Cora completes stage 2 drilling at Sanankoro gold discovery

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. FinFeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

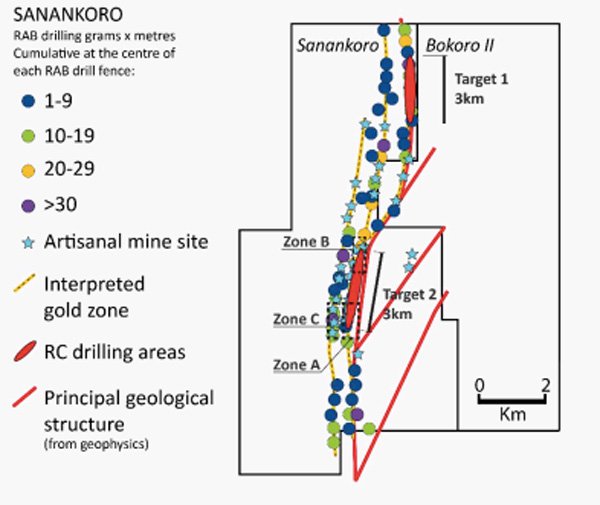

West Africa-focused gold explorer, Cora Gold (LON:CORA), has updated the market on completion of the stage 2 drilling campaign at its flagship Sanankoro gold discovery in southern Mali.

The recently completed stage 2 drilling campaign has comprised around 5,600 metres of aircore (AC) and reverse circulation (RC) drilling. This program targeted the connection of, and short extensions to, the north and south of zones A and B, aiming to extend the mineralised strike length to over three kilometres.

To date, shallow reconnaissance drilling has been completed at zone C, a parallel structure west of zones A and B.

Confirmatory drilling fences into each of zones A and B, including about 500 metres of diamond core into fresh rock.

Furthermore, drilling encountered broad zones of quartz veining, often within a sandstone and volcanic tuff package of host rocks, which is consistent with drilling on other parts of the mineralised structure. Visible gold was also observed in many panned samples at the drill rig.

Test assays have been completed using a variety of techniques in order to both mitigate the risk of sample bias and to maximise the potential for more representative results.

Full assay results are pending.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

CORA CEO, Dr Jonathan Forster, said: “We are well underway with our exploration programme at Sanankoro with stages 1 and 2 drilling now completed and assaying in progress.”

“Drilling has continued on a reconnaissance basis, with the 1 km long gap between zones A and B, and a new area about 500m to the west (zone C) all tested by drilling to depths of up to 10x0m. Orientated core drilling at selective points at zones A and B are designed to confirm the drill results of Gold Fields, and also enable the company to better understand controls to mineralisation.”

“As with our earlier programme, we encountered broad zones of quartz stockwork along the structures tested, as well as deep levels of weathering. Panning of samples at the rig often encountered visible gold, ranging from a few grains to over a hundred grains in the pan, with various levels of coarseness. This is not unusual in Birimian gold deposits and as a result, test assays have been completed using a variety of techniques to ensure any potential sample bias in the results is managed effectively.”

“Test results have, in general, confirmed the preference to use an assay procedure with larger sample sizes in order to provide better correlation of gold grade with observations of visible gold.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.