Cashed up Titan set to drill its Dynasty Gold project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

June was a busy month for Titan Minerals Limited (ASX:TTM). The company raised $12 million through an oversubscribed placement, and with capital raised from a share purchase plan (SPP) and directors support, the group should enter fiscal 2021 with a $14.5 million war chest.

Funds raised under the placement and SPP will be applied to progressing Titan’s Ecuadorian gold projects, as well as working capital.

Titan is an exploration and development company focused on exploring and developing potential tier one projects in Ecuador’s southern Andean copper-gold belt. It is also operator of a gold treatment business in a well-established mining region of Southern Peru.

A centralised processing plant produces loaded carbon from a CIP gold circuit, with feed previously averaging 17 to 24 g/t gold head grades sourced from licensed third-party operators.

The company’s flagship asset is the Dynasty Gold Project that consists of a mineral resource estimate of 2.1 million ounces at 4.5g/t gold (NI 43-101).

Titan’s strategy is to conduct a high-impact drilling campaign across Dynasty and deliver a JORC resource during the December quarter of 2020.

Coupled with an ongoing logging and sampling program, this drilling should enable the company to quickly convert the substantial NI 43-101 Resource (Canadian Resource) to a JORC Compliant Resource.

Funds from the capital raising will also be used to commence exploration activities at the highly prospective Copper Duke Project, including airborne geophysical surveys for high resolution magnetic coverage and surface sampling programs.

Dynasty hosts near surface high-grade mineralisation

The Dynasty Gold Project has a rich history of exploration which culminated in the establishment of a 2.1 million ounce gold resource (average 4.5 g/t gold) based on foreign resource estimates.

The company plans to establish a JORC Compliant Resource following upcoming exploration activities.

Dynasty is located in the Loja Province of southern Ecuador, and the drill-ready project is comprised of five concessions totalling nearly 140 square kilometres, including three concessions that received an Environmental Authorisation in early 2016 which are fully permitted for exploration and small-scale mining.

Nearly 27,000 metres across 201 holes has been drilled with some of the better intercepts including 8.5 metres at 13.9 g/t gold from 97 metres and 12 metres at 5 g/t gold from 115 metres.

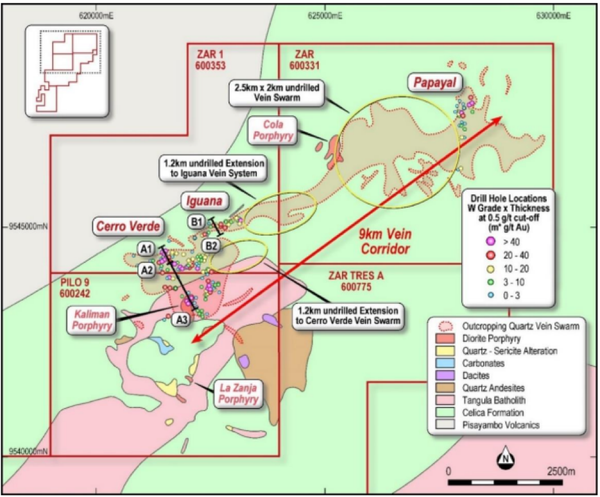

As indicated below, a 9 kilometre long outcropping vein swarm corridor with extensive high-grade gold assay results has been identified in surface rock chip and trench sampling that is only partially drill tested at its extents.

Approximately 95% of mineralised drill intercepts are within 100 metres of surface and a five kilometre drill gap on the mineralised corridor remains to be assessed.

Titan has conducted a reconciliation of the historic operations of mining through to 31 December, 2018.

Where an initial three veins in the resource estimation were developed, small-scale mining produced gold from several other veins not intersected in previous drilling at the Cerro Verde prospect area, and not included in the current foreign resource estimation (blind veins).

Titan found 40% more gold was extracted from the same volumes in the foreign resource estimate, where 69% more tonnes were mined versus the resource estimate, at 15% lower grade.

The additional density of high-grade veining in combination with indications of low-grade aureoles around veins and vein intersections indicate bulk tonnage potential of the resource in the Cerro Verde prospect area.

Consequently, this prospect could be developed as a low-cost project.

Historical data offers Titan an edge at Copper Duke

Another potentially lost cost project is Copper Duke.

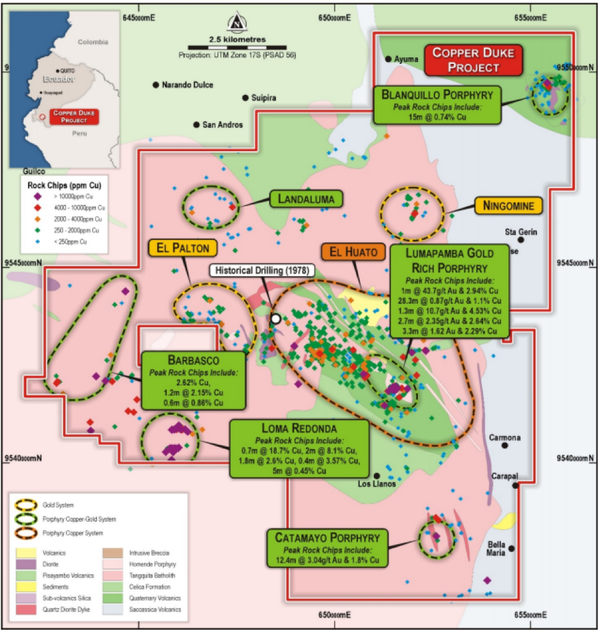

Historically, modern exploration commenced at Copper Duke with an extensive stream sediment geochemistry initiated by the United Nations in 1968.

A follow-up program in the early 1970s was completed by the UN and referred to as ‘Operation 8’, with the objective to define copper and molybdenum anomalies.

Several anomalies were identified and follow-up work on multiple targets included the zone now referred to as the El Huato anomaly which is featured on the following map.

Subsequent geophysical surveys generated three anomalies reportedly correlating with surface geochemistry within the Copper Duke Project, including a coincident anomaly with the El Huato geochemistry anomaly.

The UN survey reports located to date do not include detailed results of IP or geochemistry datasets and raw datasets or other public domain source for those surveys have not been identified.

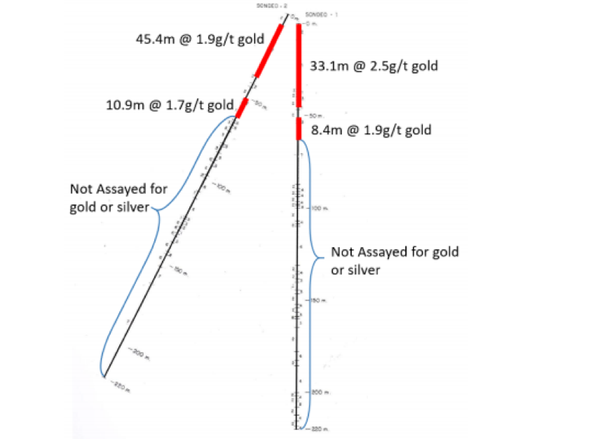

In 1978 a diamond drilling programme was completed and comprised of two diamond holes drilled from the same platform, one vertical and the other inclined.

The program was completed based on an earlier recommendation to complete a maiden drill test of four holes on the three IP/Geochemical targets within the Copper Duke area.

A UN report summarised petrographic studies and assay results for gold, silver, copper and molybdenum analyses of the recovered core.

Two holes were completed at one target from a single drill pad, with the other two targets remaining untested.

The two diamond holes completed in 1978 totalled 440 metres within the Copper Duke Project area.

As indicated below, in the vertical hole SON-01, only the first 53.7 metres of the 220 metre hole was analysed for gold and silver, and in SON-02 only the first 62.75 metres was analysed for gold.

However, the samples were impressive, returning 33.1 metres at 2.5 g/t gold and 154 ppm copper from 9 metres.

Another sample featured 45.4 metres at 1.9 g/t gold and 168 ppm copper surface.

More recent results indicated the presence of widespread high-grade gold mineralisation hosted in quartz veining, ranging from 174 g/t gold to 0.1 g/t gold and from 249 g/t silver to 0.1 g/t silver.

Peak assay results from representative channel sampling work included 61.5 g/t gold, 5.1 g/t silver and 0.2% copper over a width of 3.9 metres.

The presence of near surface mineralisation suggests upfront capital expenditure could be relatively low, and if such a prospect were brought into production all in sustaining costs (AISC) may be extremely low because of easy access to the ore, as well as the copper credits received being offset against production costs.

With pandemic restrictions now easing, Titan is well-placed to begin its program of works at both Dynasty and Copper Duke, with plenty of news expected from mid-July onwards.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.