A Classic discovery in the making at Kat Gap

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Classic Minerals Ltd (ASX:CLZ) were up 200% under all-time record volumes at one stage on Wednesday after the company released assays results from the company’s recent reverse circulation (RC) drilling program at its Forrestania Gold Project (FGP) in Western Australia.

Classic completed a total of 32 holes for 2040 metres at the Kat Gap project with the aim of improving/increasing known high-grade gold mineralisation.

Drilling results from Kat Gap continued to impress with significant zones of gold mineralisation located on the granite greenstone contact.

Recent drilling at Kat Gap also showed that high-grade gold mineralisation projects very close to surface and continues down-dip with increasing width.

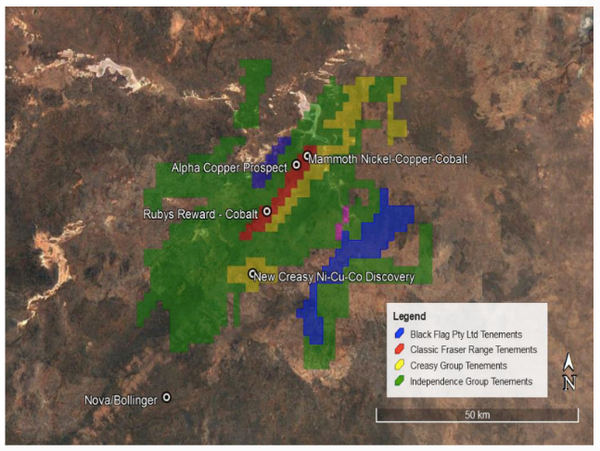

The Kat Gap Project is strategically located approximately 70 kilometres from the company’s Forrestania Gold project containing the Lady Magdalene and Lady Ada gold resources.

Kat Gap adjoins the Forrestania Nickel project currently operated by Western Areas Ltd (ASX:WSA).

In what is shaping up as the bargain basement discount deal of the year, Classic recently purchased the Kat Gap project from private company Sulphide Resources Pty Ltd for a total consideration of $250,000 plus GST, and a 2% NSR royalty on production from tenements E74/422 and E74/467 which are shown below.

Sizeable widths, high grades, shallow depths

Classic’s assay results are outstanding on all fronts.

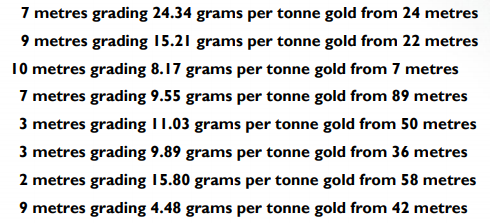

Firstly, the average width of seven high-quality intercepts is 7 metres and the average grade is approximately 14 g/t gold with the best intercept being 7 metres grading 24 g/t gold from 24 metres.

Depths range from 7 metres to 89 metres, but most were within the 20 metre to 50 metre range as shown below.

Importantly, Kat Gap continues to grow with the main granite-greenstone contact gold lode doubling in strike length to 400 metres with significant gold mineralisation intersected on the northern extension drill lines.

The system is wide open with no historical RC drilling further north along strike.

This round of RC drilling at Kat Gap was focused primarily on testing a 200 metre long northerly strike extension of the main granite-greenstone contact along with testing up-dip and down-dip projections of previous high grade intercepts.

The system remains open in all directions.

Of course, the high grades and shallow nature of the gold mineralised system on the granite-greenstone contact will enhance the economics of any future open pit mining operation.

High potential for quality grades at depth

However, there looks to be far more to Kat Gap than near surface ore, and on this note, chief executive Dean Goodwin said in fairly colloquial terms, ‘’I’m absolutely rapt with the extended zones of ore-grade gold intersections along strike to the north, together with the great results we are now starting to see down dip at depth.

‘’Only a handful of deep holes have been drilled at Kat Gap to date.

‘’These new results clearly demonstrate that the system has great potential.

‘’The northern extension drilling focused on testing the granite-greenstone contact at shallow depths down to only 50 metres vertical below surface.

‘’If these ore-grade zones continue further down dip and along strike for another 200 metres to 300 metres, we’ll have a real tiger by the tail.’’

The next stage for Kat Gap is to continue an aggressive RC drilling program, extending the known mineralised zone further north and south from the current drilling area.

Management’s plan is to focus its attention on testing the northerly extensions for another 300 metres.

Classic will also probe at depth down dip along the entire 400 metres of gold mineralised granite greenstone contact that the company has delineated to date.

This work should give us a pretty good idea of how good this system really is.

A few deep diamond holes to collect valuable structural data will also be incorporated into the program to probe at depths between 200 metres and 300 metres below existing drill coverage.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.