Busy Rumble Resources shares 2018 exploration plans

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

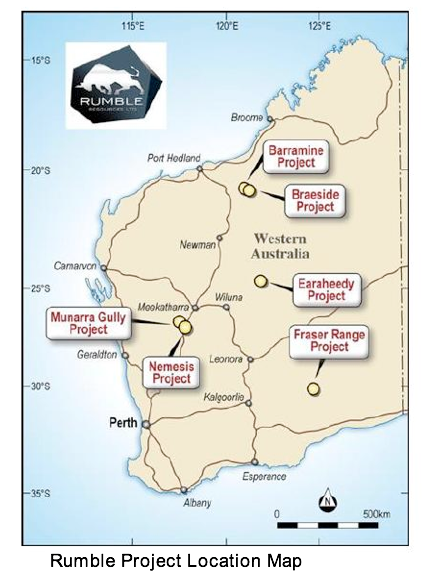

Rumble Resources Ltd (ASX:RTR) has today updated the market on its planned 2018 exploration programs across its four projects — Braeside, Munarra Gully, Nemesis and Earaheedy projects, all of which are on track to be drilled tested in the coming months.

Given the prospective nature of all four projects, each drill program offers the chance for RTR to make high grade discoveries.

It should be noted that RTR is an early stage company and investors should seek professional financial advice if considering this stock for their portfolio.

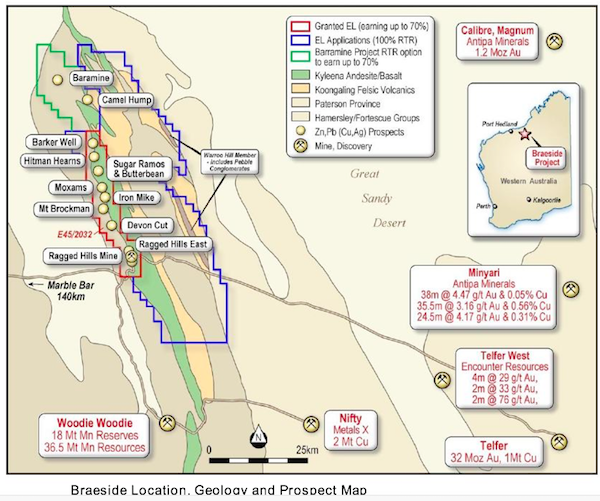

Braeside zinc-lead-copper-silver-vanadium project

During 2017, RTR completed the first ever modern systematic exploration at the Braeside project which included soil sampling (regional and infill), Heli-VTEM and prospect geological mapping with grab sampling which generated thirteen (13) targets that were subsequently tested by nineteen (19) first pass reconnaissance RC drill holes.

Now, the company has commenced geological mapping and detailed sampling aimed at generating drill targets. This includes follow up of the new Devon Cut high-grade zinc discovery and delineating new high order drill targets. The first drill program at Braeside for 2018 is on track to commence in late May.

Fieldwork is planned for later this month, with detailed geochemistry (soil and grab sampling) and geological mapping to generate drill targets.

Numerous high-grade targets have been identified at the Braeside Project from infill soil and rock chip sampling within E45/2032 and remain untested, which will be the focus for new drill target generation. Following the RC drilling program schedule for May, RTR will undertake a diamond drill program to follow up significant mineralisation.

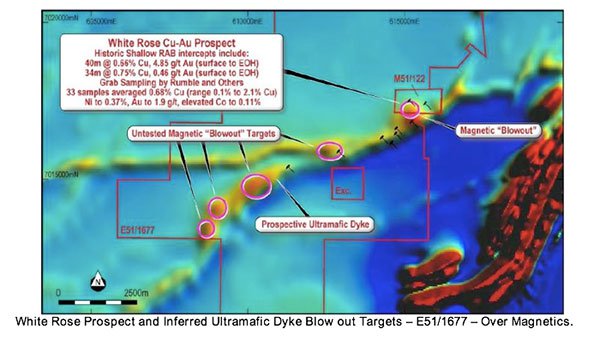

Munarra Gully high-grade copper-gold project

At Munarra Gully, RTR is targeting a highly prospective ultramafic intrusion with significant copper gold mineralisation and elevated nickel-cobalt. The initial target is the White Rose Prospect located near and around the two open cuts where shallow historic RAB drilling has defined exceptional copper-gold mineralisation that is completely open along strike and at depth.

Orientation soil sampling has been completed over magnetic features at Munarra Gully, and RTR has commenced ground TEM (transient electromagnetic) traverses over the White Rose prospect, in particular targeting semi to massive copper/nickel sulphide conductors which cover the historic exceptional drilling results.

In addition, RTR plans to commence RC drilling this month at the White Rose Prospect. It has already completed an orientation soil program over the ‘blow out’ targets, and is awaiting results.

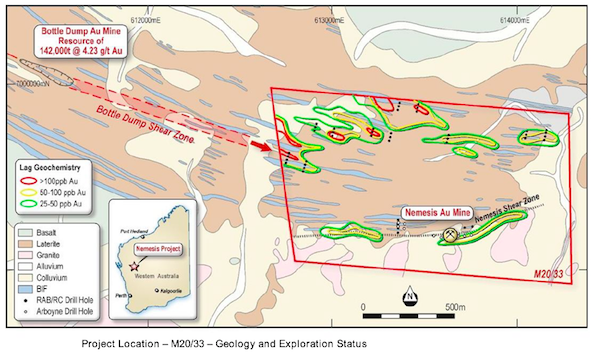

Nemesis high-grade gold project

The Nemesis Project hosts the historic workings at the Nemesis gold mine, which were worked to a maximum depth of 70 metres with three steep plunging high-grade gold (average grade of 98 g/t gold) shoots (85° to the east) over a strike length of 60 metres.

RTR’s has commenced mapping and analysis to determine the plunge extent of the historic high-grade gold mine, with a look to generating drill targets. It plans to start drilling at Nemesis in late April.

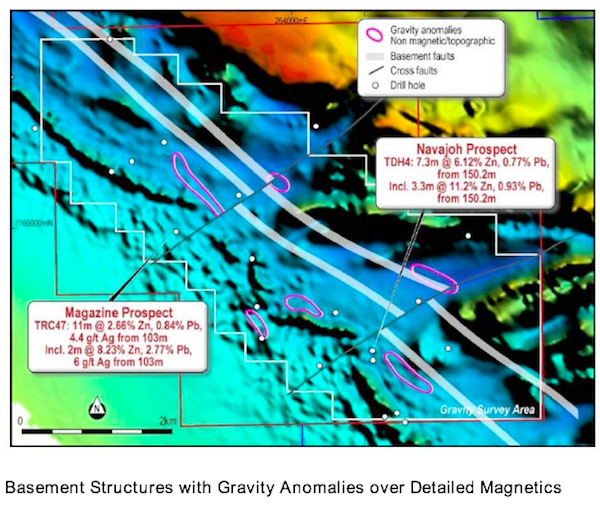

Earaheedy high-grade zinc project

Broad spaced drilling (completed in the 1990s) at the Earaheedy project defined several prospects containing oxidised and primary zinc-lead mineralisation (zinc dominant). This mineralisation was associated with a flat-lying “northeast dipping laterally continuous dolomite horizon with over 20 kilometres strike”.

Partial leach soil sampling over gravity targets has been completed by RTR, consisting of 370 samples on 200m x 200m spacings to cover the gravity trends and anomalies with the aim to help delineate “base metal leakage haloes”. The company is now awaiting assays.

Further, RTR has also submitted an EIS application, with RC and diamond drilling of gravity/structural high-grade zinc targets scheduled for July.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.