Castillo Copper Releases High-Grade Maiden JORC Copper Resource

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Castillo Copper today announced a high-grade maiden JORC Inferred Resource for its Cangai Copper Mine.

The Cangai Copper Mine is part of the Jackaderry Southwest Copper Cobalt Project in NSW and has been the subject of intense exploration since the early 1900s.

Legacy mining in the 1900s only went down to 85m and was drilled using manual labour, confirming the presence of a high-grade resource.

In the last 30-40 years, one hole in particular intersected near vertical ore shoots at 230m, which again exhibited significant mineralisation.

The mine was abandoned in the 1990s due to market forces and Rio Tinto’s takeover of Conzinc Riotinto of Australia (CRA).

CCZ recently reopened the Cangai Mine, with a view to capitalising on historical data.

It should be noted that it is still early stages here and investors should seek professional financial advice if considering this stock for their portfolio.

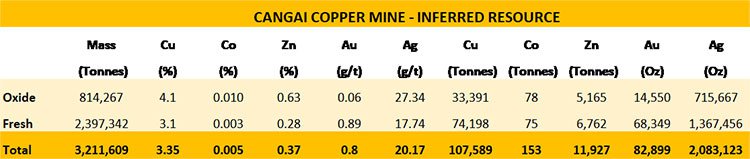

Looking at the numbers, the high grade maiden JORC Inferred Resource for Cangai in unmined working sections of 3.2Mt @ 3.35% Cu implies circa 108,000 tonnes of contained copper.

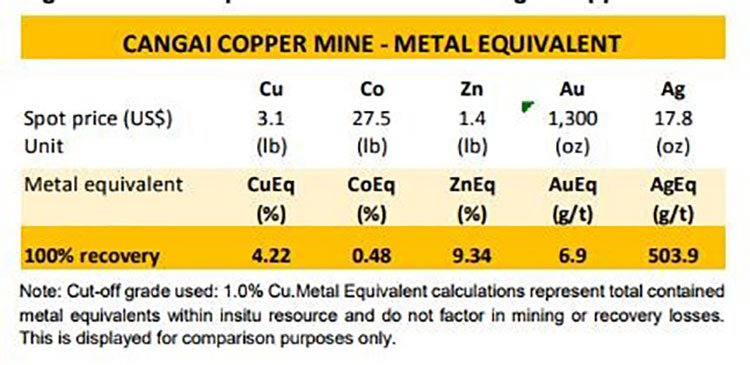

On a metal equivalent basis the key base metal results are: CuEq – 4.2%, ZnEq – 9.3% and CoEq – 0.5%, AuEq – 6.9g/t, and AgEq – 503.9g/t.

“This is an outstanding start and arguably delivers CCZ one of the highest-grade copper resources in Australia,” said CCZ Managing Director Alan Armstrong.

Results thus far account for just a small accounts for a small part of CCZ’s Jackaderry Project, which leaves the Board optimistic that incremental desktop work and a maiden drilling program will underpin further exploration and Mineral Resource size upside moving forward.

“Moving forward, the Board plans to further prove up this initial resource by expanding across the Jackaderry project, which includes an inaugural drilling program.

“Within the Cangai Copper Mine, 3D JORC modelling showed there are unmined high-grade supergene ore working sections, which are potentially direct shipping ore material that could be extended further.

Desktop research has confirmed supergene ore present with up to 35% copper.

High grade copper at the Cangai mine

More significantly, given the resource is relatively shallow and located on the top of a hill, an open pit deposit could potentially be developed. The project has excellent infrastructure with sealed roads that link directly to Newcastle Port.

Comparisons have been drawn with the $904 million Sandfire Resources, which has comparable supergene ore in an open pit environment and has had six years of consistent, safe and profitable production looking at 63-66kt of production in FY 2018.

Whilst CCZ is still a junior and some way off Sandfire, it is confident it can gain traction as it looks to expand its resource.

The Resource size for the Jackaderry Project set to increase substantially with incremental historic assay results and an inaugural drilling campaign which is slated to commence shortly.

The drilling programme will target additional supergene ore mineralisation as 3D JORC modelling has confirmed is open in all directions.

Cangai is the first of four JORC compliant Inferred Resources across CCZ’s Australian projects to be released as the Board looks to expedite proving up then utilising third party processors near excellent transportation infrastructure to fast-track product to key north Asian markets.

If practical, Castillo Copper will sell product to third parties via the London Metal Exchange or enter into offtake agreements.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.