Canyon upgrades Guinea style bauxite resource

Canyon Resources (ASX:CAY) released a significant resource upgrade for its Minim Martap Bauxite Project in Cameroon on Friday, with the total tonnes increasing 62% and the Indicated Resource component increasing by 850%.

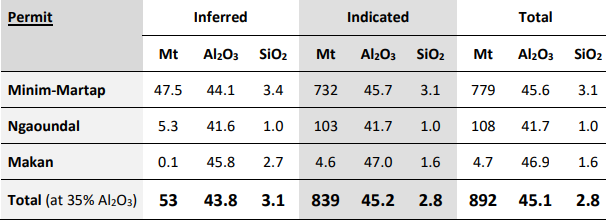

The Minim Martap Project now has a total resource estimate of 892 million tonnes at 45.1% Al2O3, 2.8% SiO2 (cut-off grade 35% Al2O3).

This development had an immediate impact on the company’s shares as they surged from the pre-trading halt price of 16 cents to hit a high of 18 cents.

Canyon Managing Director Phillip Gallagher said, “Upgrading the Minim Martap resource to nearly 900 million tonnes of high-grade, low contaminant bauxite confirms the Minim Martap Project as a global tier-1 bauxite asset.

“The bauxite is proven to be very gibbsite-rich with negligible boehmite, making it suitable for use in both high and low temperature alumina refineries.

“The Minim Martap Project is now one of, if not the, largest Guinea-style, high-grade, low contaminant bauxite deposit located outside of Guinea with accessible and operating infrastructure including an existing rail and two potential port options.’’

As outlined below, a large proportion of the resource with a cut-off grade of 35% is in the higher confidence ‘Indicated’ category.

More than half the world’s seaborne bauxite supply is sourced from Guinea, and management believes that the Minim Martap Project will be a valuable and strategic global asset for major refiners looking to secure alternate streams of long-term, high grade bauxite.

This being the case, Gallagher believes that Canyon is in a strong position to negotiate off-take deals and commence discussions with major companies to advance development of the project.

The establishment of offtake agreement/s could be the next major share price catalyst for the group.

More than 50% of bauxite plateau unexplored

While Canyon’s resource is substantial enough to begin discussions regarding offtake agreements, while also positively impacting the advanced prefeasibility study, it is worth noting that there is the potential to significantly increase the size of the high-grade resource.

Up to this point, exploration initiatives focused on reviewing and verifying past exploration work, identifying and mapping all the target bauxite plateaux and testing new previously unexplored bauxite plateaux.

Combined exploration completed on the project by both Canyon and the previous owners has tested less than 50% of the identified bauxite plateaux, with some of the larger plateaux close to the rail line yet to be drilled.

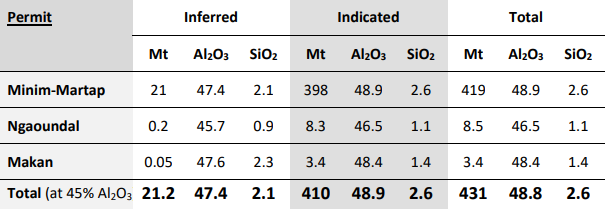

Of significance is the fact that the total bauxite resource based on an extremely high cut-off grade of 45% (see below) has increased from 251 million tonnes at 50.8% Al2O3 and 1.9% SiO2 to 431 million tonnes at 48.8% Al2O3 and 2.6% SiO2.

Not only does this resource feature high-grade bauxite, but it also has extremely low levels of deleterious elements, with the latter being a key determinant of realising premium prices from manufacturers of aluminium.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.