Axiom Mining progresses with approvals and finance at Isabel Nickel Project

Published 19-JUN-2017 11:02 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Axiom Mining (ASX: AVQ) underwent a substantial rerating on Friday after the company announced that it had made substantial progress in gaining government approval and licensing in relation to the Isabel Nickel Project located in the Solomon Islands.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

As the chart below demonstrates, the company’s shares had come off over the last six months, largely due to the licensing procedure taking a little longer than some may have anticipated.

However, the extent of Friday’s rally highlights the significance of this event, which along with news regarding funding has provided clarity and predictability regarding the progress of what is considered by some analysts as a world class nickel project.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

It is worth noting that Friday’s rerating occurred under the second-highest daily volumes traded in the last 12 months. The only prior occasion in the last 12 months when more than 5 million shares were traded in a day was towards the end of June 2016. This proved to be the commencement of a larger sustained rally which saw the company’s shares triple in value in less than a month.

Whether the current set of circumstances can support a similar rerating remains to be seen, but the focus should be on the importance of these events, summed up by Axiom’s Chief Executive, Ryan Mount who said, “I remain confident in the delivery of our initial licensing objectives, enabling us to harness our expert team’s commitment to project development in order to realise significant value from this world class nickel project in the Solomon Islands”.

Mount noted that negotiations were in an advanced stage with the government, and that initial funding is in place, and landowner partners were steadfast in their support for the project.

A promising development was the take-up of a $1 million rights issue shortfall facility by one of the company’s largest shareholders, InCoR Holdings. In addition, the company has also secured a further $4 million via a convertible note, $2 million of which is immediately available with the other $2 million accessible in October.

Axiom poised to commence production in 2017

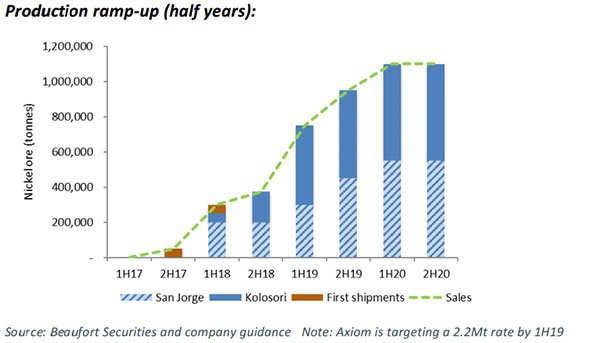

These developments have significantly derisked the Isabel project which could potentially move to small-scale production in 2017, increasing to 1.5 million tonnes in 2018 and 2.2 million tonnes in 2019.

Applying these metrics, analysts at Beaufort Securities are forecasting AVQ to generate a net profit of $3.7 million in fiscal 2018, increasing to $21.3 million in 2019, representing earnings per share of 5 cents.

This represents a PE multiple of approximately 6 relative to the broker’s share price target of 31 cents, which implies share price upside of nearly 100% based on AVQ’s closing price on Friday.

The following investment summary provided by Beaufort Securities in January 2017, along with its production projections makes for interesting reading, particularly given that it rates the project as ‘the best undeveloped nickel laterite project in the Pacific’.

Axiom controls one of, if not, the best undeveloped nickel laterite project in the Pacific with plans to fast track production over the next 6-24 months. If all goes well, Axiom will be a 2.2Mt nickel laterite producer by 2H19, and at current nickel laterite prices this should produce annual revenues of A$150m and Axiom EBITDA of A$50million adjusted for 20% local ownership.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.