Classic ramps up hunt for high-grade gold

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Classic Minerals (ASX:CLZ) has kicked off reverse circulation (RC) drilling at its Forrestania Gold Project (FGP) in Western Australia.

Following on from the encouraging results seen at its last program at the Kat Gap, Van Uden West and Lady Lila deposits, CLZ will be targeting these areas again with additional drilling.

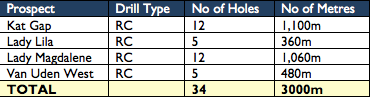

3000 metres of RC drilling is now underway at these promising targets.

On top of that, CLZ will also be returning to the Lady Magdalene deposit with the hope of locating high-grade mineralisation missed by previous explorers. Here, CLZ will be targeting high-grade cross-cutting lodes.

Assay results are expected in early July — not long from now.

CLZ CEO, Dean Goodwin, said: “Following the fantastic results of our last drilling program, including a brand-new discovery at Van Uden West and multiple high grade gold hits at Kat Gap and Lady Lila, we are very excited to be heading back to the FGP to undertake an aggressive follow up drill program.”

“I am also thrilled to be heading back to Lady Magdalene to hopefully unlock major high-grade lodes which will bolster the resource with quality oz.”

“Over the past 12 months, the company has been busy gaining a thorough understanding of the local geology and controls on mineralisation. All of the drill programs undertaken at FGP by Classic have yielded high grade gold hits,” he noted.

“There is no doubt in my mind that this is a major gold camp containing significant undiscovered resources and we are on the right path to discover and delineate these ore bodies,” added Goodwin.

Of course, as with all minerals exploration, success is not guaranteed. Consider your own personal circumstances before investing, and seek professional financial advice.

The Forrestania Gold Project contains an existing JORC (2012)-compliant Mineral Resource of 5.3 Mt at 1.39 g/t for 240,000 ounces of gold. A scoping study has also indicated both the technical and financial viability of the project.

CLZ recently raised $1 million via an oversubscribed capital raising to fund this current drilling program.

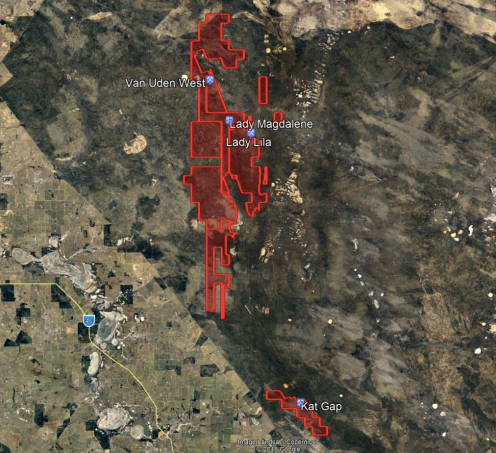

CLZ’s tenure at the FGP shown in red, including drill targets:

CLZ plans to undertake the following drilling activities in early June:

Van Uden West: a new gold discovery

Previous drilling results from the Van Uden West prospect confirmed the discovery of a significant new zone of gold mineralisation. Preliminary interpretation suggests that the prospect is geologically similar to Kat Gap, with gold mineralisation sitting adjacent to the granite/greenstone contact.

CLZ has planned five holes for 480 metres total to test the strike/depth potential of this new discovery. Previous drilling in May intersected significant gold mineralisation potentially striking in a northwest/south-east direction with a shallow easterly dip — mineralisation remains open.

Drill highlights include: 12m at 5.75 g/t gold from 59m including 1m at 25.60 g/t gold from 59m.

Lady Lila: the next Bounty goldmine?

Lady Lila is a BIF-hosted gold deposit that displays similar geological characteristics to the nearby, high-grade, prolific Bounty and Blue Vein ore bodies, which are held by $857 million-capped Kidman Resources (ASX:KDR).

Previous drilling confirmed the presence of a thick, steep east dipping ore zone, warranting additional follow-up. The upcoming drill program (five RC holes for 360 metres in total) will focus on extending the mineralisation along strike and at depth.

Importantly, mineralisation remains open at depth, and additional follow-up drilling will be undertaken immediately to continue to grow this deposit.

In May, five holes (FLLRC001 — FLLRC005 inclusive) for 366 metres were drilled at Lady Lila, with all holes intersecting gold mineralisation. Drill highlights include: 14m at 3.70 g/t gold from 71m including 1m at 13.20 g/t gold from 79m.

The present gold mineralisation models indicate a steep easterly dip; future drilling will test a possible vertical dip, as gold deposits in the area have been known to steepen at depth — as is the case with Bounty and Blue Vein.

Kat Gap: under-explored and high-grade

Kat Gap contains a shallow unmined gold deposit discovered in the 1990s, which was the subject of Resource estimations and a scoping study by Sons of Gwalia in 2003.

High-grade RC drill intercepts include 15 m at 15.1 g/t gold from 39 m depth and 6 m at 19.1 g/t from 17 m depth.

The open-ended deposit lies within a five kilometre long geochemical gold anomaly that has seen very little drill testing. Following the drill program just completed, CLZ says it sees great potential for the discovery of a substantial, shallow, high-grade gold deposit within the Kat Gap project area. The upcoming program will be testing for extensions of the high-grade system.

CLZ has 12 holes planned at Kat Gap for a total of 1,100 metres.

In May, Classic drilled four holes for 210 metres at Kat Gap, confirming that two holes (FKGRC001 and FKGRC002) returned gold mineralisation striking in a north-south direction —

mineralisation remains open. Drill highlights include: 5m at 14.10 g/t gold from 17m including 1m at 48.40 g/t gold from 20m.

Lady Magdalene: potential for game-changing, high-grade mineralisation

Lady Magdalene is a large, modestly graded deposit that appears to host high-grade, cross-cutting gold lodes within existing drill lines that are 100-200 metres apart. Previous diamond drilling confirmed the existence of these lodes, and the planned drilling will further test the extent of strike, dip and grade.

CLZ has 12 holes planned here for a total of 1,060 metres. Structural readings taken from recent orientated diamond holes MADD003 and MADD004 revealed several quartz veins and narrow shear zones exhibiting similar orientation characteristics to Lady Ada — once the logging and structural work was completed, the core was assayed and returned promising gold intercepts in those zones, including 6.5m at 3.30 g/t gold from 56.5m (including 1m at 9.52 g/t gold from 60m).

This is a pivotal development for CLZ, with the Lady Magdalene deposit appearing to host high-grade cross-cutting zones of gold mineralisation which are analogous to the high-grade Lady Ada mine.

The upcoming RC drilling program will further delineate the dip, plunge and general direction of the high-grade structures within Lady Magdalene.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.