Boss on the road to PFS and decision to mine by 2017

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Boss Resources (ASX:BOE) announced on Monday morning that it had completed an expansion study which indicates the potential for a highly economic operation at its Honeymoon uranium project.

This is a significant development for BOE which could be termed a game changer given that it was a make or break determinant as to whether the company had a commercially viable asset.

However, BOE is still an early stage play and this should be taken into account when considering this stock for your portfolio. Consider all information about BOE and seek professional financial advice.

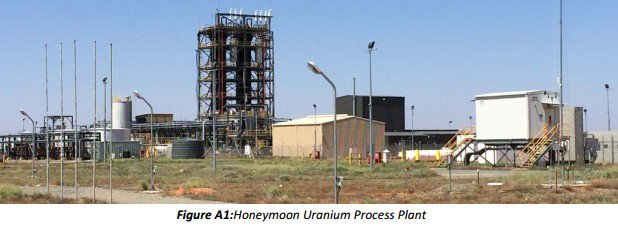

The company already had a significant advantage over most emerging players in the uranium space in that it had a large resource with established power, water and transport infrastructure, as well as important plant and equipment with a sunk value of $146 million already on site.

At this point it is worth noting that BOE’s current share price of circa 5.2 cents implies an enterprise value of approximately $44 million, effectively applying minimal value to the infrastructure on hand and no value to the recently enlarged mineral resource of 57.8 million pounds.

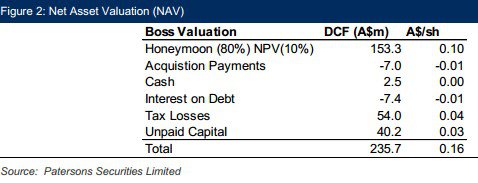

Analysts at Patersons established a net asset valuation of $235.7 million when reviewing the stock in late August. This followed a site visit to the Honeymoon project located in South Australia.

Analyst, Simon Tonkin, was very impressed with what he saw, saying, “Overall, we see Boss Resources’ (BOE) Honeymoon uranium project as one of the most attractive uranium development assets on the ASX”.

He said the project has significant advantages over its peers with an existing processing plant and infrastructure, as well as all the necessary permits to mine, process and export uranium.

He confirmed that BOE was looking to scale up the project to reduce costs and allow the project to achieve profitability in the current uranium price environment and discussed the likelihood of using a combination of resin technology in the recovery process with existing solvent extraction processing to optimise recovery.

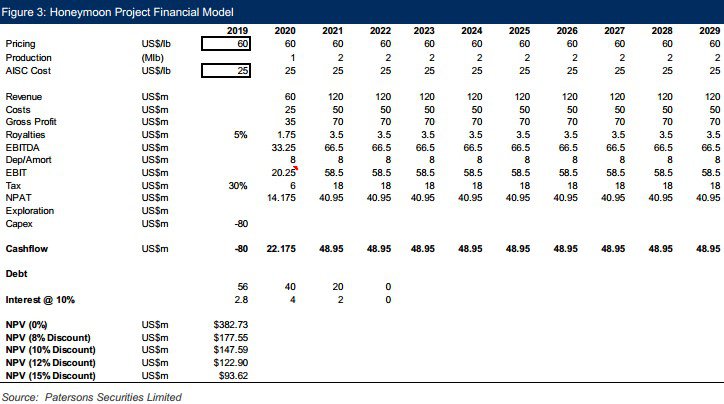

The following model fleshed out by Tonkin demonstrates the highly profitable metrics of the Honeymoon project. A maiden profit of US$14.1 million is forecast in 2020, increasing to circa US$41 million in 2021 and beyond. This is equivalent to approximately AUD$53 million, further reinforcing the fact that the group’s enterprise value is well short of fair value.

Harking back to today’s news, the expansion study has provided the necessary confidence for the company to proceed to the next phase of study (PFS) with the decision to mine expected by the end of 2017.

Front and centre will be BOE’s new processing solution referred to as a hybrid ELUEX method which will enable the company to produce at steady-state operating costs of US$24 per pound U308 equivalent.

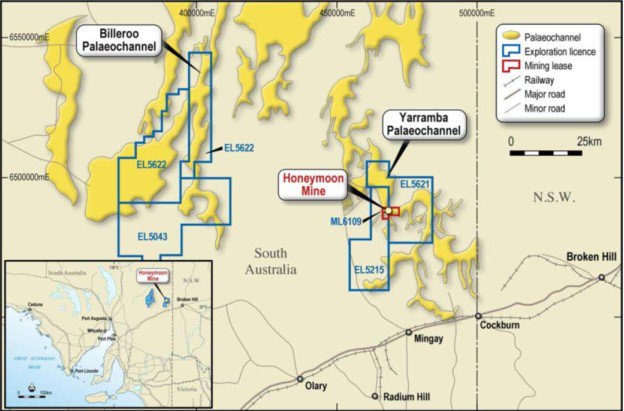

The next phase of the activity will also include exploration of the circa 2600 square kilometre tenements, which based on success to date and the establishment of a large resource can definitely be described as highly prospective.

BOE is in such a strong resource position as an emerging producer that for the first three years of production all of the material can be sourced from the measured and indicated resource. For years four and five, 80% of production can be sourced from measured and indicated resources.

Overall, 50% of production for the first nine years can be sourced from the measured and indicated resource.

While the company’s shares increased four-fold between October 2015 and April 2016, a lack of news flow since then has seen them taper off slightly, perhaps presenting a buying opportunity in the vicinity of 5 cents per share.

It is worth noting that Patersons valuation and price target of 16 cents implies upside of more than 200% to Wednesday morning’s opening price of 5.2 cents.

However, uranium stocks can be hard to get your head around and there have been far more flops than successes, making it essential to get an understanding of just what you are investing in.

The following is a thorough profile of the project, its history and the progress made to date. It is well worth examining to gain an understanding of the asset and the impressive inroads management has made.

The Honeymoon is far from over

The Honeymoon Uranium Project is located in South Australia and is 80km north-west from the town of Broken Hill near the SA / NSW border.

Mining and uranium export permits (both State and Federal) are still valid which means production at the original design throughput can commence at Honeymoon with a very short lead time.

Prior to the start of this Expansion Study (and as part of the purchase due diligence exercise) a detailed technical review was undertaken to identify the issues that impacted the plant prior to being placed on care and maintenance, optimisation opportunities and cost reduction strategies that could form the basis for a planned redesign and start-up.

This assessment indicated problems with wellfield performance that led to lower feed grades to the plant and that further to this the plant production rate was too low, even if design throughput was reached, for a sustainably profitable uranium mine at current depressed uranium prices.

These economics were due to the sizing of the operation (0.88Mlbs/annum) which made the cost structure for Honeymoon inefficient, with a high proportion of fixed costs within the overall cash cost for the mine.

BOE therefore proposed that a larger processing plant facility, with the possible use of resin technologies, could significantly reduce the cost of production. In parallel with these investigations, the company announced a 330% total increase of the Global Honeymoon Resource based on a detailed review of the existing drilling data.

Importantly part of the resource increase comes from deposits located approximately 70 kilometres from the main processing plant. It is believed that these deposits could be effectively treated with the use of satellite ion exchange processing units.

As a result, Boss initiated its Expansion Study focussing on expansion scenarios and processing routes. At a high level, three main processes were initially considered in the Study:

• Optimise and expand existing solvent extraction plant

• Implement a combined ion exchange and solvent extraction process (Eluex)

• Implement an ion exchange only process

As has now been determined, the preferred route identified based both on economics and project risk was a hybrid of the Eluex process that maximised the utilisation of the existing equipment at Honeymoon. This was then further developed to provide a base case to carry forward to the next phase of the Project (the Pre-feasibility Study).

At the same time possible production scenarios were assessed to determine an optimal ramp-up strategy and maximum final production capacity.

It should be noted that earnings forecasts, broker recommendations and price targets and past share price performances may not be met or replicated and as such should not be used as the basis for an investment decision. Seek professional financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.