Blackham receives high-grade drilling results from Bulletin ahead of capital raising

Published 18-AUG-2016 13:58 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Blackham Resources offers a good mix of visibility and blue sky, evidenced by this week’s news that its Wiluna processing plant was on track to be commissioned in August, along with some encouraging results released yesterday from the latest round of drilling results conducted at its Bulletin mine, part of the group’s cornerstone Matilda gold project situated in Western Australia.

This double dose of good news saw the company trade as high as $1.18 yesterday, a level it only touched briefly nine years ago. On Wednesday morning BLK when into a trading halt with management flagging an upcoming announcement regarding a proposed capital raising.

Hence, this recent round of good news couldn’t have happened at a better time as it should position the company to raise funds at a premium price.

Drilling results from the Bulletin mine are important from a number of perspectives. Firstly, they included some particularly high grades at reasonable widths including 15.6 metres grading 7.5 grams per tonne gold and 6 metres grading 26.4 grams per tonne gold.

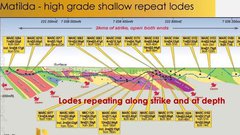

Furthermore, it provides additional support for BLK’s near to medium term strategy of expanding the Matilda project to production of circa 200,000 ounces.

On this note, Managing Director Bryan Dixon said, “The latest Bulletin drilling has demonstrated the potential to continue growing the Wiluna resources close to surface and an updated Bulletin resource is likely to complement the work we are doing on the Wiluna open pits with both feed sources being integrated into the expansion study currently underway”.

The company’s shares have more than doubled in the last two months on the back of strong exploration news and the commencement of mining at its Matilda project.

It should be noted that share prices are subject to fluctuations and production goals may not necessarily be met and investors should take a cautious approach to any investment decision regarding BLK and not base a decision solely on historical performances.

12 month share price performance Vs ASX Gold index to August 1, 2016

With the expanded Matilda gold project boasting 48 million tonnes grading 3.3 grams per tonne for 5.1 million ounces of gold, it is a promising development that the latest drilling results from Bulletin are expected to upgrade existing resources from the inferred to indicated category, resulting in further ore reserve additions.

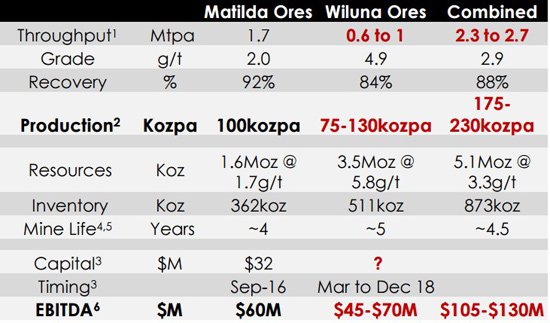

Blackham has already commenced open pit mining and underground development work at Matilda and the 100% owned Wiluna gold plant has the capacity to process up to 100,000 ounces per annum.

Management has established a strong track record of delivering on projected milestones and one of the most closely watched will be targeted gold production within three weeks. While this has been well flagged, it is not unusual for investors to respond positively to the event when it actually materialises.

With an eight year mine life across four substantial gold systems and an aggressive exploration program in place there is scope for important news flow. In the near to medium-term, management’s range of expansion studies are aimed at growing production to between 175,000 ounces per annum and 230,000 ounces per annum while better monetising the expanded output.

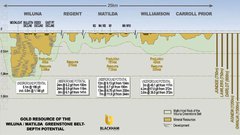

As can be seen below, Wiluna is key to the group’s expansion strategy and should strong news flow regarding robust grades continue, this is likely to be a positive share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.