Classic Minerals establishes 93,000 ounce gold resource at Kat Gap

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Classic Minerals Ltd (ASX:CLZ) has established a Maiden JORC Compliant, Inferred Mineral Resource estimate of 1 million tonnes at 3 g/t gold for 93,000 ounces (0g/t lower cut-off) at its Kat Gap deposit in Western Australia.

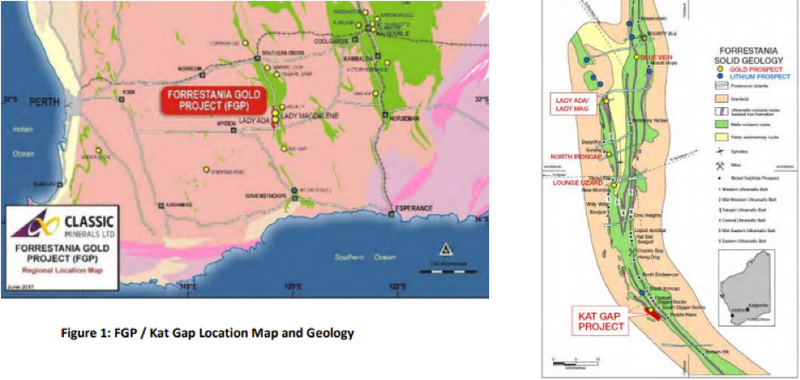

The Kat Gap Project is approximately 50 kilometres from the company’s Forrestania Gold Project (FGP) and adjoins the Forrestania Nickel Project currently operated by Western Areas Ltd.

Resources estimated for Kat Gap by Sons of Gwalia in 2003 totalled 56,000 ounces grading 1.4g/t gold at zero grade cut-off and 36,000 ounces grading 3.9g/t gold at 1.5g/t gold grade cut-off.

The latest results strengthen the case for near term commencement of mining operations at the FGP to take advantage of historically high Australian dollar gold prices, currently in the vicinity of $2650 per ounce.

The maiden resource was primarily calculated to pave the way for the application of a mining lease over the Kat Gap deposit area.

Scoping studies, metallurgical testwork and optimisation work on possible open pit scenarios are currently underway potentially underpinning the economics for near term mining operations.

Comprehensive drilling of 500 metre zone

Building on gold exploration efforts in the area since the 1990s, Classic Minerals commenced an ongoing programme of RC and diamond drilling in April 2018.

This maiden JORC Compliant Mineral Resource is the culmination of several work programmes since this time.

The resource estimate utilises only recent Classic data, omitting the historic information and concentrating on a well drilled 500 metre zone centred on 6372200N – a zone of strong mineralisation cut by a prominent Proterozoic dolerite dyke.

While the dyke is mostly barren in terms of gold mineralisation, from a geological perspective there is evidence of localised remobilisation and concentration proximal to its contacts with the Kat Gap lode.

Mineralisation has been modelled to around 150 metres below surface and with typical widths of between 3 metres and 4 metres.

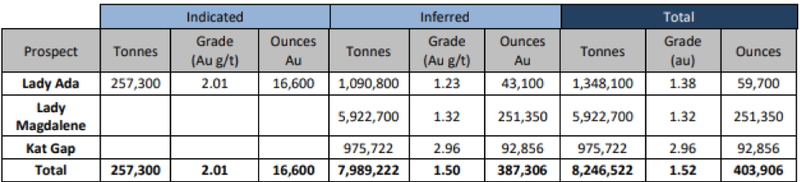

One of the key takeaways from establishing the Inferred Mineral Resource is that it grows the global mineral resource inventory for the company’s Forrestania Gold Project to 8.25 million tonnes grading approximately 1.5 g/t gold 404,000 ounces across all of its projects.

Establishing the resource paves the way for the application of a mining lease over the Kat Gap deposit, and from a broader perspective allows a quick upgrade to indicated resources post the acquisition of downhole surveying and specific gravity data.

Potential to produce economic operation at current prices

A number of recommendations have been made in response to obtaining exploration data and establishing the Inferred Mineral Resource at Kat Gap.

Importantly, management is looking to gain a better understanding of the orebody, an initiative that will provide confidence in reported resources.

On this note, chief executive Dean Goodwin said, ‘’With the Maiden Inferred Mineral Resource now estimated for the Kat Gap Project using all available reliable data collected by Classic Minerals over the past two years, a series of staged programs can be undertaken to improve the confidence in its status and hence, begin the initial process of open pit optimisation studies and ore reserve definition.

‘’The relatively high-grade and near-surface nature of this deposit implies that it has the potential to produce an economic operation at the present elevated gold prices, which is effectively triple the most optimistic case previously put forward for Kat Gap, when it was last reviewed by Sons of Gwalia in April 2003 (Fotakis, 2003).

‘’A comprehensive program of infill development RC drilling to bring the resource area down to a 10 metre north by 10 metre east drill spacing south of 92850mN is recommended to improve the interpretation in the continuity of the resource for a potential high-grade, Stage 1 type start-up open pit operation in that region.’’

Subsequently, it is intended that drilling should be regularised to a 20 metres north x 20 metres east spacing to a depth of about 80 metres, which can then be reassessed pending updated optimisation results and/or discovery of additional ore intersections of near-surface, higher-grade gold mineralisation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.