AXE updates market with 2018 plans for advanced material strategy

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

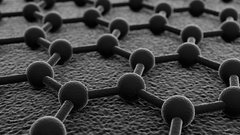

Archer Exploration Limited (ASX:AXE) has today provided a positive end of year update on its graphite/graphene development strategy, and formally announced its new CEO, Dr Mohammad Choucair.

World renowned materials expert Choucair began his role with AXE on Friday, December 1. His strategic appointment is excepted to drive the company’s transition as it looks to become an advanced technology company, initially focussed on graphite and graphene related technologies.

Dr Mohammad Choucair and the Hon, Tom Koutsantonis, SA Minister for Minerals and Energy, after announcement of the grant of the mining tenements. Source: Archer Exploration

In further management related news, AXE appointed the Hon Kevin Foley to its board mid-year. Foley was the longest-serving Deputy Premier of South Australia, who in his role as Treasurer played a crucial role in regaining and retaining the state’s AAA credit rating. Through high-level business and negotiation skills, Foley won significant defence contracts and assisted in brokering the Olympic Dam negotiations with BHP Billiton.

AXE’s purchase (announced in October) of Carbon Allotropes online graphite and graphene marketplace complements the appointment of Choucair as CEO, as both developments support the company’s ambition towards building a graphene and graphite advanced materials business.

At the same time, it’s worth noting that this is an early stage play and investors should seek professional financial advice if considering this company for their portfolio.

In essence, the company’s aim with such a business is to use advanced materials specifically in the fields of reliable energy, quantum technologies and human health. In exploring these possibilities, AXE has reviewed select market segments, and is in the process of pursuing opportunities to develop suitable technologies within each. These are segments with a large market size, and for which AXE already has some sort of competitive advantage.

Granting of mining leases

Earlier in the month, AXE informed the market it had successfully acquired mining licenses, which includes the processing of graphite and graphene, at its 100 per cent owned Eyre Peninsula Graphite Project.

The licenses allow for the mining and processing of approximately 10,000 tonnes per annum of ultra-high-quality graphite, and up to 100 tonnes per annum of graphene.

This is a key piece of the puzzle for AXE, as test work undertaken by the CSIRO previously indicated that Archer graphite is suitable for use in lithium ion batteries. With these licenses granted, and a new CEO with the required experience and expertise, the company will begin additional and accelerated battery test work.

Cash in the bank

With a new CEO, a new high-profile board director, and freshly granted mining licenses at its Eyre Peninsula Graphite Project, all the company really needs to gain further traction is adequate funds to maximise on the above developments.

To this end, in late November the company informed the market it had raised A$3 million from a heavily oversubscribed Share Purchase Plan — enough to see it through its next stages of the Eyre Peninsula Project and its activities in graphene and graphite related battery test work.

All the above news amounts to a small-cap company (with current market capitalisation of just ~A$23 million) with considerable potential to become a vertically integrated graphite/graphene advanced materials business, along with copper and cobalt projects also in the pipeline. Shareholders could well be in store for a high volume of news flow coming out of AXE in 2018.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.