Castillo identifies standout mineralisation at Broken Hill

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Castillo Copper Limited (ASX:CCZ) has informed the market that it will progress its planning for a drilling campaign at its Broken Hill tenure, which will focus on the highly prospective ‘Area 1’.

The decision comes in the wake of fresh assay results from the site, which in combination with legacy data confirmed high-grade cobalt mineralisation at surface within the Himalaya formation.

Initial field trip – new findings

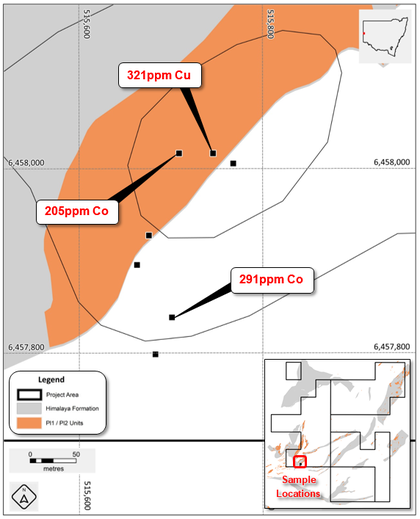

During a field trip that was announced on June 28, CCZ’s geology team collected rock-chip samples from outcropping Himalaya formation within ‘Area 1’.

Upon laboratory analysis, new elevated results of up to 291ppm cobalt were confirmed, a clear indicator of underlying mineralisation.

This result was a key driver behind the company’s decision to prioritise a drilling program at ‘Area 1’ (as seen below), which intends to gather sufficient geological data to model a JORC (2012) compliant Inferred Resource.

Of course, as with all minerals exploration, success is not guaranteed — consider your own personal circumstances before investing, and seek professional financial advice.

Field team mobilised

Following receipt of the new cobalt assay results, CCZ will redeploy its field team to the site to complete exploration work.

The field team intends to:

- Extensively sample the outcropping Himalaya formation in Area 1

- Structurally map the outcropping Himalaya formation in Area 1

- Review historical copper workings within the tenement, and

- Commence the ‘control’ soil sampling program to establish a baseline for future sampling programs

It is believed upon completion of the above, the geology team will design a maiden exploration drilling program to intersect prospective mineralisation at depth.

Secondary mineralisation potential

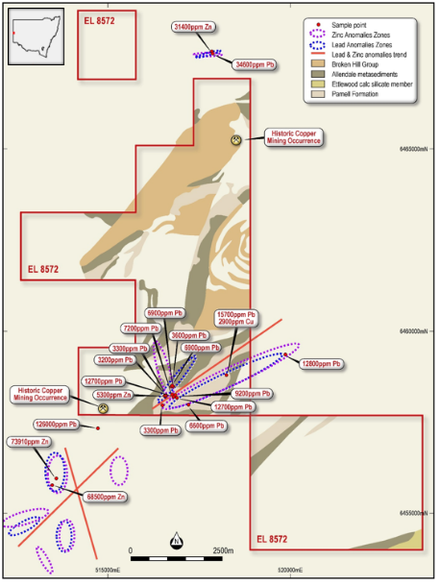

In addition, CCZ has noted that zinc-lead-copper potential is currently being targeted as a secondary focus within ‘Area 1’.

Historical geochemical assay results of up to 5,300ppm zinc, 12,800ppm petabyte and 2,900ppm copper have been confirmed within the southern portion of ‘Area 1’.

Outside the tenement and interpreted to strike along the same trend of mineralisation, results of up to 126,000ppm petabyte and 73,910ppm zinc show the project’s upside potential (below).

To the north of the tenement, results of up to 34,600ppm petabyte and 31,400ppm zinc have been recorded.

The region is in close proximity to the Broken Hill group which includes the Allendale metasediments, Ettlewood Calc Silicate Member, Hores Gneiss, Parnell Foundation and Silver King Metadolerites.

Upon completion of reviewing ‘Area 1’, the geology team will turn its attention to reviewing the Broken Hill project for its secondary mineralisation potential. As the project is still largely underexplored and the correct host lithologies are present for traditional Broken Hill style mineralisation, the northern part of the tenement boasts significant upside.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.