BKT begins mining licence application, aims at 2H CY2018 build

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This product is classified as ‘very high risk’ in nature due to its location and geopolitical situation of the region. Finfeed advises that extra caution should be taken when deciding whether to engage in this product, however if you are not sure whether it is suitable for you we suggest you seek independent financial advice.

Tanzanian graphite developer Black Rock Mining Limited (BKT:ASX) has today informed the market it has commenced the formal mining licence application process, and provided an update on its 100%-owned Mahenge Graphite Project.

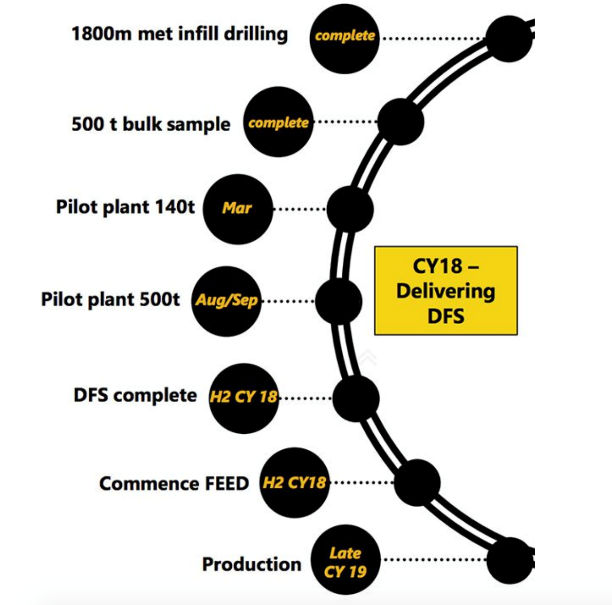

Promisingly, the company has reported that its Definitive Feasibility Study remains on track for completion in 2H CY18 with construction targeted to commence in the current calendar year.

The company has been busy readying itself to bring a pilot plant online at the largest high-grade flake graphite Resource in Tanzania, as it outlined in today’s update.

The Mining Licence application process commenced on 5 February 2018 with the submission of the draft Environmental and Social Impact Assessment (ESIA) to the National Environment Management Council (NEMC) of Tanzania.

BKT expects to lodge its final application in May 2018 following receipt of comments on the draft ESIA. Further, the company aims to have the necessary export approvals in place in the near-term and its transport-to-port plan finalised.

However it is an early stage of this company’s development and if considering this stock for your portfolio you should take all public information into account and seek professional financial advice.

Regarding its second pilot plant, the company plans to undertake infill drilling and bulk sampling in the near-term in order to further validate the size and amenability of its graphite asset.

BKT is working off a strategy management refers to as ‘Crawl, Walk, Run’ which involves reinvesting cash flow and building out its business by adding modules in a staggered fashion.

Its Definitive Feasibility Study commenced in December, following a successful capital raise totalling A$4.74 million to go towards it.

Bulk sampling and metallurgical drill campaign towards DFS

As part of the DFS workflow, BKT were undertaking a 1,800 metre PQ-sized, metallurgical drill campaign which has now completed. This latest drilling was intended to provide adequate metallurgical sample to provide for metallurgical variability sampling and a second round of pilot plant testing targeted for completion in September 2018.

Further, it is focused on providing information for the first five years of the plant performance, which should aid BKT in raising awareness of the magnitude of the Mahenge Project.

The below photo shows BKT’s Board inspecting samples at the Mahenge Project.

According to today’s announcement, the engineering and other activities which underpin the DFS are all on track. This includes CPC Design’s commencement of an engineering design of the plant and infrastructure for Module 1 at Ulanzi, Mahenge.

Process design criteria, including flow sheets and mass balances, will be finalised once the first pilot plant run scheduled for March 2018 is completed. The company’s plan is that once demand increases, production will ramp up and cash flow will be used to build a further two plants.

BKT CEO John de Vries commented on today’s update: “Black Rock is progressing the DFS on Mahenge Module 1. The study remains on schedule and budget for delivery in H2 2018. The availability of concentrate from the pilot plant is important as it delivers real concentrate to support marketing and development of offtake agreements.

“The ability to place credible volumes of product in the hands of potential offtake partners is a significant differentiator and will rapidly accelerate our marketing capacity. As part of the Pre-Feasibility Study we articulated our core business strategy of Crawl, Walk, Run. Succinctly this strategy is about risk management. This is about always having data to support our investment decisions and a business plan that is flexible and opportunistic, but is well supported by clear and well understood planning.”

Overall the study remains on budget and schedule for delivery in the second half of this calendar year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.