Castillo partners with global base metal trader to monetise legacy ore stockpiles

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Castillo Copper Limited (ASX:CCZ) has signed an MOU with Noble Group, a global base metal and commodities trader, that provides a clear avenue to monetise the legacy stockpiles at Cangai Copper Mine.

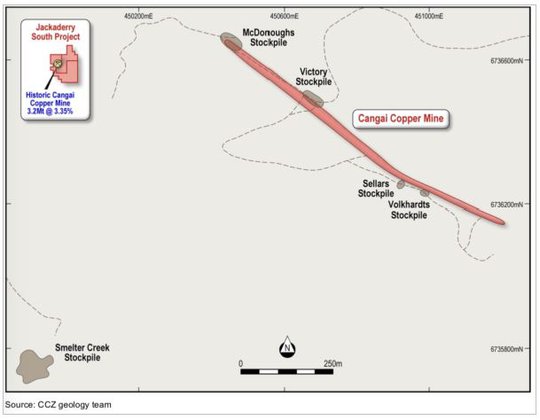

The Cangai Copper Mine, near Grafton in northeast NSW, is CCZ’s flagship project. The project comprises a volcanogenic massive sulphide (VMS) ore deposit, with one of Australia’s highest grade Inferred Resources for copper: 3.2Mt at 3.35% copper. In terms of contained metal, the Inferred Resource is 107,600t copper, 11,900t zinc, 2.1Moz silver and 82,900Moz gold. Notably, supergene ore with up to 35% copper and 10% zinc is present, which is ideal feedstock for direct shipping ore.

CCZ, with Noble Group, will work towards delivering a binding off-take agreement enabling Noble to exclusively distribute up to 200,000t of copper concentrate from existing stockpile ore.

Upon signing a binding off-take agreement, which the parties aim to expedite, Noble Group will pay CCZ a A$500,000 pre-payment for working capital purposes, subject to satisfactory due diligence and definitive long form documents.

CCZ continues to undertake metallurgical test-work on the stockpile ore which has already demonstrated copper concentrate recoveries >80%, with the grade up to 22% copper.

It is also working to secure regulatory approval to remove the stockpiles and closely follow the legislative protocols to secure the ministerial consent to do so. Work will continue in an attempt to expedite the process, in parallel with CCZ moving towards crystallising the binding off-take agreement.

CCZ continues to progress the diamond drilling campaign at Cangai Copper Mine, focusing on massive sulphide conductors identified during the first DHEM survey program. At the same time, the DHEM survey team will be commencing work on drill-holes from the Phase I campaign to evaluate conductors found from the fixed loop electromagnetic program.

CCZ Chairman Peter Meagher commented: “We are delighted to have signed a collaboration agreement with Noble Group, with the objective being to generate early cash flow by processing of the legacy stockpiles at Cangai, provided regulatory approval can be secured and further test work on the stockpiles is successful.

“The Board intends to work diligently with our counterparts from Noble Group to ensure a binding off-take agreement can be achieved in a timely manner. Concurrently, our legal team are working through the necessary legislative protocols that should hopefully deliver the necessary ministerial consent to remove the stockpiles.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.