Comet poised to explore Barraba ahead of copper rebound

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Comet Resources Ltd (ASX:CRL) has received subscriptions for $650,000 under a placement of the 65 million fully paid ordinary shares, together with one free attaching option (exercisable at $0.02 on or before 30 June 2021) for each share issued, to support the acquisition of the Barraba Copper Project in New South Wales.

Funds raised will also assist in the completion of initial project works.

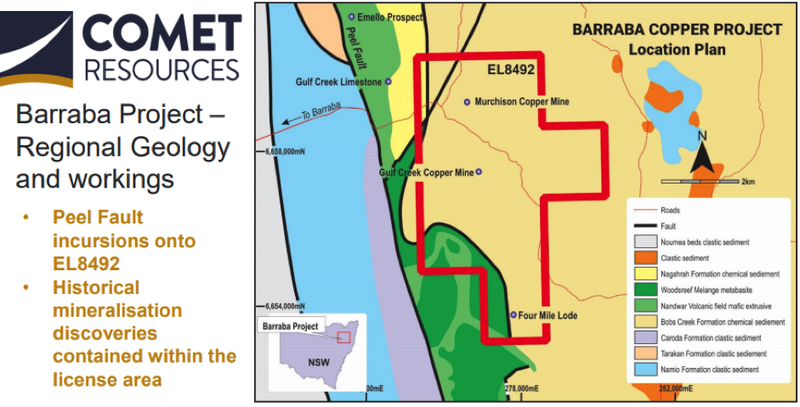

The exploration licence EL8492 covers an area of nearly 2400 hectares near the town of Barraba, approximately 550 kilometres north of Sydney.

It sits along the Peel Fault line and encompasses the historic Gulf Creek and Murchison copper mines.

The region is known to host VMS (Volcanogenic Massive Sulphide) style mineralisation containing copper, zinc, lead and precious metals.

Historical workings at Gulf Creek produced high-grade copper and zinc for a short period around the turn of the 19th century, and this area will form a key part of the initial exploration focus.

Funds to cover acquisition and initial field exploration

A portion of the placement will be conducted under the company’s current placement capacity with the balance of 11 million shares to be issued following receipt of shareholder approval.

The capital raise replaces the previously announced raising at $0.025 per share which has now been withdrawn.

Referring to the group’s proposed exploration strategy, managing director Matthew O’Kane said, “I’m very pleased that we have been able to work with our advisors and the vendors of the Barraba Project to come up with terms that enable us to continue with the acquisition and proceed with a placement that is sized to reflect current market conditions.

‘’I am now looking forward to the initial field exploration program at Barraba as soon as logistical and regulatory conditions permit.”

CRL believes that copper is set to see an increase in demand due to global efforts to reduce emissions from the transport network and also from the generation of renewable electricity.

Copper is not only an important part of the batteries used in BEVs, but is also used extensively in the electric motors that drive the wheels of BEVs.

The red metal also has applications beyond the automotive industry as it is used extensively in the generation of electricity from renewables such as solar and wind.

There is significant potential for post Covid-19 fiscal spending initiatives by governments to provide further demand for copper.

What lies beneath

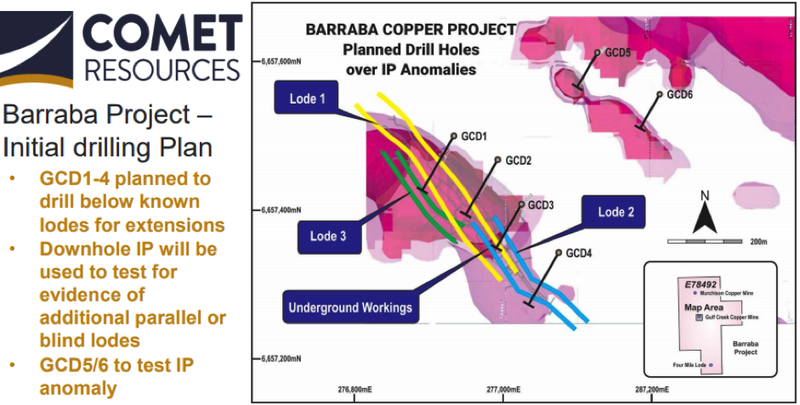

With regard to the Barraba Copper Project, it has not been systematically tested by modern exploration techniques.

Hence, the initial exploration program will include drill testing of areas below the historically identified deposits, as well as high-level exploration targets delineated by an induced polarisation (IP) survey of parts of the licence area that weren’t followed up.

To complement the drill testing, CRL will also complete downhole geophysics with the aim of providing additional information about potential parallel and blind lodes, in addition to the known historical lodes.

As VMS deposits often occur in clusters, management is buoyed by the potential for new discoveries at the Barraba Copper Project though new exploration works and testing the extent of the previously discovered and partially mined lodes.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.