Comet graphite test work indicates high value product

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

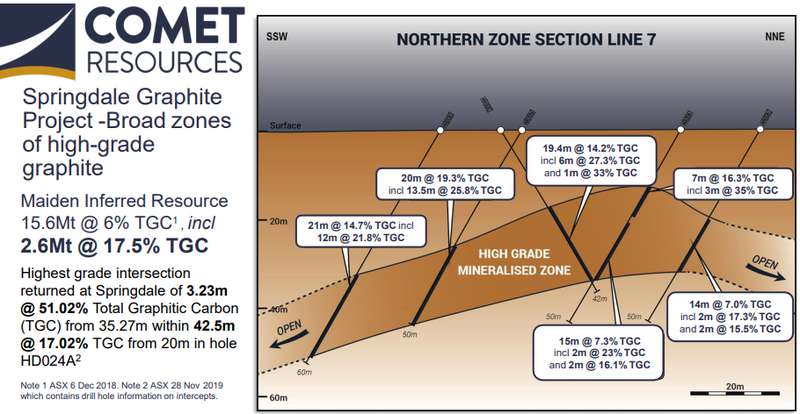

Comet Resources Ltd (ASX:CRL) has received promising metallurgical test work completed on material from the diamond drilling program at the Springdale Graphite Project in Western Australia in 2019.

This included a total carbon grade of 96.9% in final optimised flotation results.

These results open up opportunities for potential applications in high price graphite markets for anode materials and lubricants.

This will also pave the way for further test work on graphene.

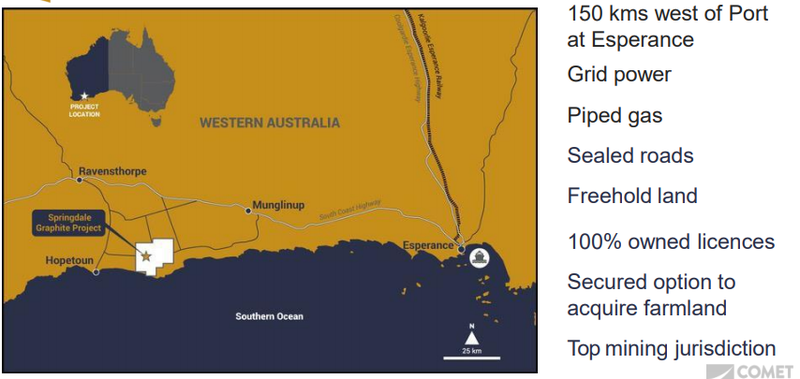

The 100% owned Springdale graphite project is located approximately 30 kilometres east of Hopetoun in the southern region of WA.

The project has good access to infrastructure, being within 150 kilometres of the port at Esperance via sealed roads.

The tenements lie within the deformed southern margin of the Yilgarn Craton and constitute part of the Albany-Fraser Orogen.

Comet owns three tenement’s (E74/562 and E74/612) that make up the Springdale project, with a total landholding of approximately 198 square kilometres.

Graphite concentrate has unique characteristic size distribution

Further test work on end uses for the product can now be advanced once a bulk sample of the concentrate is produced.

The graphite concentrate produced has a unique and potentially very valuable characteristic in its size distribution, with about 66% of the product passing the 38 μm screen.

Generally, this size fraction of graphite is mainly a by-product of processing of larger flake fractions, which produces smaller size graphite, but this damages the flakes in the process, reducing their performance and value.

Deposits that contain high-quality ultra-fine graphite are uncommon, and as a result can potentially carry a high value.

Commenting on the implications of these tests, particularly in terms of developing an economically viable project at Springdale, Comet managing director Matthew O’Kane said, “The results of this test work, delivering a very high grade with high recoveries and producing a very unique and potentially high value product, demonstrate the potential for an economic project at Springdale.

‘’While large flake graphite is paid a premium versus mid-size flake, high quality super fine products attract prices in excess of large flake, with battery anode spherical uncoated product at 25 microns attracting prices of US$2800/tonne and at 10 microns US$3800/tonne.

‘’Further test work will determine the amenability of the Springdale product for these anode applications.

‘’In parallel with this test work we are continuing to advance the due diligence work on the Santa Teresa High Grade Gold Project and preparation for the initial drill program at the Barraba Copper Project.”

Strategies to reduce costs and produce value-added saleable products

Further optimisation testing has continued under management of Independent Metallurgical Operations (IMO) on the flotation regime to further reduce both capital and operating cost requirements.

Management is also considering strategies that will increase concentrate grade by assessing a reduction in the number of flotation and concentrate grinding stages and further optimisation in the reagent additions.

Multiple tests have been conducted for the optimisation testing which has indicated reagent consumption can be reduced by 47% without any detrimental effect to overall product grade and recovery.

There is also an indication that flotation stages can be reduced by 36%, further reducing capital and operating cost requirements.

Additional test work on a 5 to 10 kilogram sample of flake concentrate in Europe is designed to convert the concentrate obtained by flotation into value-added saleable products.

Three different processes are being investigated, including purification to carbon content above 99.9%, as these carbon levels pave the way for high-tech applications such as usage in batteries.

Another process being investigated is micronizing for products such as lubricants and carbon brushes that require well-defined small flake graphite particles for their end uses.

Spheronisation for usage in Lithium-Ion-Battery Anodes is also being examined given the rapidly expanding market for electric vehicles due to the global drive to de-carbonise the transport industry.

These test work streams are designed to confirm the suitability of Springdale Project graphite as a precursor material for these high value-added products.

The next step is to first produce the required bulk sample of float concentrate for shipment to the facilities in Europe.

This work is expected to be completed during the quarter, with testing of the concentrate planned to commence afterward.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.