Bonanza 10oz. Grades Gold Reported by Classic Minerals at the Forrestania Gold Project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Classic Minerals Limited (ASX:CLZ) has reported highly promising assays results from its most recent reverse circulation (RC) drilling program at the Forrestania Gold Project (FGP) in Western Australia.

The company completed a total of 21 holes for approximately 1300 metres at the Kat Gap Project, not only identifying high-grade mineralisation, but locating a new high grade zone to the west of the main target.

Further deeper drilling will be conducted by Classic to determine the extent and significance of this new potential footwall gold lode.

In the interim, management is spoilt for choice in terms of choosing drilling targets with the potential to strike more high-grade gold through exploring this new territory, as well as conducting infill and extensional drilling to the north and south of the current drill pattern.

Consequently, the upcoming drilling program has the potential to add significantly to the length of strike ahead of future open pit optimisation studies.

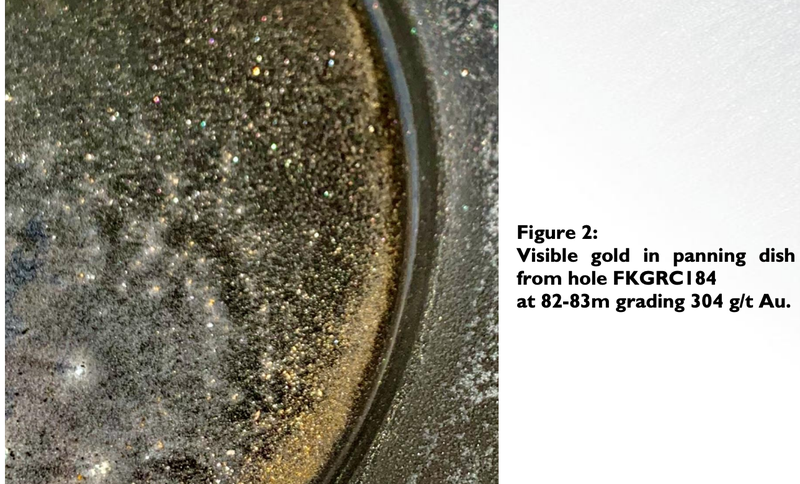

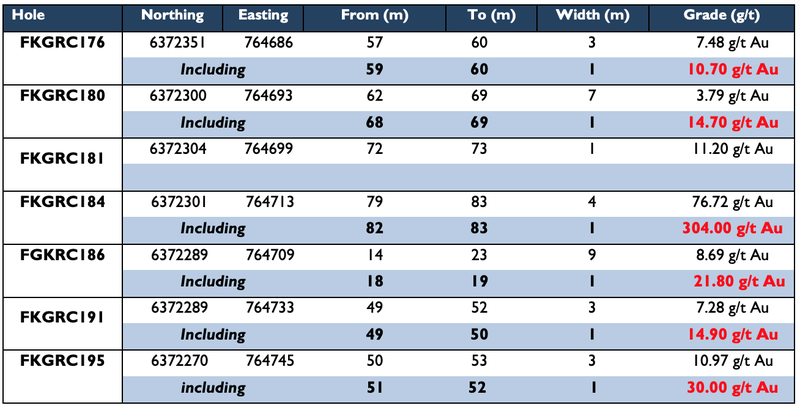

Standout results from recent drilling included 4 metres grading 76.7 g/t gold from 79 metres (FKGRC184) and 9 metres grading 8.7 g/t gold 14 metres.

FKGRC184 included a bonanza hit of one metre grading 304 g/t gold from 82 metres.

It is worth noting that this area is an unknown quantity, previously not drilled by Classic, and with no record of historical drilling having been conducted around this drill hole.

Infill drilling also provides promising results

Reverse circulation holes were drilled within an area north of the Proterozoic Dyke, infilling areas previously drilled on 10 metre and 20 metre spaced sections.

These holes will be particularly helpful in assessing future open pit optimisation studies.

Shallow high-grade hits included 3 metres at 11 g/t gold from 50 metres and 3 metres at 7.5 g/t gold from 57 metres.

The following more detailed data demonstrates that the results that have come to hand are more than just a flash in the pan.

Commenting on the significance of drilling to date and how it may impact the group’s exploration strategy going forward, chief executive Dean Goodwin said, ‘’This new very high-grade intersection out into the granite is an exciting development for the Kat Gap Project.

‘’We decided to extend some of our planned drill holes west of our current drill pattern to see if further gold lodes were lurking out in the granite, and we were right. Now we just have to work out what orientation this new lode is running at.

‘’This new intersection really bodes well for our future drilling programs that will be conducted out in the granite following up the historical auger geochemical anomalies.

‘’We also started a program of infill drilling north of the Proterozoic dyke in readiness for future open pit optimisation studies. Existing RC drilling is a little far apart to get meaningful data, so we need to infill drill for about 400 metres of strike.

‘’These new results are only the start of that extensive program with many more results to come over the next few months. We will also be conducting extensional RC drilling to the north and south of our current drill pattern which will hopefully see the deposit grow another 200 metres or so.’’

Kat Gap drilling to provide accurate open pit optimisation data

Building on Goodwin's comments, the next few rounds of RC drilling at Kat Gap will focus mainly on infill testing the main granite-greenstone contact north of the Proterozoic dyke for a strike length of some 400 metres.

This work will assist engineers in conducting more accurate open pit optimisation studies prior to future mining operations.

Further RC drilling will also test the northerly and southerly extensions for another 100 metres to 200 metres along strike.

RC drilling will test the extent of the recently discovered supergene horizon south of the Proterozoic dyke out in the granite. Further drilling will then be conducted to determine the source of this new supergene zone.

RC drilling programs will also be carried out in the granite to test the large five kilometre long geochemical anomaly identified in previous historical auger soil sampling.

The initial program will focus around the cross-cutting Proterozoic dyke where high auger values were returned along with a site located in the north-eastern most area of the geochemical anomaly.

Historical RC drilling at Kat Gap is mostly on 100 metre to 200 metre line spacings.

There is strong potential for additional mineralisation to be identified up-dip, down-dip and along strike, both outside of and within the existing historical RC drill coverage.

Consequently, Classic presents as a news-driven story with the potential for numerous share price catalysts as this extensive exploration campaign progresses.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.