Blackham negotiates top dollar hedge price

Published 21-SEP-2016 15:23 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

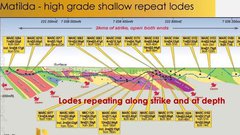

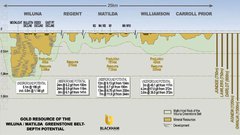

Most of Blackham Resources’ (ASX:BLK) news over the last few months has revolved around the commissioning of its Matilda gold project and the potential to substantially increase production from near-term annualised levels of circa 100,000 ounces to a range between 175,000 ounces and 230,000 ounces.

With strong exploration success and management demonstrating its ability to successfully make the transition from explorer to producer, BLK is shaping up as one of the most promising emerging Australian based gold companies.

While this recent news has been focused mainly on the company’s growth potential, today’s announcement regarding the forward sale of 34,250 ounces of gold at an average price of $1774 per ounce is more about providing stability and earnings visibility.

However, don’t underestimate the potential share price impact of this news given that the hedging price is highly lucrative and the nature of the deal provides a useful balance against the backdrop of exploration developments.

This is a robust price when one looks at a gold price of US$1300 and an USD:AUD exchange rate of 75 cents, which is in the vicinity of prevailing metrics. This implies an Australian dollar gold price of $1733.

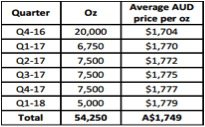

As can be seen from the following table, BLK has been developing its hedge book at various price points and the group still has in place the initial 20,000 ounce hedge program at an average price of approximately $1704 per ounce.

At this stage the gold price was hovering in the vicinity of US$1280, and it wasn’t until the spike in late June that there was a substantial uptick towards US$1360.

On this basis, the negotiated forward sale appears attractively priced. Based on the spot price, the Australian dollar gold price is only about $40 higher than it was in May. However, BLK has managed to achieve an average price that is $70 higher than that negotiated approximately four months ago.

Whether BLK is able to sustain this remains to be seen, so if considering this stock for your portfolio seek professional financial advice.

Looking at fluctuation throughout 2016, the gold price topped out at circa US$1370 in July. At this point the Australian dollar was in the vicinity of 76.5 cents, implying an Australian dollar gold price of $1790.

The fact that BLK has secured an Australian dollar price so close to the peak 2016 level as the S&P/ASX 300 All Ordinaries Gold Index (XGD) has fallen from circa 5700 points in July to less than 4700 points appears to be an excellent achievement.

It is also worth noting that BLK’s total gold hedge commitments only represent 35% of the forecast production over the next 18 months.

As analysts crunch the numbers there could be a share price rerating given that BLK has pulled back from a 12 month high of $1.18 a month ago to trade in the vicinity of 80 cents, well below the 12 month consensus target price of $1.15.

However, historical share price trends may not be repeated and forward projections may not be achieved, and investors should not use this information as the basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.