Cobalt play Meteoric Resources releases positive report

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Meteoric Resources (ASX:MEI) has released an operational update for the three months to 31 March.

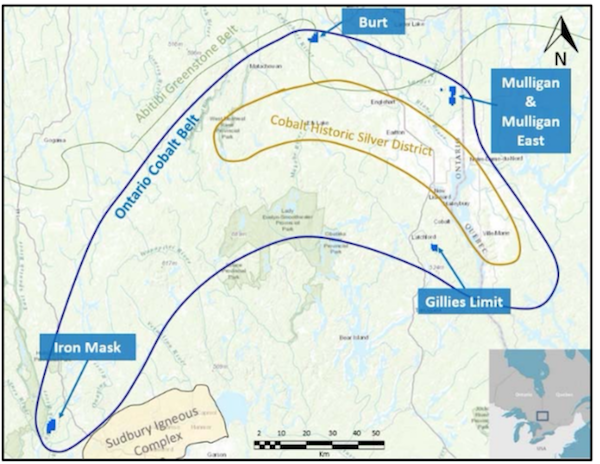

In the quarter, MEI confirmed high-grade cobalt mineralisation at Mulligan with rock chip samples grading up to 9.71% cobalt and 16.5 g/t gold, and picked up two new primary cobalt projects in Canada — the Gillies Limit Project and the Burt Cobalt Project, as shown below:

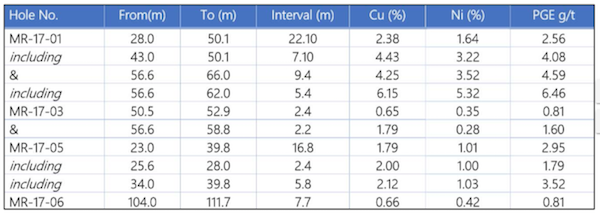

In addition, assay results from its Midrim maiden drilling campaign intersected significant high‐grade shallow mineralised intersects including the following highlights:

- 22.1m @ 2.38% copper; 1.64% nickel & 2.56 g/t ‘platinum group elements’ MR‐17‐01 from 28m

- 9.4m @ 4.25% copper; 3.52% nickel & 4.59 g/t ‘platinum group elements’ MR‐17‐01 from 56m

- 16.8m @ 1.79% copper; 1.01% nickel & 2.95 g/t ‘platinum group elements’ MR‐17‐05 from 23m

- 7.7m @ 0.66% copper; 0.42% nickel & 0.81 g/t ‘platinum group elements’ MR‐17‐06 from 104m

The quarter also saw MEI appoint Andrew Tunks as Managing Director and Tony Cormack as Cobalt Project Manager. Further, the report includes the company’s cobalt exploration plans for the coming quarter, with drilling scheduled to commence in mid-2018.

It should be noted that MEI is still in its early stages and investors should seek professional financial advice if considering this stock for their portfolio.

MEI expands cobalt portfolio

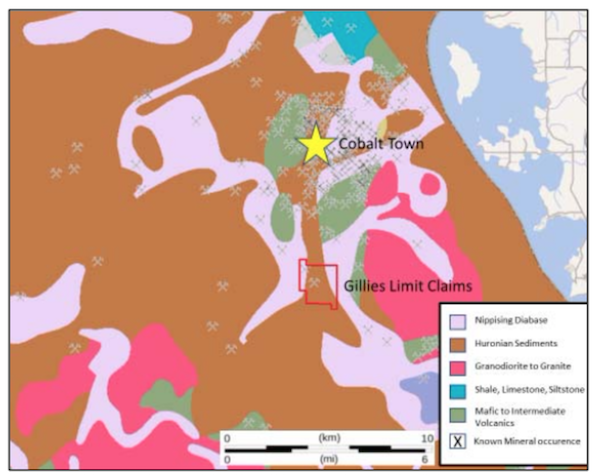

During the quarter MEI entered into a conditional agreement to acquire the Gillies Limit project which consists of 11 contiguous claim blocks within the prolific Cobalt Camp mining district. The project is located on the same geological trend, and within just 2.5 kilometres of, numerous historical high‐grade cobalt and silver mines including the Cobalt A‐53 mine, the Silver mining company mine, the Provincial mine and the Waldina silver mines shaft.

Promisingly, recent exploration activities on the claims revealed visible cobalt minerals exposed throughout the property. MEI will first resample the extensive historic workings with the aim of defining primary cobalt mineralisation, and then plans to fast-track its rigorous exploration approach with an extensive program of prospect scale mapping, surface sampling, geophysics along with resampling of the numerous outcrops and open pit operations.

The below map shows the location of Gillies Limit in relation to Cobalt Town:

The consideration for the acquisition was an initial payment of C$50,000 and C$50,000 in MEI Shares, and three additional payments, on the 1st, 2nd and 3rd anniversaries of completion, of C$30,000 and C$30,000 in MEI Shares. In addition, the agreement stipulates introduction fees of C$5,000 and 1,000,000 MEI Shares.

In the quarter, the company also staked highly prospective primary cobalt ground in Ontario with the Burt Cobalt Project. The project is located 7km directly along strike from Battery Minerals Resources’ Island 27 project, and hosts three major north-south trending faults identified as being the key hosts of primary cobalt mineralisation throughout the district.

These cobalt fertile structures will be the focus for MEI’s exploration program of mapping, geochemistry, geophysics and drilling planned for Q2CY18.

Mulligan and Midrim projects

Rock samples taken by MEI during the quarter confirmed high‐grade cobalt grades at the Mulligan project, with one sample returning a result of 9.71% cobalt, 14.3 g/t gold and 0.3% nickel.

This supports the prospectivity of the Mulligan area, which has been highlighted in several high-grade historical samples which returned results such as 12.6% cobalt, 1.03% nickel, 29.8 g/t gold, 39.7 g/t silver, 19% cobalt and 56.7 g/t gold.

According to a 1952 report on Mulligan, eight tonnes of cobalt ore was shipped from the Mulligan site for mineral extraction, with an impressive recovery rate of 10% cobalt.

MEI also undertook a maiden drilling program at its Midrim project during the March quarter, returning outstanding shallow high‐grade copper and nickel results.

The drilling program was conducted over November‐December 2017 where a total of 15 holes were completed across the project for 2,270 metres of NQ diamond core. A total of 512 core samples were submitted to ALS in Sudbury for analysis, with the following results:

Upcoming exploration activities for MEI

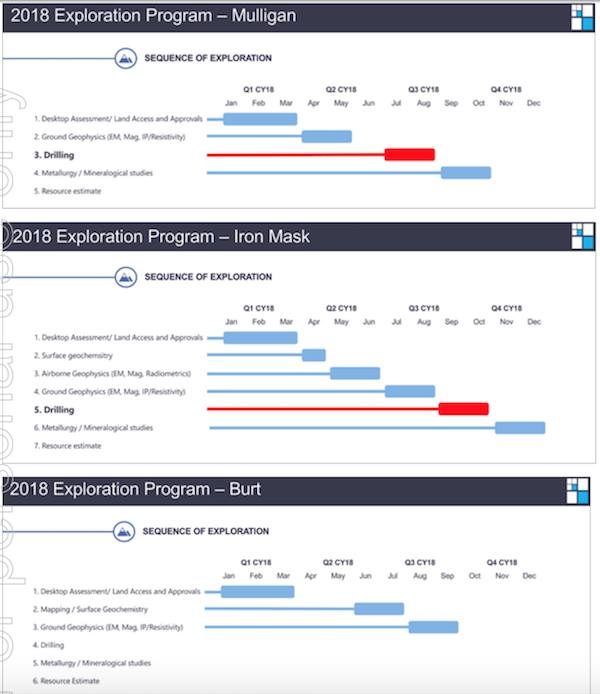

The next phase of the MEI’s strategy, according to its quarterly report, is to fast‐track a comprehensive exploration program across all its primary cobalt projects.

The work program will include prospect scale mapping, geochemical surveys, airborne and ground based geophysical surveys along with diamond core drilling scheduled at the high priority Mulligan and Iron Mask projects.

With its recent acquisitions, MEI now holds five highly prospective cobalt projects in Ontario and is fully funded to conduct its comprehensive exploration plans, which are as follows:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.