Blackham completes DFS and confirms gold production for 2016

Published 24-FEB-2016 11:41 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Blackham Resources (ASX:BLK), a junior gold explorer based in WA, has completed a highly-awaited Definitive Feasibility Study (DFS) on its flagship Matilda Gold Project indicating production could commence as soon as Q3 2016.

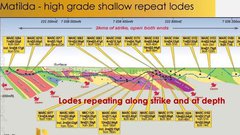

According to BLK’s DFS, the Matilda Gold Project contains 45Mt @ 3.2g/t for 4.7Moz. In the Indicated category BLK has at least 21Mt @ 3.4g/t for 2.3Moz.

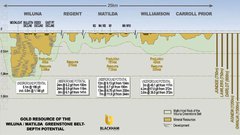

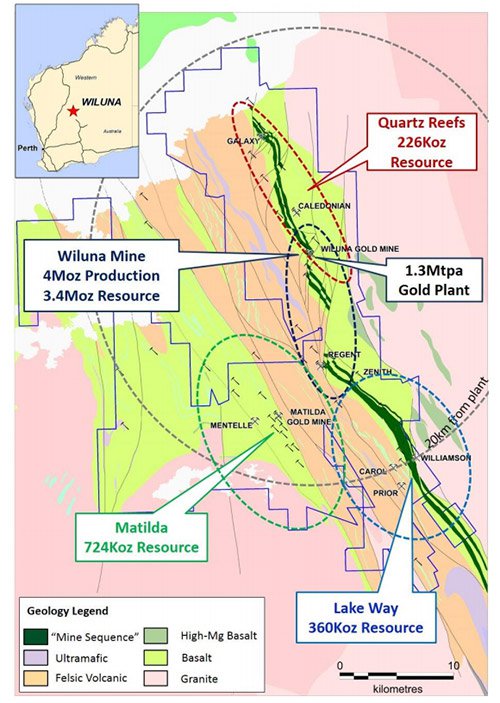

Matilda is located in Australia’s largest gold belt, stretching from Norseman to Wiluna. BLK currently owns tenements stretching over 780 sq. km. that have historically produced over 4.3 million ounces of gold. BLK also owns the Wiluna gold plant, gas power station, camp, bore-fields and all underground infrastructure needed for production.

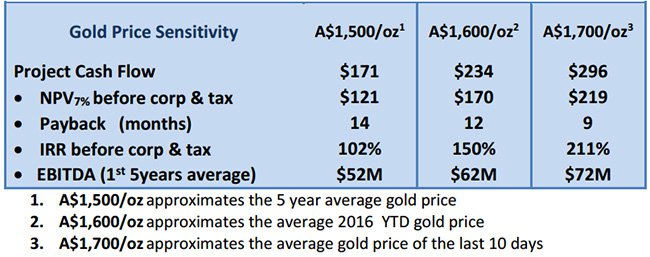

BLK cites “very low capex”, “substantial plant and infrastructure” and “minor refurbishments” as the key reasons for Matilda’s strong commercial potential and likely ‘fast payback’ within 12 months. Given current estimates, BLK says that “every A$100/oz increase in the gold price adds A$63 million to Matilda’s cash flow”.

Definitive detail

During the DFS process, an additional 2.5 years was added to the mine life from the previous PFS as well as a 44% increase in inventory, “which results in a significant improvement in the Project’s economics” says BLK.

BLK’s 7 year mining inventory is expected to contain 8.3Mt @ 2.9g/t for 767,000oz and Reserves of 6.1Mt @ 2.5g/t for 481,000oz, with an average annual production rate of 101,000oz.

When factoring in pre-production capital costs of around A$32 million, BLK expects to hit around A$234 million in cash flow and an net present value (NPV) of A$170 million. The strength of gold prices when priced in Australian dollars, is also expected to help BLK’s project economics.

BLK Managing Director Bryan Dixon said, “The Matilda Gold Project DFS has confirmed the robust near term cash flows from the Project, enabling us to benefit from the currently strong AUD gold price”. And added, “Matilda is the most capital efficient, nearest term producer and has the shortest payback amongst its Western Australian development peers”.

BLK Managing Director Bryan Dixon

In a possible further boost, BLK said that its updated DFS “does not include current drilling programmes undertaken at Matilda, Galaxy, Golden Age and Bulletin this year” but will be included as part of an update, prior to production commencing. This could potentially mean BLK expands its Resource further later this year.

Mining operations

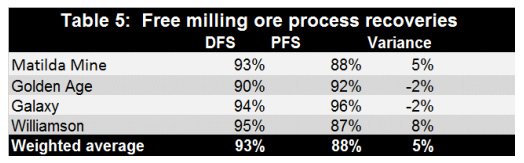

BLK intends to operate a Fly In, Fly Out (FIFO) operation from Perth and conduct open-pit mining as planned at Matilda, Williamson and Galaxy. The mined ore will be trucked to the Wiluna gold plant for processing. As part of the DFS, BLK’s rate of gold recovery from mined ore has also ticked up from 88% to 93% across the Matilda Project.

Operating Costs

Matilda’s C1 cash costs and cash operating costs (AISC-all in sustaining) are forecast to be A$850/oz and A$1,160/oz with an underlying gold price of A$1,600/oz.

At the time of writing, gold priced in Australian dollars was trading at A$1,671/oz, having reached a high of A$1,781 earlier this month – its highest rate since 2011.

Future funding to develop Matilda is expected to come from Orion Mine Finance, who have already committed $13 million with a further $23 million to be made available subject to pre-agreed financing conditions being met in the coming weeks.

In a final word to its market announcement, BLK confidently proclaimed, “Blackham is committed to its Project Implementation Plans to allow for first gold pour by Q3 2016”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.