Cashed-up Okapi Resources reports solid quarter

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

ASX junior Okapi Resources (ASX:OKR) has released its quarterly activities and cash flow reports, reporting pleasing progress across its diversified portfolio.

Encouragingly, OKR remains well-funded, with cash reserves of $4.9 million.

OKR has received assays results from a Stage 1 soil sampling program at its Mambasa Project in the Democratic Republic of Congo (DRC), with anomalous gold results of up 0.93 g/t gold reported.

Here, two lineations have been defined within the gold in soil results. Anomalous gold results show a +3,000 metre long north-west trend, which is very encouraging, given it is a similar geometry shown by some of the more significant gold projects in the region, including Kibali and Geita.

A similar north-west fabric can be seen in satellite imagery, and the lineation is currently interpreted as the same structural trend that hosts deposits in the Ngayu Greenstone Belt.

Also apparent in the gold in soil results is a +3,000 metre long north-south trend that potentially represents another structural control associated with anomalous gold-in-soils results.

As the company previously announced, it has also completed the Stage 2 sampling program, which resulted in the submission of 500 infill samples. These are all now with ALS Laboratories in South Africa for multi-element analysis.

All results are pending and will be released in the not so distant future. OKR hopes that results will permit drilling and logistical work for a potential drill program.

Exploration activities planned for the September quarter for Mambasa include: review of Stage 2 sampling results; logistics, mapping and planning; detailed geological mapping; and implementation of a scout drilling program.

However, it is an early stage of this company’s development and if considering this stock for your portfolio, you should take all public information into account and seek professional financial advice.

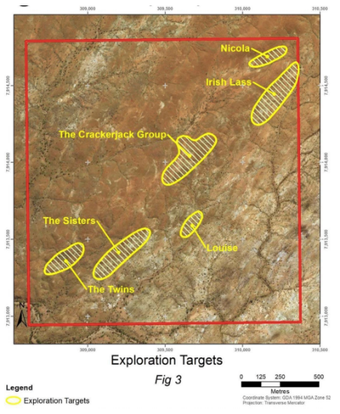

OKR’s Crackerjack Project in WA is also progressing well. Further desktop assessment of the multi-element data gathered during the last round of field work at Crackerjack has been completed. This information will be used to aid assessment of the potential size of mineralised zones and to facilitate the ranking of prospects for further work.

Planning has been completed for a detailed follow-up mapping and rock chip sampling program in the September quarter, the focus of which will be around the newly identified Nicola, Louise and The Twins prospects, and will also include the complex Sisters area.

The remaining historic drill-holes will also be surveyed where possible to help with interpretation and allow better modelling of the known gold-bearing structures. Positive results will confirm the prospects as drill-ready targets.

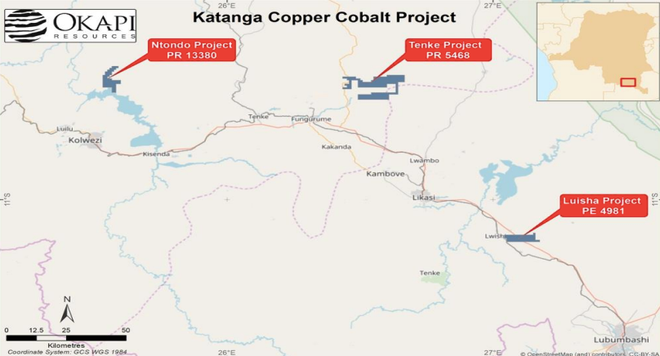

When it comes to OKR’s Kataganga Copper-Cobalt Project in the DRC, the company has secured an extension of time to finalise legal due diligence (now 180 business days to 24 September), as agreed with project vendor Rubamin FZ.

OKR is planning a detailed mapping project on the Tenke and Ntondo projects as a precursor to a potential airborne geophysical survey post-due diligence.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.