Cortadera system larger than Hot Chili expected

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The potential for Hot Chili Ltd (ASX:HCH) to transform its Cortadera Copper-Gold Project gets better by the day as the company releases promising drilling results.

Today, HCH announced a break-through in the collection of historical information, not previously available to the company.

New data regarding the Cortadera copper-gold porphyry discovery in Chile indicates a robust picture of its growth potential beyond the existing three porphyry centres discovered to date, revealing a much larger porphyry system than first recognised and confirmation of a fourth porphyry within the discovery window.

Management is particularly encouraged by key attributes of the Cortadera porphyry system including the association of magnetite with copper porphyry mineralisation.

This is a common characteristic in globally significant gold-rich copper porphyries such as Alumbrera in Argentina, Cascabel in Ecuador and Batu Hijau in Indonesia.

New anomaly larger than those at existing discovery

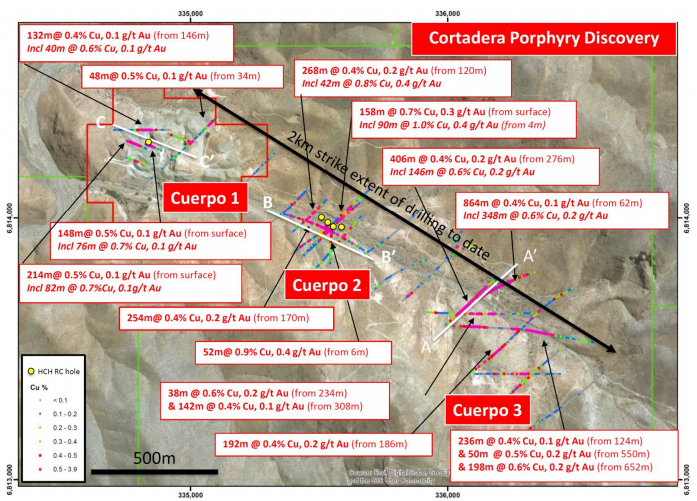

Hot Chili has secured geological logs for all 23,230 metres of historical diamond drilling. Initial modelling of Cortadera using this information has expanded the known local extents of each of the three porphyries (Cuerpo 1, 2 and 3).

Other key digital datasets now secured include geophysics (magnetic and IP surveys), surface geochemistry, mapping and various modelling and surveys undertaken during the period between 2011 and 2013.

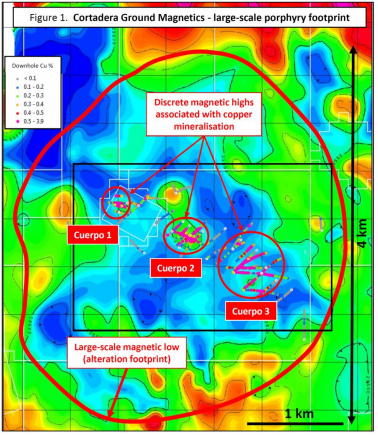

Of most significance is the addition of a detailed ground magnetic survey across Cortadera as displayed below.

Magnetics reveal a large-scale footprint surrounding the Cortadera discovery, the key characteristic which management mentioned as aligning with globally significant, gold-rich copper porphyry deposits.

The large alteration related magnetic footprint is elliptical and measures approximately three kilometres by four kilometres in dimension.

Within the centre of the magnetic footprint (magnetic low), each of the three porphyry centres are associated with discrete magnetic anomalies (magnetic high).

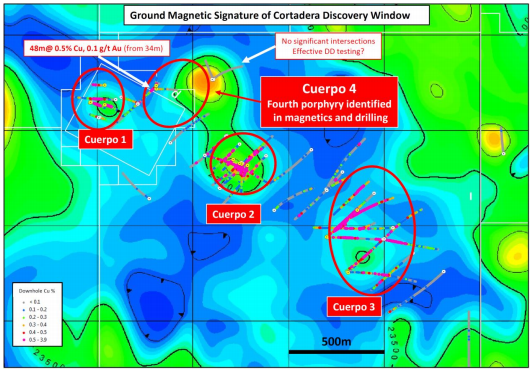

Importantly the survey revealed a fourth magnetic anomaly lying between Cuerpo 1 and Cuerpo 2 which appears to be larger and more intense than those related to the existing discovery as indicated below.

Hot Chili drilling confirms presence of fourth porphyry

Two historical diamond drill holes directed towards testing this magnetic anomaly were unsuccessful in recording any significant mineralisation.

However, it is now apparent that an orphaned historical drilling intercept of 48 metres grading 0.5% copper and 0.1g/t gold appears to lie on the southern flank of the fourth magnetic anomaly.

This is shown in the north-west corner of the following map, just south of the 132 metre intersection which featured similar grades.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.