Classic’s Forrestania Gold Project resource grows to 311,000 ounces

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

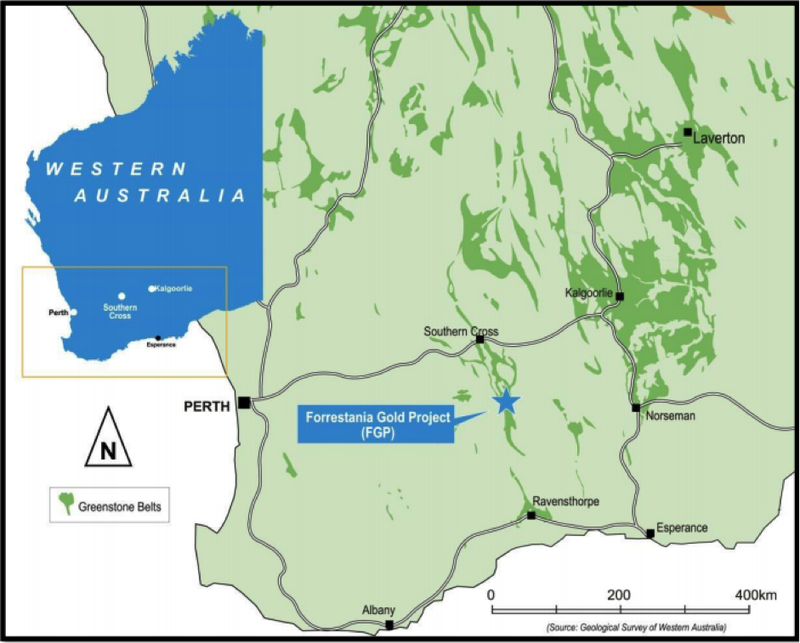

Classic Minerals Limited (ASX:CLZ) has substantially upgraded its Lady Ada Mineral Resource Estimate at the Forrestania Gold Project (FGP) in Western Australia.

Contained gold ounces for the deposit have increased 71% to 1.35 million tonnes grading 1.38 g/t gold for 59,700 ounces.

Classic holds 80% of the gold rights for the FGP, which also includes the unmined Lady Magdalene resource of more than 5.9 million tonnes grading 1.32 g/t gold for 251,350 ounces, just one kilometre north of Lady Ada and located in the same geological rock sequences.

With the recent update to the Lady Magdalene mineral resource, the FGP now comprises existing resources of nearly 7.3 million tonnes at 1.33 g/t for 311,050 ounces of gold.

Resources are located beneath an existing open pit shell at Lady Ada and the unmined, near-surface deposits at Lady Magdalene.

Potential for Classic to transition to producer

The project presents an opportunity for near term mining operations and production.

The current mineral resources are reported in compliance with the JORC Code (2012) and are estimated with a lower cut-off grade of 0.5g/t gold.

When a higher cut-off is applied (1g/t gold), it is possible to delineate higher-grade pockets of the mineral resources, particularly at Lady Ada, which was previously mined at an average grade of 8.8 g/t gold.

Classic continues to focus on delineating these higher-grade zones at both deposits, to potentially generate early cash-flow and support the costs associated with mining, haulage and toll treatment.

At a block cut-off grade of 1 g/t gold, the Lady Ada resource is estimated to contain combined Indicated and Inferred resource of 590,750 tonnes grading 2.17g/t gold for 41,200 ounces and at a block cut-off grade of 2 g/t, the Lady Ada resource estimate produces 218,300 tonnes grading 3.56g/t gold for 24,950 ounces.

Classic will undertake a review of the updated mineral resource and related technical data with a view to completing an update Scoping Study on the FGP.

Management is hopeful that plans for a joint venture to mine and process ore will be finalised in the first half of 2020, a development that could be a significant share price catalyst.

Narrower drill spacings could delineate higher grade mineralisation

Gold mineralisation at Lady Magdalene is hosted within a sheared mafic suite.

The mineralisation is about a kilometre long and is drilled to a down-dip length of up to 400 metres (240 metres vertical depth), generally over 3 to 5 metre thick, with grades ranging between 1 and 5 g/t gold, peaking at 31.1g/t gold over 1 metre.

The recent drilling by Classic and resource estimation work for Lady Magdalene appears to indicate that higher-grade zones may well cross-cut the deposit, but that the current drill spacing (approximately 50 metres north x 25 metres east) is probably too wide to allow delineation of these shoots in any continuous detail at this stage.

Historical diamond drill hole FWRD011 contained an intersection of 7 metres at 9.1 g/t gold, with visible gold less than 25 metres from the natural surface and alludes to these, higher-grade, cross-cutting, sheared intersections being present in the ore system at Lady Magdalene.

Overall though, Lady Magdalene presents occasional, discontinuous high-grade gold zones and hence, is considered a high-tonnage, low-grade gold system.

There is scope for significantly increasing the mineral resources at Lady Magdalene further, mostly by drilling down-dip extensions, but management noted that there is also poor definition of the known, narrow, higher-grade intersections, closer to the surface.

A large program of infill RC resource definition drilling combined with selected diamond drilling could address this issue as it may provide a better understanding of the orientation of gold mineralisation in these interpreted higher grade zones.

Capture of a detailed topographic image across the project area will also support future exploration efforts, while also providing an accurate reference which the historic collars can be related to.

Further share price catalysts in 2020

These ongoing activities are likely to represent numerous share price catalysts in 2020, but the real takeaway following the resource upgrade is that Classic has a value accretive asset with early stage production opportunities.

The deposits have proven to have high gravity gold recoveries with free-milling gold and are of a non-refractory ore style.

Importantly, existing mineral resources are potentially amenable to conventional open pit mining.

Classic can minimise capital costs by entering into JV mining and treatment contracts, and developments on this front would also be well received by investors.

The scoping study will also be an important milestone for the company as it will provide an insight into the commercial viability of the project, as well as the potential returns on capital invested.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.