Comet Resources to acquire Santa Teresa Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Comet Resources Ltd (ASX:CRL) has executed a binding heads of agreement (HOA) with privately owned El Alamo Resources Limited (EARL) for the proposed 100% acquisition of the Santa Teresa Gold Project.

It has done so, while concurrently executing a non-binding term sheet with Raptor Capital International Limited for gold streaming and royalty financing to fund activities at the project for up to US$20 million (initial minimum of US$6 million).

The acquisition will be completed on a staged basis, with Comet acquiring a 50% interest upon satisfaction of due diligence and the initial US$6 million financing being made available to the company, with the remaining 50% interest to be acquired upon a decision to mine being made in respect of the project.

Commenting on the highly prospective features of the Santa Teresa Project and the importance of the proposed funding agreement, Comet managing director Matthew O’Kane said, “Santa Teresa contains attractive near-surface high-grade gold mineralisation that is open along strike and at depth.

“Along with the non-dilutive development funding from Raptor, I believe we can add significant value to Comet as we move the acquisition to completion and the project to production.”

O’Kane also highlighted that the company continues to prepare for its initial field exploration program at the Barraba Copper Project in New South Wales.

The Santa Teresa Gold Project

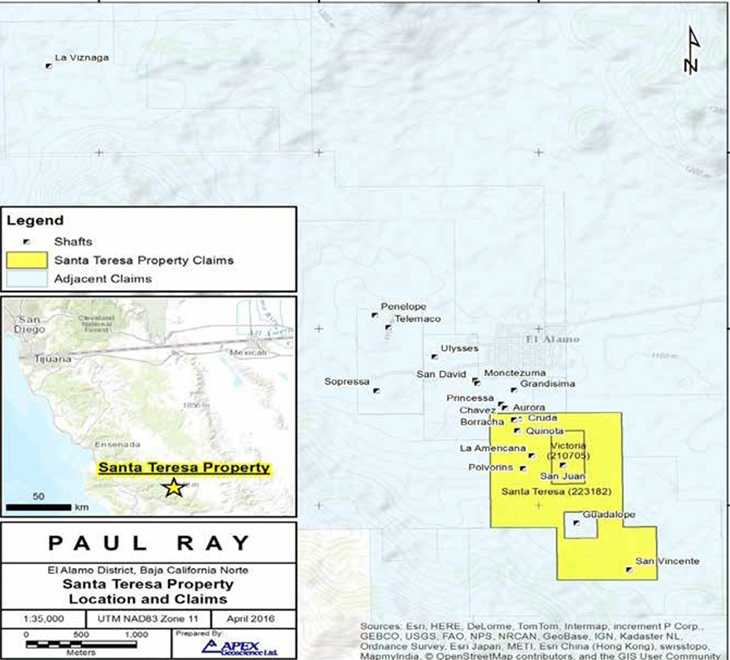

The Santa Teresa Gold Project is comprised of two mineral claims totalling 202 hectares located in the gold rich El Alamo district.

The claims are 100 kilometres south-east of Ensenada, Baja California, Mexico and 250 kilometres south-east of San Diego, California.

The project is prospective for high grade gold, with an existing Inferred Resource of 64,000oz Au at an average grade of 8.7g/t, reported at a cut-off grade of 4g/t.

When capped at 20 g/t the Inferred Resource is 64,000 ounces gold at an average grade of 8.7 g/t and a cut-off grade of 4 g/t.

In addition to the two claims of the project, two additional claims totalling a further 378 hectares in the surrounding El Alamo district are being acquired from EARL.

The following map indicates the significant historical exploration activity that has been conducted in the El Alamo district, and the region has reported gold production of between 100,000 ounces and 200,000 ounces of gold.

Comet to focus on near-term production opportunities

Following the conclusion of the project acquisition, Comet aims to focus physical works at Santa Teresa on assessing near term production opportunities within the Santa Teresa licence area itself, as well as the other licences proposed to be acquired in the El Alamo district if this work warrants commencement of mining activities.

All such activities may be financed by the Raptor stream financing under the conditions of the aforementioned non-binding term sheet.

The use of proceeds is to fund development activities at Santa Teresa and the facility will be secured only against the Santa Teresa Gold Project itself and any further tenements acquired in the region.

Comet has made it a condition of the acquisition of the project that the stream and royalty financing is concluded to its satisfaction.

In progressing its gold assets, Comet has expanded its portfolio while also balancing its commodity exposures through diversification.

The company is developing a portfolio of base and precious metal projects with the acquisition complementing and building on the recently acquired Barraba Copper Project in New South Wales.

The 2,375 hectare exploration licence that covers the project area, EL8492, is located near the town of Barraba, approximately 550 kilometres north of Sydney.

It sits along the Peel Fault line and encompasses the historic Gulf Creek and Murchison copper mines.

The region is known to host VMS (volcanogenic massive sulphide) style mineralisation containing copper, zinc, lead and precious metals.

Comet will commence drilling shortly, and these results will add to what should be a solid year of newsflow for the group.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.