Castillo targets nickel-cobalt in Queensland

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

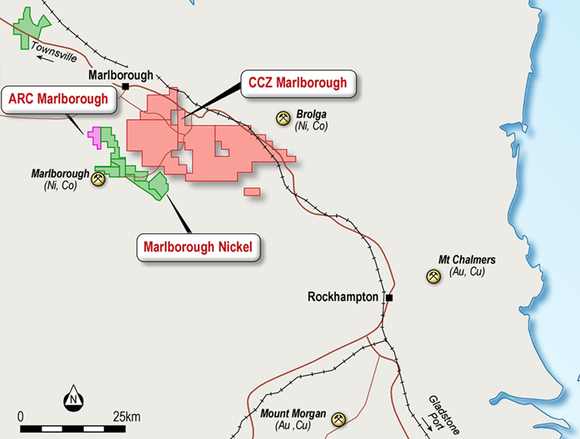

Castillo Copper Ltd (ASX:CCZ) and A-Cap Resources (ASX:ACB) have signed a binding Heads of Agreement to form a joint-venture to explore the highly prospective nickel-cobalt Marlborough project, near Rockhampton in north-east Queensland (QLD).

A-Cap has agreed to invest up to $2.25 million over two years to fund exploration activities up to the completion of a bankable feasibility study which would provide it with a 60 per cent stake in the project.

This leaves Castillo free carried with an interest of 40 per cent.

Importantly, ACB is a well-funded and experienced group, with significant connections in China that can deliver prospective customers for Australian sourced base-and-speciality metals.

Allows Castillo to focus on existing projects

Not only does this come at a time when both cobalt and nickel are being recognised as vital components of lithium-ion battery technology, but it is also strategically significant in terms of complementing Castillo’s existing asset base.

This includes the company’s plan to reopen the high grade Cangai Copper Mine in New South Wales and develop its cobalt-zinc Broken Hill project.

Castillo’s chairman, Peter Meagher commented on the multiple benefits of this transaction in saying, “This is a significant milestone for CCZ, as it is a win-win transaction on two fronts.

“Firstly, we are working with a first-rate strategic partner in ACB that brings project development expertise as well as prospective customers for nickel and cobalt in the all-important China market.

“Secondly, the earn-in joint-venture arrangement with ACB enables our Marlborough project to be optimised concurrently as we focus on re-opening the Cangai Copper Mine and developing the cobalt-zinc Broken Hill project.”

Of course it is early stages with regards to this agreement, so investors should seek professional financial advice if considering this stock for their portfolio.

Adjacent to existing resource and infrastructure

According to the Queensland government, the Marlborough project which comprises three tenements is adjacent to an area that contains proven and probable reserves of 48.7 million tonnes at 0.94 per cent nickel and 0.06 per cent cobalt within a total resource of 70.8 million tonnes.

Given significant legacy mining operations in the region, there is adequate supporting infrastructure, a skilled labour pool and access to ports.

As indicated on the map below, resources and mining leases are within three kilometres of the project.

Furthermore, historic data indicates that past exploration by the likes of BHP and some smaller players identified mineralisation that could point to the presence of metals such as nickel, cobalt, vanadium and scandium.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.