Blackham signals resource push with Tropicana geologist hire

Published 13-APR-2016 14:09 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Blackham Resources (ASX:BLK) may be painfully close to production, but it’s already thinking about the next source of gold – hiring award-winning geologist Bruce Kendall to help extend its resource.

It told its investors yesterday that it had appointed Kendall as its chief geological officer, with Kendall holding over 20 years’ experience in the mining game.

He has previously been with Independence Group, Jabiru Metals, and even AngloGold Ashanti.

He played a key role in the development of the Tropicana gold deposit, planning the discovery holes for the resource and then leading the exploration team through the project’s PFS stage.

His expertise in doing so led him to become a joint winner of AMEC’s prospector of the year award in 2012.

BLK managing director said the hire was a coup for the company – and flagged a focus on extending mine life at its Matilda project.

“We are fortunate to have secured the services of Bruce Kendall who we believe will make a significant contribution to our efforts to strengthen and lengthen mining inventory and reserves at the Matilda Gold Project,” he said.

Earlier this week it told the market that its latest exploration would help convert more of the project’s Inferred resource to the surer Indicated category.

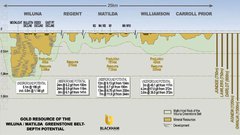

BLK intends to produce around 100,000oz per year when it goes into production in the next quarter, offloading its mined material to the Wiluna gold plant which has a throughout capacity of 1.7Mtpa.

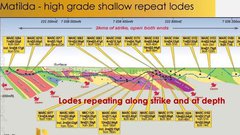

Matilda is located in Australia’s largest gold belt, stretching from Norseman to Wiluna.

BLK currently owns tenements stretching over 780 sq. km. that have historically produced over 4.3 million ounces of gold. BLK also owns the Wiluna gold plant, gas power station, camp, bore-fields and all underground infrastructure needed for production.

BLK’s 7 year mining inventory is expected to contain 8.3Mt @ 2.9g/t for 767,000oz and Reserves of 6.1Mt @ 2.5g/t for 481,000oz, with an average annual production rate of 101,000oz.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.