’s shares were sold down heavily due to disappointment regarding the second drill hole.

With holes one and three now confirming management’s expectation that it is homing in on a highly promising system rather than just an isolated area of mineralisation, Galan could emerge as one of the most promising emerging players in the lithium sector.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.