Classic identifies high grade mineralisation and extends strike

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Gold exploration and development company Classic Minerals Limited (ASX:CLZ) has received promising assay results from its most recent reverse circulation (RC) and diamond drilling program at the Forrestania Gold Project (FGP) in Western Australia.

The FGP contains a Mineral Resource of 4.8 million tonnes at 1.40 g/t for 216,650 ounces of gold, with a recent scoping study suggesting both the technical and financial viability of the project.

However, with the continued delineation of high-grade gold mineralisation at the Kat Gap Project, the strike length is growing, a factor that could potentially further improve the financial metrics of a project at FGP.

Classic has just completed a total of 21 holes for 1580 metres at the Kat Gap project, 7 holes for 640 metres at Lady Magdalene and 3 holes for 270 metres at Stormbreaker with the aim of improving/increasing known high-grade gold mineralisation.

High-grade results included 3 metres at 20.7 g/t gold from 39 metres, 6 metres at 4.8 g/t gold from 59 metres and 3 metres at 5.3 g/t gold.

These results build on previous exploration in excess in 2019, a landmark year for the company.

Strike increases to more than 500 metres

Drilling results from Kat Gap continued to deliver the goods with significant zones of gold mineralisation located on the granite-greenstone contact.

Most holes returned gold mineralisation, and drilling has now extended the strike coverage to over 500 metres with mineralisation open in all directions.

Recent drilling at Kat Gap also showed that high-grade gold mineralisation projects down-plunge at depth.

Kat Gap is strategically located approximately 70 kilometres south-south east of the company’s Forrestania Gold project containing the Lady Magdalene and Lady Ada gold resources.

RC drilling at Lady Ada/Magdalene also detected several potential high-grade cross-cutting quartz lodes north of the Lady Ada open pit.

Both quartz veins were intersected at shallow depths in the leached profile approximately 15 to 20 metres below surface.

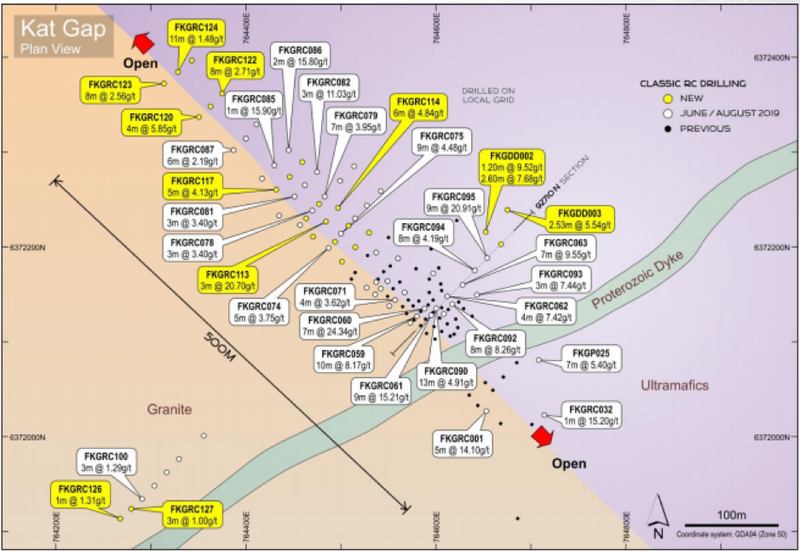

The following map shows the location of recent drill holes in yellow at Kat Gap, as well as other strong drilling results (white) recorded during previous exploration campaigns.

Just the tip of the iceberg

Highlighting the potential for the company to discover a much larger system at Kat Gap, Classic chief executive Dean Goodwin said, ‘’Kat Gap keeps on growing both along strike and at depth.

‘’I’m very pleased with the extended zones of ore grade gold intersections along strike to the north, together with the great results we are now starting to see down dip at depth.

‘’Only a small number of deep holes have been drilled at Kat Gap to date, and these new results clearly demonstrate that the system has great potential to grow not only along strike but at depth as well.

‘’The northern extension RC drilling focused on testing the granite-greenstone contact at shallow depths down to only 50 metres vertical below surface.

‘’If these ore-grade zones continue further north, then we could be looking at strike lengths in-excess of 600 to 700 metres.’’

Diamond drilling identifies high grades at depth

Three diamond holes FKGDD001 – FKGDD003 for a total of 527 metres were also drilled, testing beneath shallower high grade gold mineralisation on the main granite-greenstone contact lode in the vicinity of the cross-cutting Proterozoic dyke.

These holes can be seen on the above map, once again represented in yellow and situated to the far right.

These deeper holes were primarily designed to gather important lithological and structural data from the core to gain a better understanding of the controls, orientation and location of potential high-grade plunging shoots and to aid in future planning of deeper diamond and RC holes.

The holes intersected narrower zones of gold mineralisation which was somewhat expected as the contact zones were steeper dipping than originally thought and shoot control and orientation is yet to be understood.

Better results from these holes included 1.2 metres at 9.5 g/t gold from 136 metres and 2.6 metres at 7.7 g/t gold from 142 metres.

The flatter dipping contact zones are clearly associated with high grade shoots which the diamond holes have missed.

Where the contact is steep the gold lode tends to narrow and weaken in grade.

As the contact rolls to a flatter angle, both the width and grade of the gold lode generally increases.

Further deep drilling is required at sufficient spacings to determine the location of these flatter dipping higher grade contact zones and their potential plunge direction.

Identifying north, south and at depth extensions

Future drilling programs at Kat Gap will focus mainly on testing the main granite-greenstone contact further north and south along strike from the current drilling area.

The next RC drilling program will test the northerly and southerly extensions for another 100 metres along strike.

RC drilling will also probe at depth below the current shallow holes along the entire 500 metres of strike delineated by Classic to date.

Aircore and RC drilling programs will also be conducted out into the granite to test the large five kilometre long geochemical anomaly identified in historical auger soil sampling.

Historical RC drilling at Kat Gap is mostly on 100 metres to 200 metre line spacings.

There is strong potential for additional mineralisation to be identified up-dip, down-dip and along strike, both outside of and within the existing RC drill coverage.

Classic has planned follow up RC holes with drilling scheduled for mid-December, and in discussing the group’s strategy Goodwin said, ‘’The next stages for Kat Gap are to continue RC drilling programs, extending the known mineralised zone further north and south from our current drilling area.

‘’We have neglected the southern strike potential south of the Proterozoic dyke.

‘’There is no geological reason why the gold mineralisation should be any different on the southern side, we just worked on the north side because the gold grades were slightly better.

‘’The next RC program will focus not only on the northern strike but also the southern strike potential for at least 100 metres.

‘’If we have similar numbers south of the dyke then we could be looking at something really special with strike lengths in excess of 800 metres in total.

‘’Deeper holes will also be incorporated into the next few programs to probe at depths of between 200 metres and 300 metres below existing drill coverage.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.